Due Diligence During Economic Downturn

Alpha Sense BI

JULY 21, 2023

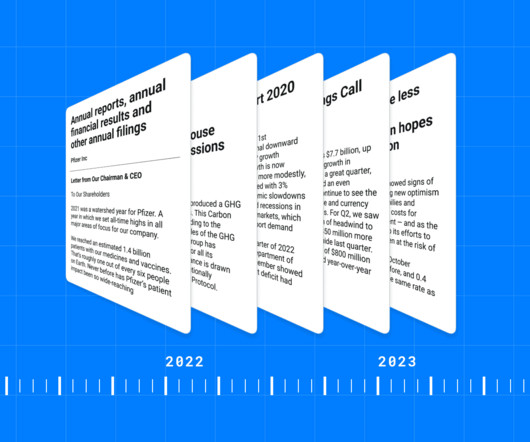

In periods of high risk, renewed attention is brought to due diligence and what should concern your decision-making. The market landscape is dramatically different now than it was in 2021 and 2022. It’s imperative to get a market intelligence platform that aggregates exclusive content (i.e., Is Cash Flow Stable?

Let's personalize your content