Find competitors’ customers using public sources

Probably the most commonly requested of the competitive intelligence services that we get asked to deliver in a competitor analysis project is, who are my competitor’s customers? The most obvious reason why companies want to know is so that their salespeople can then go and target those customers. For this, they don’t even really need to know the names of the individual buyers, at least not from us. These days, there is plenty of specialist sales enrichment software that can identify buyers within a company, so a company name is usually enough.

Finding who are the individual buyers is also possible, but more difficult and will return lower numbers than just finding company names. Among the sources listed below, case studies, LinkedIn and internal sales knowledge are the best options for identifying individuals.

Beyond sales targeting as a reason for wanting to find your competitor’s customers, knowing a competitor’s customers (or more helpfully, the customers of multiple competitors) can also help a company understand the industries being targeted by a competitor (if a preponderance of customers come from one or two industries), or the business size segments being targeted. And it can help a company benchmark their own success e.g. by comparing how many Fortune 500 companies a company and its competitors have, or how many customers in an industry, and so on.

You don’t always have to pay an agency to find who are your competitors’ customers. You can do much of the research yourself, for free or nearly-free. Let’s talk about the sources of information that you can use.

1. Website case studies

The first port of call for finding a competitor’s customers, and for most competitor analysis, is their website. Most B2B technology companies (which are the kind of company with whom we work) have case study sections, or perhaps just a list of their customers. Even a scrolling banner may have a few customer names. Some of the more sophisticated companies will have video interviews, or webinars, with key customers.

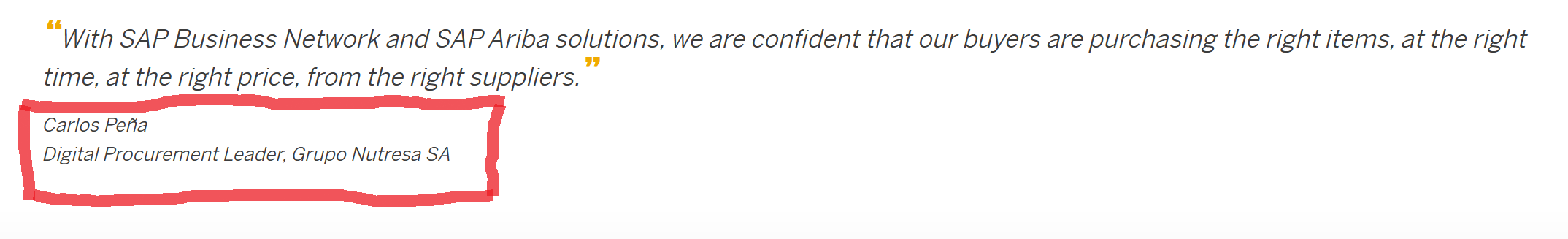

These are all good sources for company names. For example, the SAP case studies page lists dozens of customers, through case studies, videos and other examples.

That’s the first level - finding the names of companies that are customers. But there is more information to be had. For many of these, the names of the individuals are available, which will make these customers easier to target. It’s usually not clear if named individuals are buyers or administrators or other purchase influencers. But they will be something very relevant and a good starting point for salespeople to target.

And here is a video case study for ServiceNow, featuring the name of an individual clearly closely involved with the product or purchase.

While you are reading these case studies, don’t ignore all the other useful information that they have. Case studies may reveal a lot about how your competitor positions itself, the ROI of a a product, the length of sales and implementation cycles, the post-sales services that the competitor offers, and other information.

2. LinkedIn

LinkedIn provides multiple paths to finding the names of a competitor’s customers. One recommendation - pay for a premium subscription like Sales Navigator. If competitor analysis is your job, this is worth doing (we’ve been saying that for years that LinkedIn is a fantastic competitor research tool).

