Due Diligence During Economic Downturn

Alpha Sense BI

JULY 21, 2023

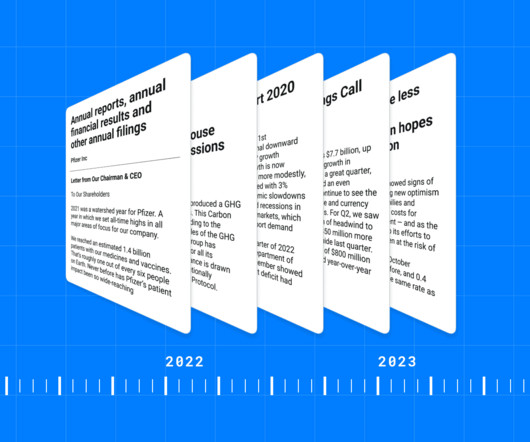

In periods of high risk, renewed attention is brought to due diligence and what should concern your decision-making. The market landscape is dramatically different now than it was in 2021 and 2022. Ultimately, if a company’s bank account is dry of ample capital, you should avoid investing. Is Cash Flow Stable?

Let's personalize your content