Banking on customer experience and security via technology-based innovation

CIO

JULY 20, 2023

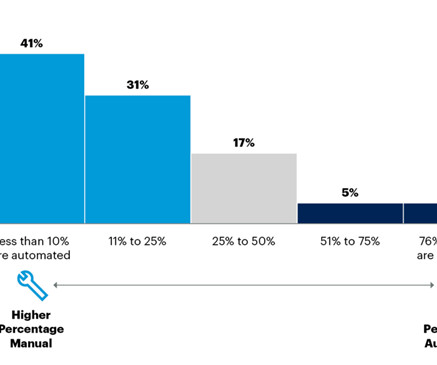

Since then, automation has filled the gap in improving customer experience and security. Workflow automation and data analytics are streamlining document management, cross-checking data, assessing for risk, ensuring regulatory compliance, and so on. Security and privacy.

Let's personalize your content