Venture Capital in the Age of AI: Transforming Due Diligence

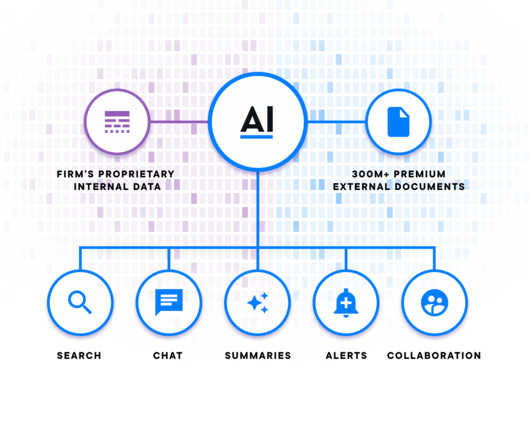

Alpha Sense BI

DECEMBER 26, 2023

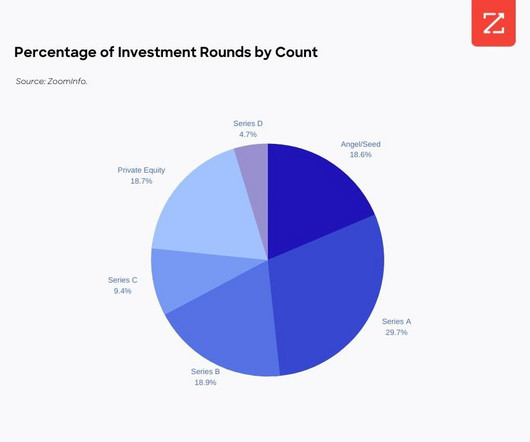

Over the last 12-18 months, both venture capital investors and start-up firms have felt the aftershocks of ongoing economic volatility. Following a ‘dry powder’ run in 2021, venture capital investment in the US nearly doubled from 2020. Similar to other asset classes, venture capital deal patterns mirror macroeconomic sentiment.

Let's personalize your content