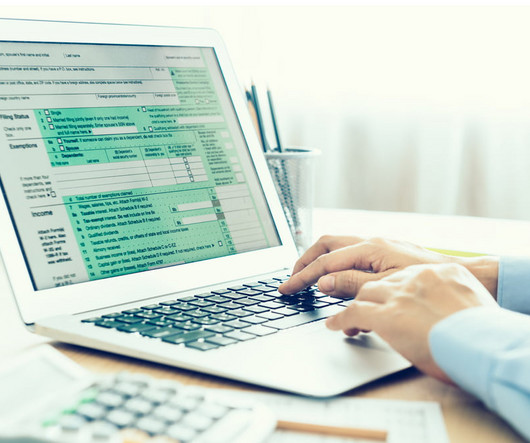

Capitalizing on technology budgets: A CIO’s story

CIO

APRIL 29, 2024

While traditional approaches to bridging the profitability gap, like layoffs and budget cuts, can harm company culture, an innovative and practical alternative is capitalizing on technology budgets. Capitalizing on technology budgets presents a viable solution. Tracy’s team of around 30 people couldn’t support that model.

Let's personalize your content