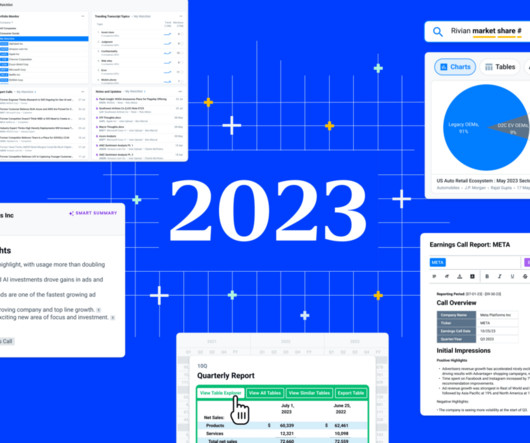

9 Competitive Intelligence Tools to Trial in 2023 (Free & Paid)

Alpha Sense BI

JULY 14, 2023

To survive in today’s fast-moving and always-evolving market landscape, every business needs competitive intelligence (CI)—comprehensive knowledge about your competitors and how your company stacks up. CI allows you to track competitor behavior and glean the insights you need to create competitive advantages.

Let's personalize your content