Generative AI: 5 enterprise predictions for AI and security — for 2023, 2024, and beyond

CIO

OCTOBER 25, 2023

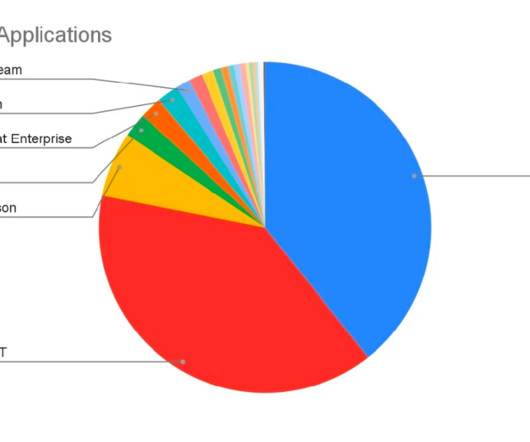

From IT, to finance, marketing, engineering, and more, AI advances are causing enterprises to re-evaluate their traditional approaches to unlock the transformative potential of AI. Indeed, since June 2023, the finance sector has experienced continuous growth in these areas. In general, they fall into two buckets: 1.

Let's personalize your content