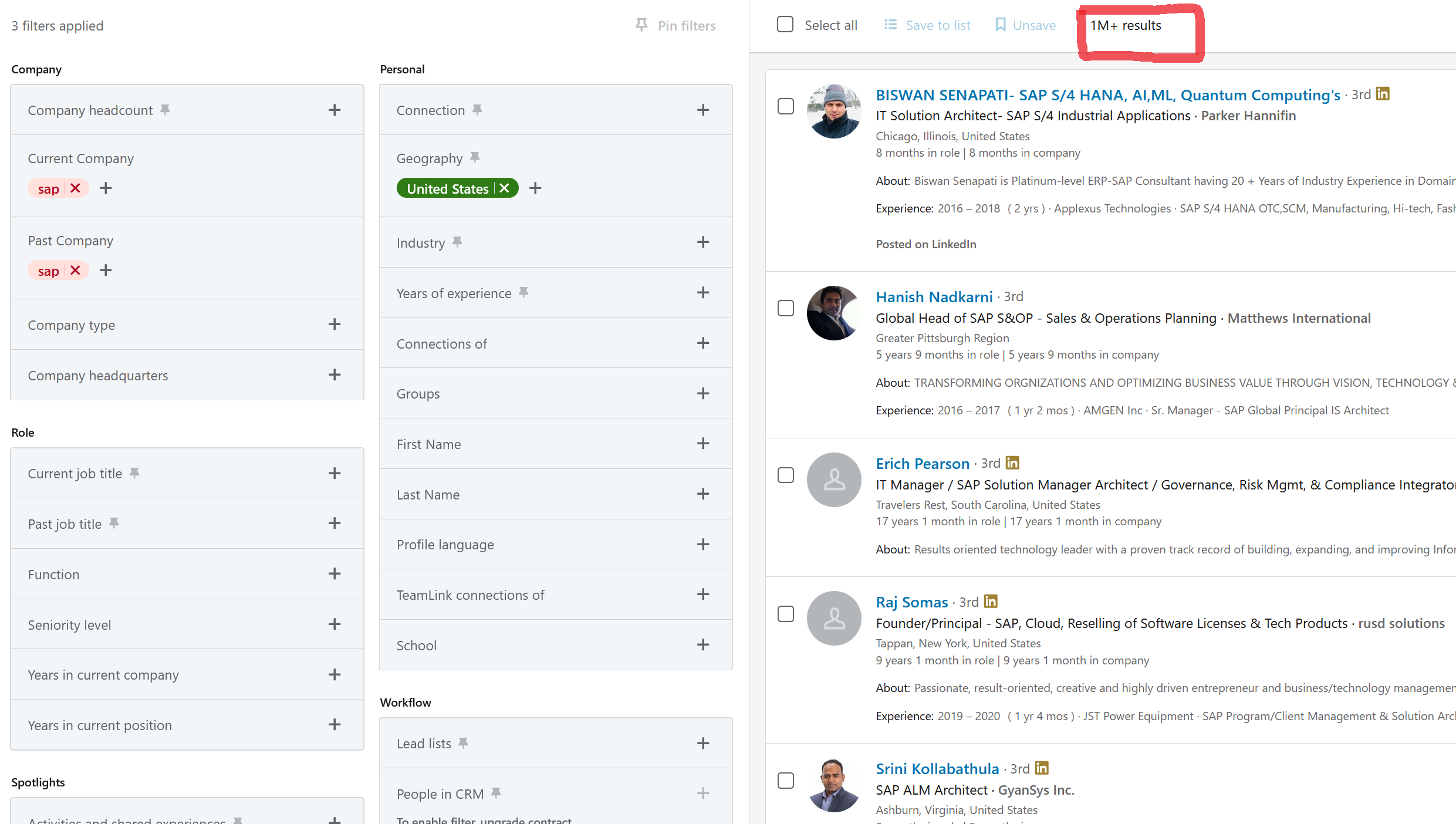

Keyword search of LinkedIn profiles can turn up some customer names. For example - a keyword search for “SAP”, excluding people whose current or previous employer is/was SAP, is a great starting point. Many of the results will not be people working at customers - they may be channel partners of SAP, for example. Or it may not be conclusive if someone’s employer uses SAP - for example, people who say they have SAP skills but who do not say which employer in their history uses SAP. So although LinkedIn is a great resource, you will still need to dig through what may be a vast number of profiles.

For example, this search for the SAP keyword in the US, excluding SAP as a present/current employer, returns 1M+ results - where to start?! LinkedIn provides further filtering options but for a vendor like SAP, of course there will be a huge number of potential profiles as a starting point. A search for Sailpoint, for example, gives 10,000 profiles instead of 1M. A search for Sinequa gives 100 profiles, which is eminently manageable.

