A Comprehensive Guide to Benchmarking Analysis

Netbasequid

AUGUST 26, 2021

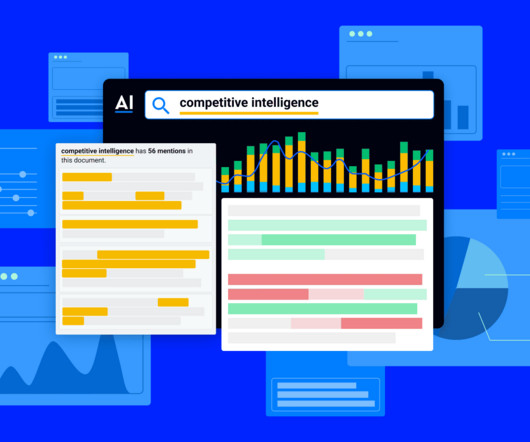

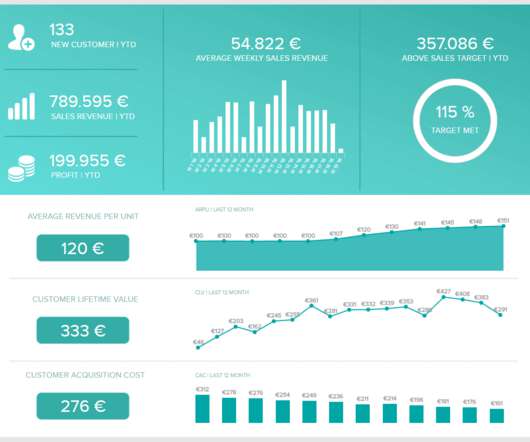

Pretty much any data point can be used as a benchmarking metric. A benchmarking analysis measures your performance in a specific area and compares it against industry standards or competitive performance. Here, we’ll explore how to measure your brand’s success with our comprehensive guide to benchmarking analysis.

Let's personalize your content