Climate Innovators in the Information Age

CIO

NOVEMBER 9, 2022

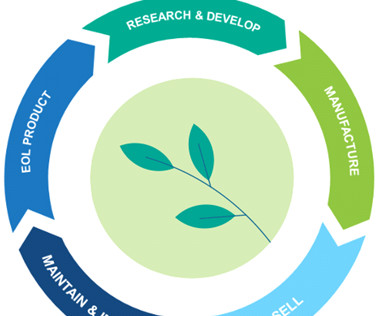

Global sustainable investment considers “ESG [environmental, social, and governance] factors in portfolio selection and management across seven strategies of sustainable or responsible investment. ESG is discussed much more now, but the impact is well beyond just the moment. Intelligence builds on these connected systems.

Let's personalize your content