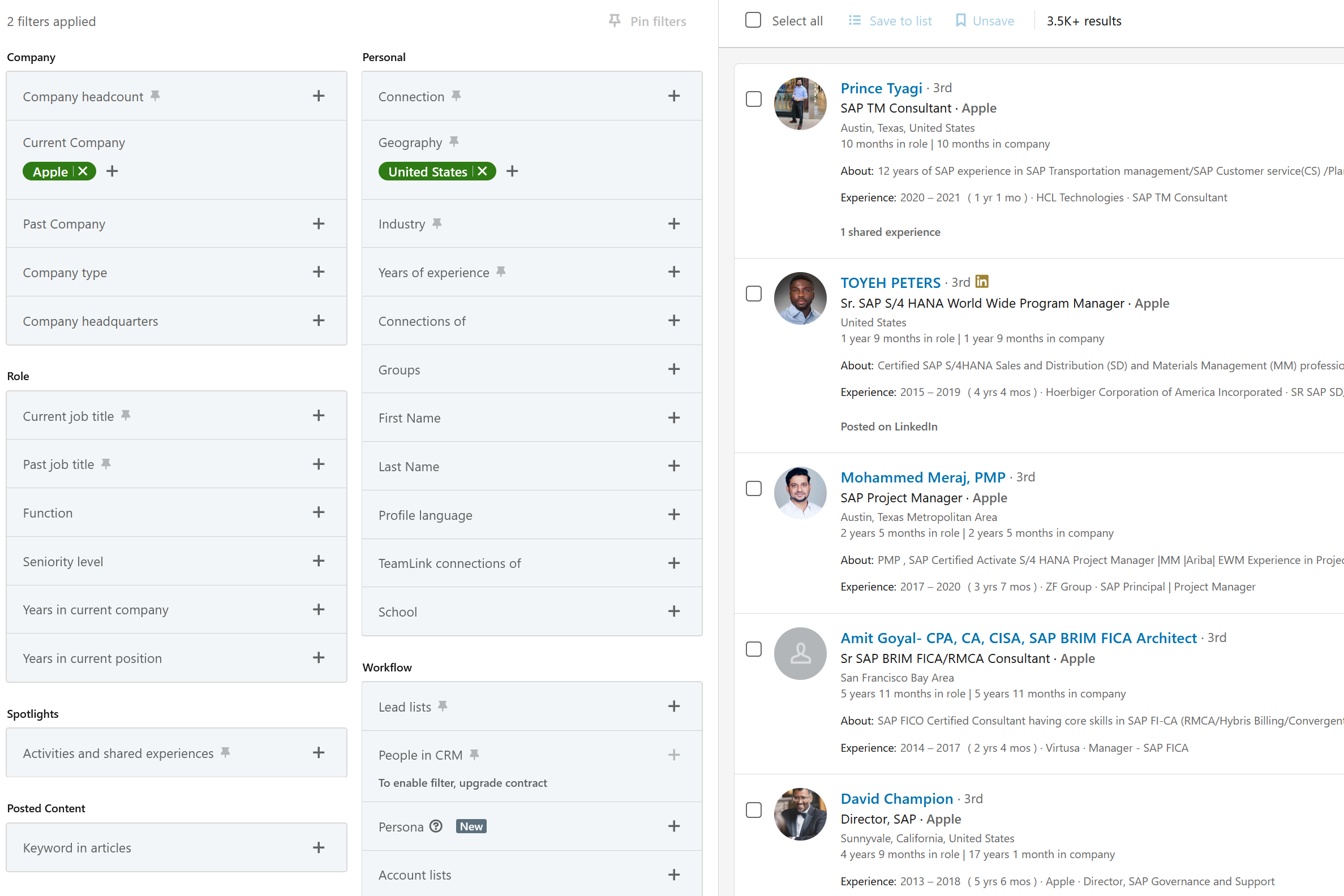

Another option for narrowing down the search is to guess a specific target customer. For example, you may want to know if Apple uses SAP. So you can do the same search, but just limited to profiles where the current (and perhaps past) employer is Apple.

This returns 3,500 results (people currently at Apple in the US, with SAP as a keyword) - see image below. A quick scan shows that Apple clearly does use SAP, and the individual results can be used to build a sense of who might the buyers, the key users and the influencers and which SAP modules are being used.

