Due Diligence During Economic Downturn

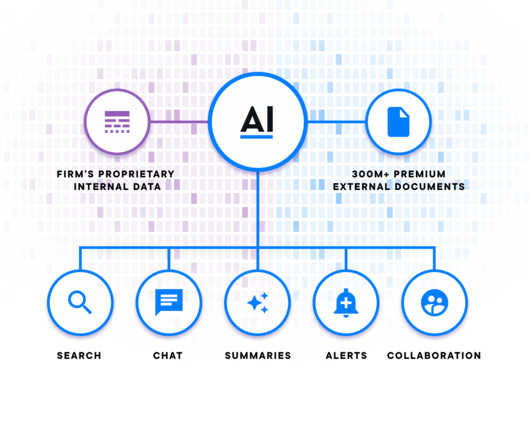

Alpha Sense BI

JULY 21, 2023

We’re living in unprecedented times of extreme market volatility plagued by macroeconomic hardships (i.e., and growing global tensions (i.e., In periods of high risk, renewed attention is brought to due diligence and what should concern your decision-making. rising inflation, supply chains disrupted by COVID-19, etc.)

Let's personalize your content