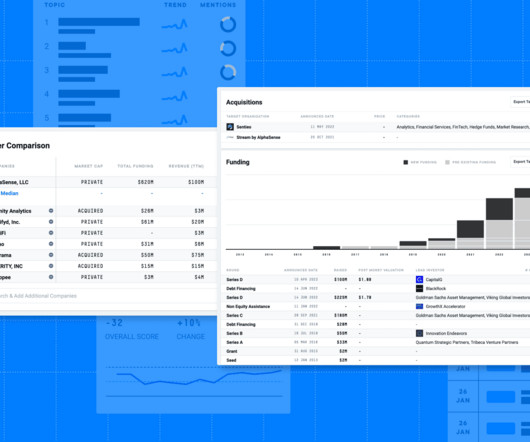

Due Diligence During Economic Downturn

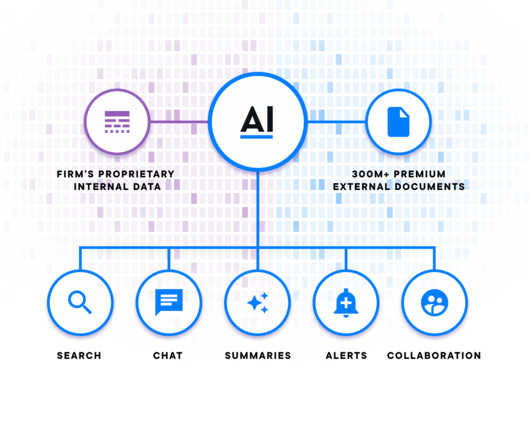

Alpha Sense BI

JULY 21, 2023

and growing global tensions (i.e., In periods of high risk, renewed attention is brought to due diligence and what should concern your decision-making. More importantly, if a company fails to plan for an economically uncertain future with its own capital, then it will likely borrow at high-interest rates.

Let's personalize your content