15 Tips for Understanding Your Industry and Gaining a Competitive Edge

Understanding your industry is an important step in planning your business activities. Many companies avoid doing this because it requires effort, so taking the time to analyze your industry will give you an advantage over many of your competitors. Business decisions – in sales, marketing, product development and other functions – are often based on assumptions about what industry your company is in. Sometimes that may be a simple question, but in most instances, it turns out to be more complicated.

For example, our company Aqute could be in competitive intelligence, or market research, or consulting. If we decide we are in competitive intelligence, we could be in competitive intelligence software or competitive intelligence services. If we decide we are in consulting, that could be strategic or operational. And so on. The answer depends on how granular we want to get, the nature of what we provide and the requirements of our customers. And we may be in more than one of these sectors, because they overlap.

1. Key steps to understanding your industry

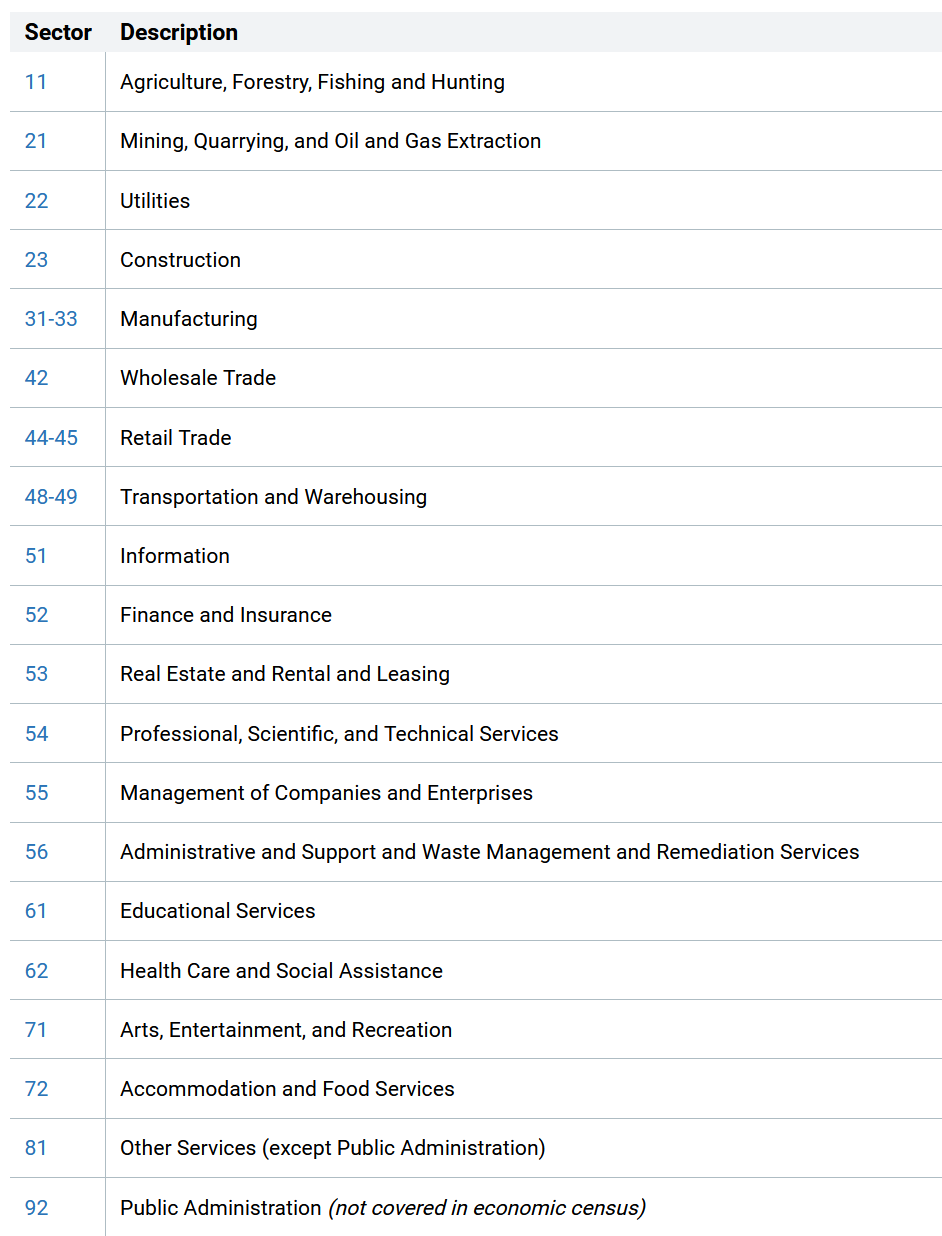

Industries from census.gov

There are four key steps to understanding your industry:

Define your industry at a broad level. Are you in technology, or retail? In logistics or financial services? This may not be straightforward. Many online retailers could be considered technology companies as much as they may be retailers. Amazon may seem to be a retailer (or even a technology company) but is also one of the biggest logistics companies. It’s in physical retail and online stores. And that’s before we consider its pharmacy business, Alexa, Ring or Amazon Web Services. But Amazon is unusually complex and in most cases, it should be relatively obvious what industry you are in.

If you might be in multiple industries, ask yourself, how do your customers see you? Amazon could be a technology, ecommerce or logistics company but to its customers, it is primarily an online retailer.

At this point, you may find it useful to look at the ‘official’ lists of industries to see which one you are in. There are many industry taxonomies - maybe three good starting places are BLS, IBISworld and Census.gov.Once you know what industry you are in, try to narrow that down to a segment. More on this later, but this is likely based on who are your customers and what are their requirements. If your industry is software (which, because it is so large and varied, will not help you with planning your business activities), your segment may be HR tools or core banking systems.

