Venture Capital in the Age of AI: Transforming Due Diligence

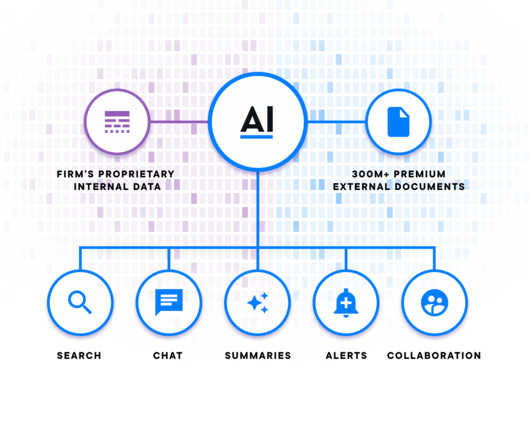

Alpha Sense BI

DECEMBER 26, 2023

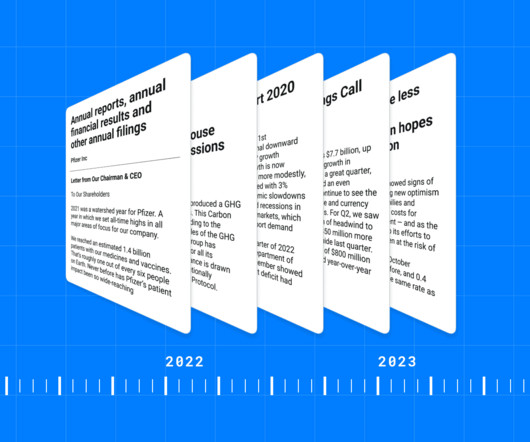

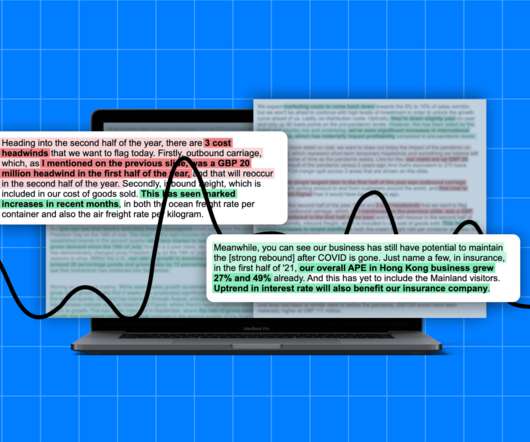

On the AlphaSense platform, this reality rings true as we noticed an over 50% increase in documents mentioning “due diligence” over the past year. Once an arduous and time-consuming task, the dawn of artificial intelligence (AI) and generative AI (genAI) has transformed the way venture capital investors conduct due diligence.

Let's personalize your content