It’s time to go paperless: are bank branches ready?

CIO

MAY 16, 2023

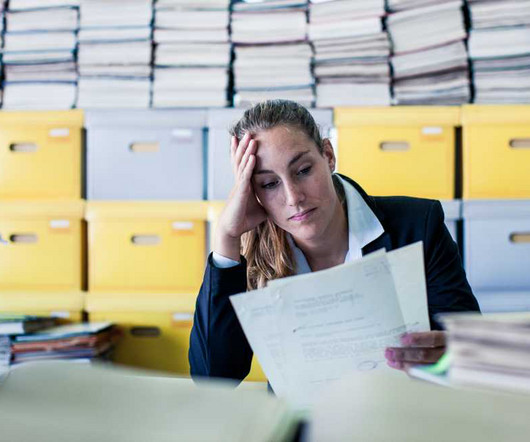

When the chief banking officer of a $10.3B community bank visited a competing super-regional branch in her suburban New Jersey neighborhood, she noticed something troubling. Set amid an open floor plan, the stacks of files left sensitive customer information—business and personal, loans and deposits—available for all to see 1.

Let's personalize your content