Figure out who are your customers. What kind of companies – for example, which industries they themselves are in (e.g. manufacturing or travel), their size and other attributes. And who are your buyers in those companies e.g. your customers may be in many industries but share the common attribute that it is always Heads of Training who buy your product.

Understand your competitors. Identifying your competitors is important in itself for many reasons, such as being able to target their customer base, or benchmarking your offering. But it can also help further define your addressable segment. For example, Aqute is in competititve intelligence, but the common use of that term includes SEO and SEM competitor analysis, which is not at all what we do. Identifying that the likes of SEMrush or Hrefs are not our competition helps us be more focused in our marketing. On the other hand, we are not really in consulting (because our work is more about analysis and less about strategy or implementation), but we do sometimes compete for contracts with consulting companies such as McKinsey or Boston Consulting Group.

Here it will help to understand what level of the industry you are at – for example, creating products, distributing them or selling them. Many companies can be vertically integrated, meaning that they cover multiple levels (and they may compete with different companies at each level – more on that later). For example, do you compete with resellers, or are they your greatest ally, or both?

2. Quantifying the market

Once you understand your industry, the next step is to quantify it. At its broadest level, this number may not matter – for most US retailers, for example, knowing that they are part of a $5T industry, is an irrelevance other than knowing it is plenty large enough. If it were $0.1T or $100T, most retailers will only ever capture a neglibily tiny part of it and will operate similarly in either of these extremes. In such cases, it can be more helpful to define a sub-section of your industry. For example, online mattress retail, or collaboration software for small businesses, or logistics for refrigerated food. And even so, the size of the market may be so large that only a small number of companies will have meaningful market share.tin

3. Narrowing your target market into segments

Understanding your overall industry is essential but for day-to-day business, a smaller, more manageable, market segment is more useful.

As we just saw, the most general definition of your market is likely too large to be useful. You need to be able to define your segment more narrowly. For example, if you sell software, you need a more narrow definition than knowing that you are in the software industry. You may be in accounting software, and even further, you may be in accounting software for small businesses, and even further still, you may be in accounting software for small businesses who are in services industries.

