Human Capital Management in an Economic Downturn

Alpha Sense BI

MAY 4, 2023

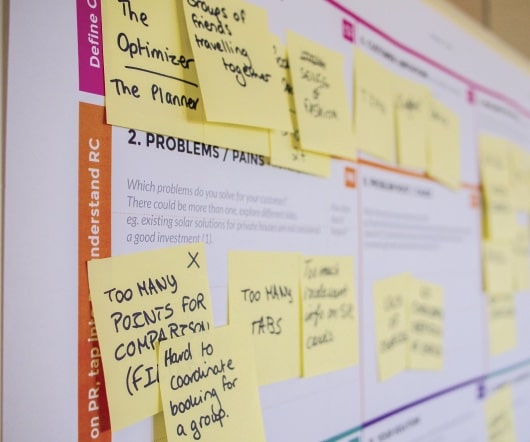

The main question is: how do we preserve our human capital? Whether their strategy involves introducing new products to the market, changing business models, or even expanding services through a new platform— leaning out teams and saving capital will not help a company to survive, let alone thrive, in unpredictable times.

Let's personalize your content