M&A Due Diligence: A Complete Guide

Alpha Sense BI

JANUARY 10, 2024

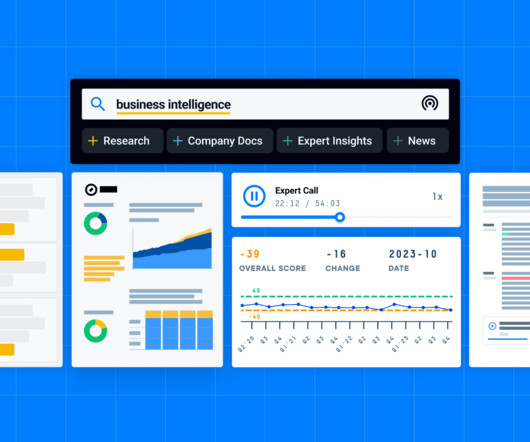

Conducting due diligence within the mergers and acquisitions space is the process of independently researching and verifying information on a potential company to ensure that a viable investment is made on behalf of stakeholders. Click “Show History” to expand your view to all snippets related to that KPI over time.

Let's personalize your content