And you could narrowly segment your market by use case i.e. from the customer perspective – for example, your target may be any type of company that needs software for communicating with partners, or for managing compensation incentives, or for managing expenses. With this second way of looking at your market, it is still usually helpful to understand segments such as customer size or industry – if only because you may have multiple products suited to such segments, or because it will help salespeople pitch better.

4. Did you identify have the right segments?

One cannot generalize as to whether you have identified the right segments for your specific business. But a few considerations may help you decide.

1. Your segment should be large enough to provide meaningful revenue. New business in particular are often satisfied with a target segment on the assumption that if they achieve 1% market share, they will have a sustainable business. But 1% is a difficult target. Most companies never achieve that. By definition, any market only has room for 100 companies each with 1% market share. And most markets have a lot more than 100 companies.

2. But it should be small enough to be easily described and recognizably related to your product. This is why “software” is not a good definition of a segment. Avis is possibly in the “travel” or “vacations” industry but more precisely is in the car rental industry (which is not just, or even primarily, about vacations).

3. And your customers should have the budget and sophistication to buy and use your product. This is most commonly why many companies target only enterprises, or only small businesses or only consumers (or more than one of these but with multiple products).

Chances are, you will define multiple target segments in your industry. For example, different size companies, different geographies, different customer verticals, etc. The need for these will become apparent if each such segment has different requirements, buying processes or other fundamental characteristics.

5. Adjacent and similar markets

Sometimes, your relevant market is not quite as obvious as at first might seem, especially if you consider who is your competition.

Adjacent market expansion, via Harvard Business Review

For example, if you sell collaboration software, your obvious market is collaboration software. Your immediate competitors sell collaboration software. But in practice, you are also competing against Microsoft Excel and old-fashioned paper and pencil. If you sell CRM software, your immediate competitors sell CRM software, but you are also competing against LinkedIn and perhaps other social media platforms, as well as Excel and paper and pencil, and ERP software. And perhaps communications products such as Zoom, and traditional telephony. The specifics depend on the use case and customer segments being considered.

Even outside software, this is a long-established phenomenon – for example, cruise lines competing against theme parks, railways competing against airlines, booksellers competing with cinemas and so on.

6. How big is your industry?

There are many sources of information that you can use to quantify you market. At a broad level, the answer may already be defined and publicly available. Often, a quick Google search will give you the answer, although you will likely see different estimates from different analysts and have to decide which methodology and market definition makes more sense to you, and perhaps settle for an average.

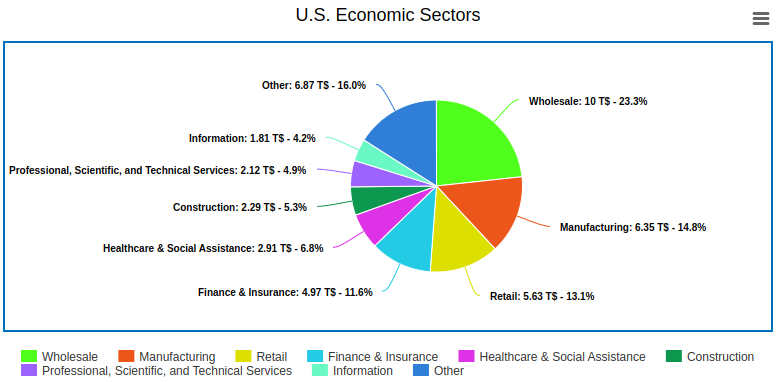

Industry data can be found from sources such as Census.gov, Statista, IBISWorld and others. Some of these, like Statista, are often criticized for poor accuracy in a similar manner to how Wikipedia is criticized, but in most cases, they provide a useful approximation. Some sources will provide free data at a high level but require payment for detailed segment breakouts.

Technology gets a lot of news coverage but is a relatively small industry

7. Is your industry growing?

While you are quantifying your industry, try to understand if it is growing. An industry in decline will likely mean that your own business will also decline. A stagnant industry will make it difficult for you to grow. While a growing industry can give your business tailwinds to help you grow.