This approach cannot be scaled infinitely, but it may be manageable to do this for, say, the Fortune 500.

A further way to narrow down the number of results is to search for “SAP” in the job titles of profiles, not as a keyword. For large vendors like SAP (and its 1M results), this can make the results much more manageable, with minimal loss of true positives. For smaller vendors, it may be more useful to try keyword searches. See what works for you.

Finally, you can look through the profiles of the competitor’s salespeople. These will sometimes mention key customers that the salesperson manages.

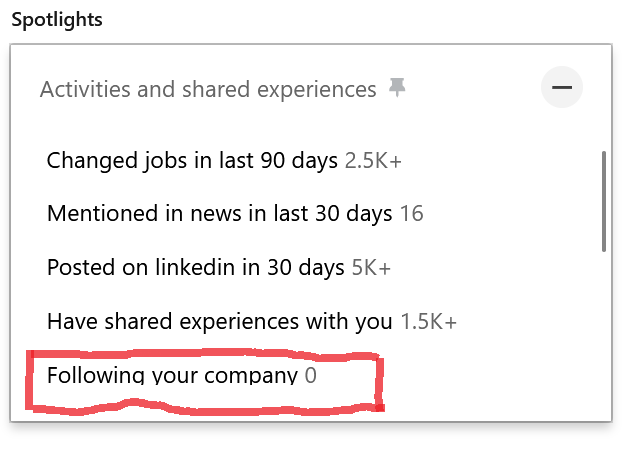

While we’re on LinkedIn, there are a couple of more oblique ways to find a competitor’s customers. If you create a fake profile where you pretend that your employer is the target competitor and then subscribe to Sales Navigator (for its advanced search filters), you can search for people who follow “your employer” (i.e. the competitor). Some of those followers will be employees at customers of the competitor. Likewise, you can search for members of groups dedicated to the competitor (e.g. SAP developer groups), and some of these group members will be employees of that competitor. Both of these used to be possible without having to fake-join and buy Sales Navigator, but no longer.

We don’t recommend these two more esoteric methods for a couple of reasons. One, they’re a bit cloak-and-dagger, which is not a good look. Two, they are less fruitful than you might think. Company followers and group members include all sorts of people and sifting for employees of competitors is impractical among all the other types of people there will be.

