ESG Frameworks: Strategies From Industry Leaders

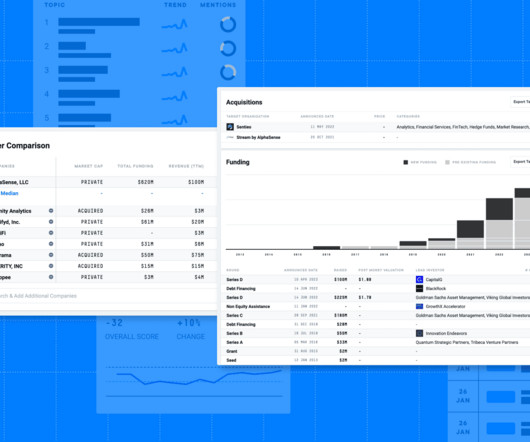

Alpha Sense BI

JUNE 29, 2023

Now more than ever, authentic programs and initiatives founded in prioritizing the environmental, social, and governance impact of supply chains prove to be one of the best ways to win over consumers, investors, and their capital—especially during an economic downturn. reveal their carbon footprint and other ESG metrics.

Let's personalize your content