Usually, growth data is available from the same sources that have data on the size of the industry – they will have size data for previous years, which leads

8. Who are your customers?

Part of understanding your industry is understanding who are your customers. In B2B markets, this means both what kind of companies would buy your products (for example, enterprises in financial services) and the individuals in those companies (for example, HR managers or software engineers).

Understanding your customers is an essential input for understanding your industry, but that is not at all the same as saying that your industry is the same as your customers’ industry(ies). If you are a broker and your customers are banks, then yes, you are both in financial services. If you are a pharmaceutical company and your customers are hospitals, then yes, you are both in healthcare. But if you are a staffing agency and your customers are in financial services, then your own industry is not financial services, even though that is your target market.

This is particularly true for software companies. A software vendor that sells facilities management software to companies in financial services, retail, education, real estate and so on is in the software industry, or perhaps in facilities management – not in those customer industries. Of course, those are verticals that it should cater to and address explicitly but they are not the vendor’s industry. There are exceptions – including where the customers of a software company are also software companies, but even there, the directly addressable segments will likely be different from the vendor’s own industry.

The distinction becomes more blurred with companies that target only one industry (e.g. building management software for multifamily management, or presentation software for higher education) but the same principle generally applies. Think carefully before deciding that your industry is the same as your customers’ industries.

9. Which companies are your customers?

There are different ways to define which companies are your customers. You may target multiple industries – for example, selling compliance software that healthcare and financial services companies might use. Or no industry in particular – for example, spreadsheet software that any company may want to use. Or companies by size – for example, cheap but limited payroll management software for small businesses; or data security software that only offers value if used at scale by enterprises. Or any company within a geography. And so on for other categorizations.

When you have defined what kind of companies are your customers, you can sense-check this by deciding on a list of specific names (e.g. Visa, Pfizer, FedEx, etc.) that you consider ideal customers and checking that they fit into your target industry as you have defined it. At some point, you will need to do this more thoroughly so that your salespeople have a list of prospects.

10. Which individuals are your customers?

Knowing what kind of companies are your customers is one thing. Knowing what kind of individuals at those companies are your buyers and users is the next step. Your product may have broad appeal (for example, word processing software), be highly specialized (for example, lab management software) or somewhere in between (for example, software for logging the hours worked by remote workers).

Knowing the types of individuals that you are targeting is a step beyond industry analysis, but essential nonetheless. For consumer-facing business, individuals are defined by their demographics, such as 35-50 year old men, and behavioral characteristics, but in business, it is more useful to understand the relevant roles e.g. HR managers, engineering team leaders or marketing VPs.

Buyers and users are often not the same thing. The buyer for software will most often be in IT, especially in enterprises, whereas users will be employees in various departments. And there may be multiple, very different users – for example, mobile device management software will have IT admin users as well as field engineers, office-based employees and others. And in that case, IT employees and other IT employees will see very different parts of the product and have different priorities.

After you determine the type of individuals who are your buyers, a new raft of factors comes into play. This is where you may start to identify single individuals (e.g. Annabel Lee, Director of Marketing, Ohio Widgets Co.) and understand their situation. Or the characteristics of groups of buyers (e.g. directors of marketing may be most influenced by trade shows, spend all their budget in Q4 and like to make decisions quickly). But that’s for another day.