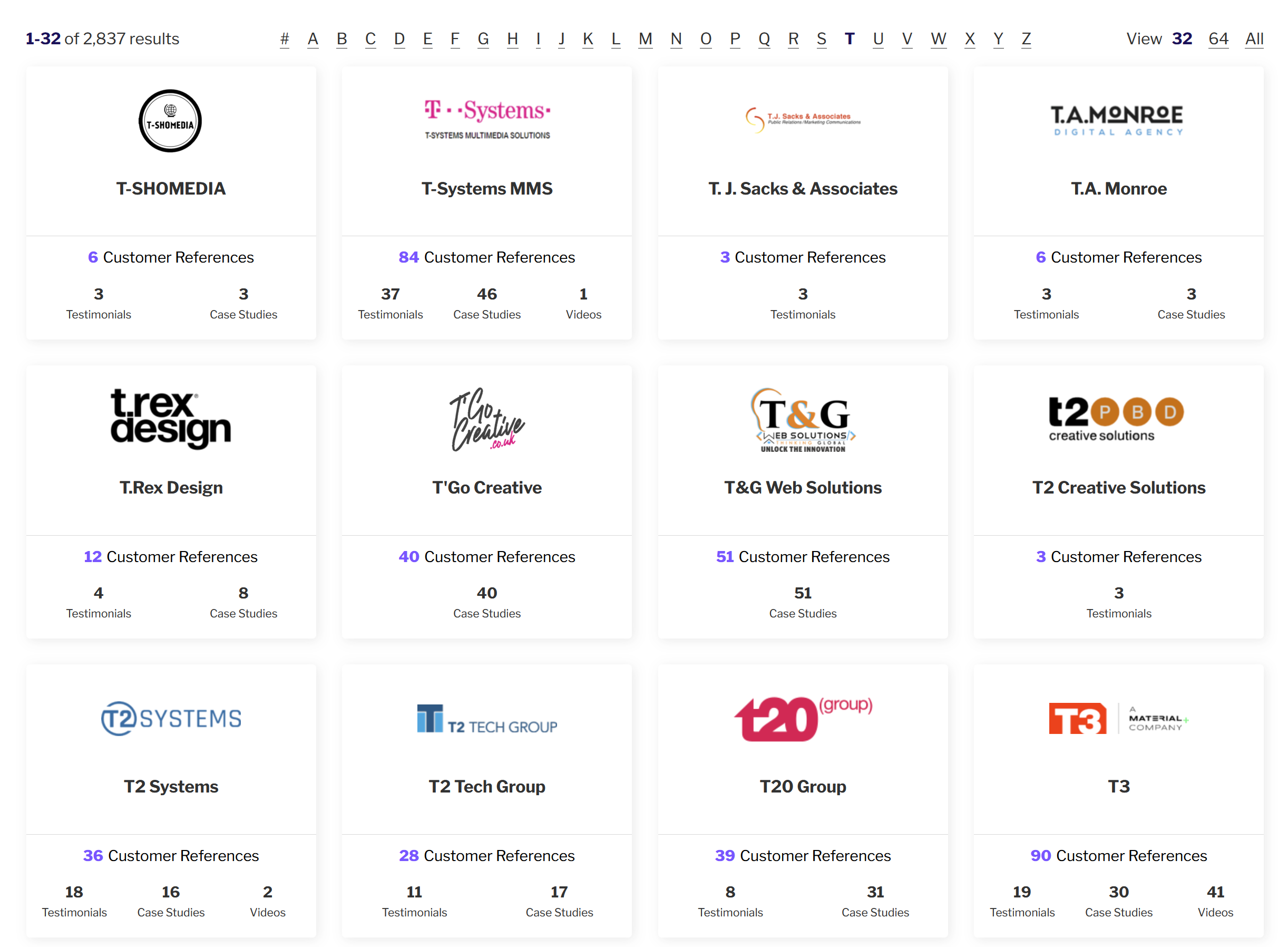

3. FeaturedCustomers

FeaturedCustomers aggregates lists of companies’ customers from those companies’ websites, case studies, videos and so on. It’s information that you could collect yourself from the root sources, but conveniently aggregated in one place.

For any one competitor, FeaturedCustomers will show a small proportion of the overall customer base, but the absolute numbers can be moderately high. Examples:

~2,000 customers for SAP

~1,500 for Sage

~1,000 for Alteryx

<100 for Dwolla

FeaturedCustomers is not the only such aggregator of reviews. G2 is a similar alternative. Both are good sources for competitor analysis.

