Key skills tech leaders need to secure a board seat

CIO

JULY 7, 2023

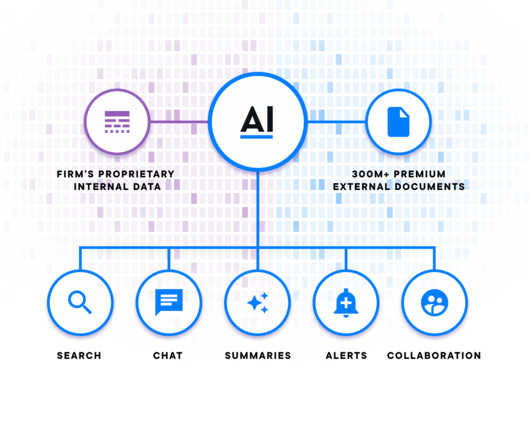

We ensure that board directors can be effective in their roles, and that they have the tools to be able to govern through the rapidly changing business environment. What are the finance implications of maintaining those investments? It requires due diligence. And it takes time to do that research.

Let's personalize your content