Slow Start to Venture Capital Funding in 2024

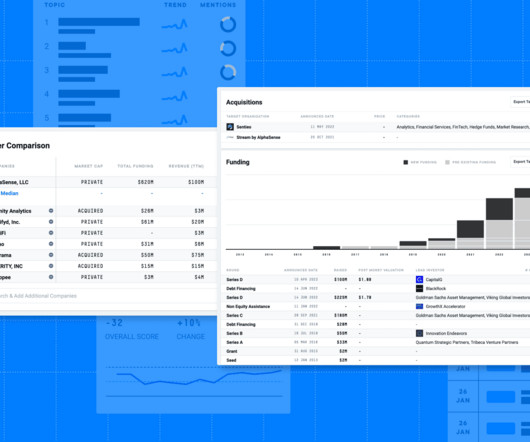

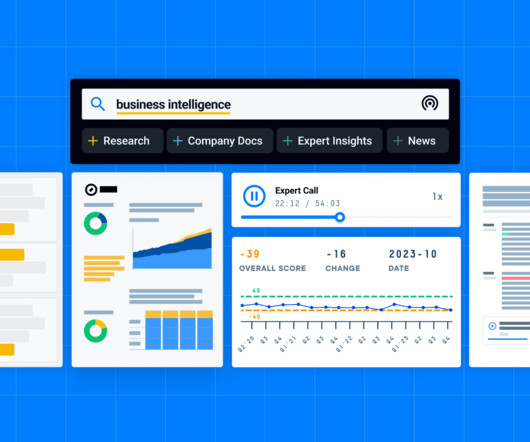

Alpha Sense BI

MAY 28, 2024

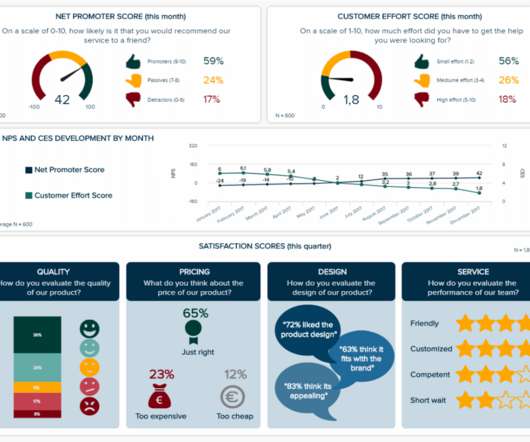

The venture capital landscape continues to test the discipline and diligence of investors and startups alike. Like many other asset classes, venture capital continues to be impacted by lingering macroeconomic factors affecting funding and liquidity prospects. Interest rates are high.

Let's personalize your content