FeaturedCustomers

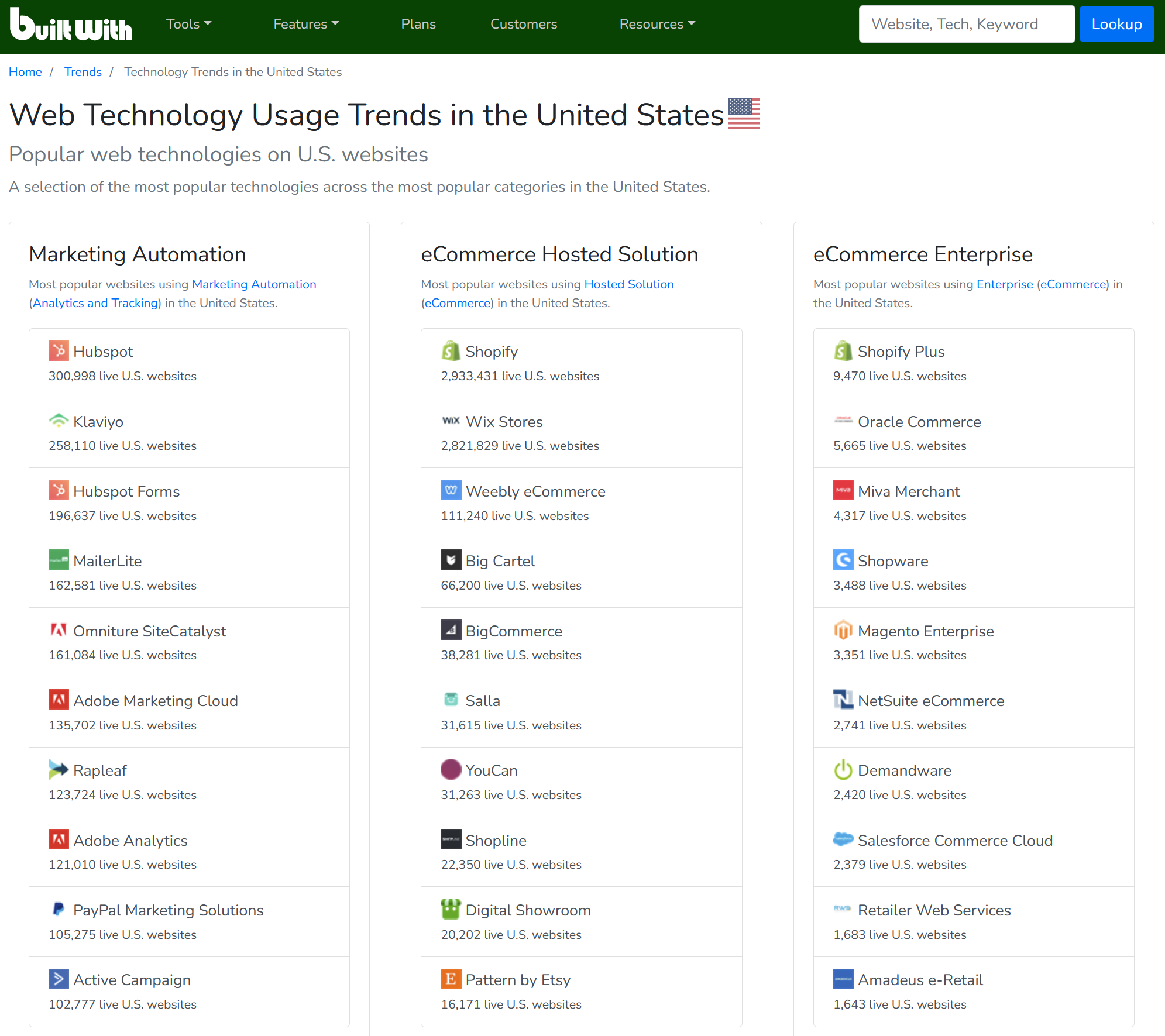

4. BuiltWith (and similar)

BuiltWith is perhaps the best of various websites that provide lists of companies using specific software (others include Similarweb, NerdyData, PublicWWW). For example, you can see what companies are using Magento, Pardot, Criteo or a lot of other products. BuiltWith crawls websites looking for code that gives away the technology stack behind that website. It’s an excellent resource for competitive intelligence, but limited by its methodology - if a company uses software only internally (e.g. SAP), BuiltWith will not find it.

BuiltWith will let you export these vendors’ customer lists in CSV format, with information such as their HQ location, website ranking and other firmographic data.

One difference between BuiltWith and FeaturedCustomers is that BuiltWith returns very long lists of customers (in the image above - 300K Hubspot customers; in the case of, say, Google Ads, millions of customers. Obviously this includes the long tail of customers, whereas FeaturedCustomers is more likely to return much, much fewer, but on the whole much larger, customers.