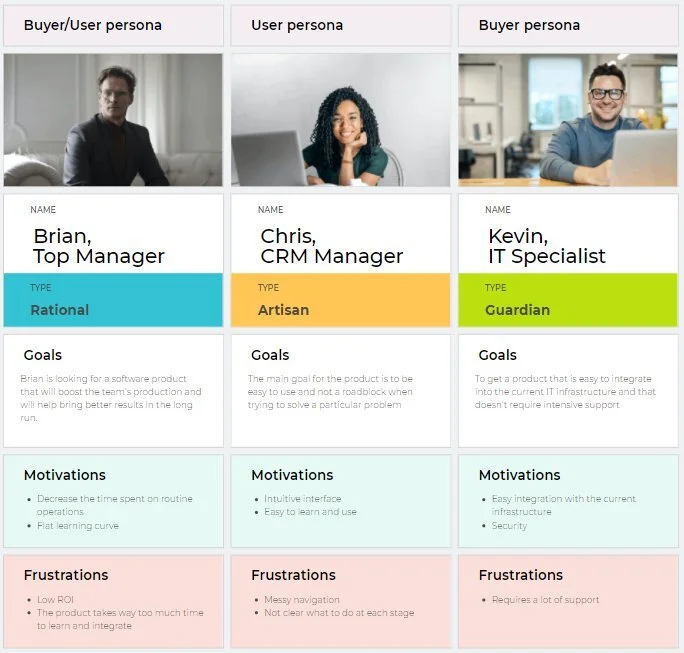

There is a whole field of research for building B2B buyer and user personas, which is beyond this article. Persona research helps you visualize in concrete terms the attributes and preferences of individual buyers and users.

Persona templates via uxpressia.com

11. What if your buyers are your users?

One common situation for software companies is that the buyer may well be the user. This is the case for B2C software, but also for B2B software where the vendor’s strategy is to land and expand. Rather than selling a central contract to, say, the IT department for 5,000 users, the vendor, relies on individual employees adopting the product informally for themselves or their small teams. The vendor will then usually hope that as adoption grows, IT will notice this and decide that a large, central contract has become appropriate.

This land and expand model has been used for software products such as team chat, collaboration and code management tools, among others.

12. What are the use cases?

Another way to understand your target market, and a whole lot more, is to map the use cases for your product. A use case is an example of how your product will be used. For example, use cases for sneakers could be running, walking, looking fashionable, yoga, exercise and so on. Some of those may have sub-use cases, for example, hill running, treadmill running, long distance running, etc.

For business products, there may be a large number of use cases. Let’s take CRM, for example. Use cases could be:

Building sales pipelines

Lead management

Omnichannel customer service

Onboarding new customers

Training salespeople

Customer analytics

Tracking competitor activity

Reducing churn

Travel and expense management for salespeople

Marketing campaign management

…. and plenty more.

Understanding your use cases will help you understand your customers and your competitors. For example, your CRM may span multiple industries because some parts of it compete with expenses management software and some parts of it compete with marketing software.

13. Environmental factors

Beyond developing a core understanding of your industry, you can also seek to understand the internal environment of the typical customer. For example, for software vendors:

Are you likely to be a new implementation or a replacement

Are your customers running on modern or legacy infrastructure, are they mostly cloud or on premise

Do your customers tend to move quickly or are they slow, perhaps because they are risk averse

Are they sophisticated enough to implement the product themselves or will they rely heavily on professional services

Are they bound by regulatory constraints; and so on.

In this context, it will help to know about the other players in your industry with whom the customer has a relationship. You may not interact directly with customers – your product may be white label, or mostly sold via resellers, or as an adjunct to something else. You may wholly own the relationship, in which case you may need to offer services beyond the product itself.

14. Who are your competitors?

Only when you have a solid understanding of your industry should you turn your attention to researching your competitors, but the adage that you should pay more attention to your customers than to your competitors remains true.

Competitor analysis is what Aqute does. That is an article for another time.

15. Keep your industry understanding up to date

Once you have the all-dancing, all-dancing model of your industry, keep it up to date, perhaps through annual reviews.

Over time, particularly in fast-moving industries, aspects of your industry will change. Your customers may start off as companies who run mostly on premise, but five years later be mostly on cloud. Or industry trends may mean that whereas sales departments were once your primary buyers, that has changed to marketing departments. Or your use cases may have changed as more employees started working from home. There are many ways in which an industry will change.

Changing your segmentation or targeting can be painful. It is tempting to use the existing industry model for as long as possible. But staying up to date will help you focus on the right segment.