The Ultimate Due Diligence Guide

Alpha Sense BI

SEPTEMBER 6, 2023

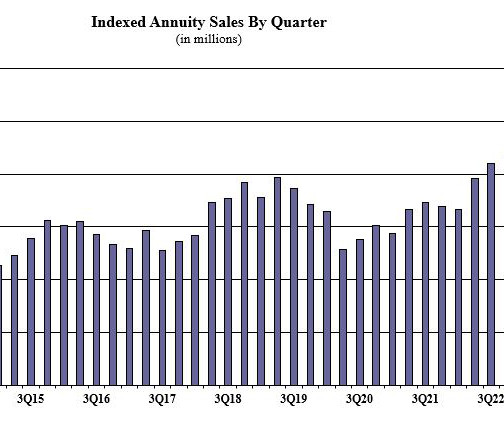

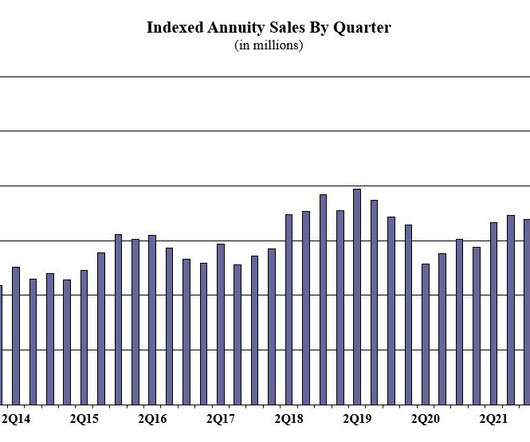

Consequently, the deals coming through your doors require extra scrutiny, and your criteria for due diligence needs to shift to take into account market changes. However, conducting poor due diligence can lead to costly mistakes. rising inflation, supply chains disrupted by COVID-19, etc.) have muddied waters.

Let's personalize your content