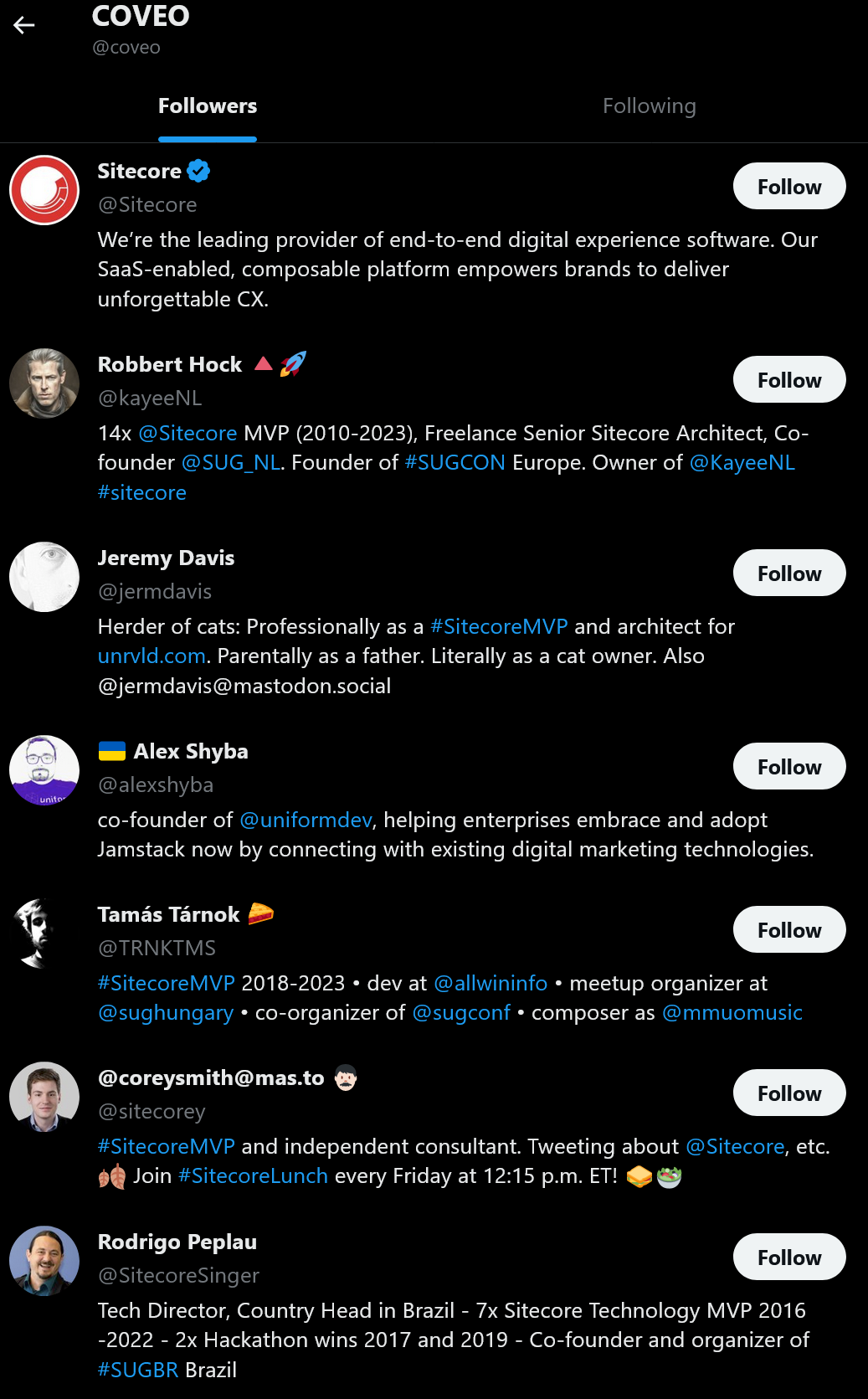

5. Social media followers

This is one of those sources that makes sense theoretically but in practice is unhelpful. In theory, if you look through, for example, a competitor’s followers on Twitter, some of those will be employees working for the competitor’s customers (or the Twitter accounts will be the customer companies themselves, particularly if they are small). However, this is needle-in-haystacks territory. Most people do not include their employer on their Twitter bios. And if they do, or if the Twitter account belongs to a company directly, how will you know if they are a customer? There are ways (e.g. using LinkedIn research) but they are very time-consuming ways.

Take a look at the example below, of followers of technology company Coveo. It would be an uphill struggle to determine which of these represent Coveo customers.

6. Internal sales knowledge

One source of competitor sales information which is only available to you is your own salespeople. Salespeople need to be carefully approached, and your company may have rules about what you can discuss with them. Also the information that salespeople provide may come with its own biases and fragmentations. But salespeople provide a unique perspective - they probably know who is the incumbent vendor at their target acounts, and which competitors they are coming up against with increasing or decreasing frequency (as well as a lot of other information).

Collecting information from salespeople is often a goal for competitive intelligence gathering programs, although salespeople may not see the benefit in taking time out from generating revenue, to provide information to a less frontline (competitive intelligence) team.

7. Analyst reports

Analyst reports, such as from Forrester and Gartner, will often call out key customers of the companies that they analyze. These will be in very small numbers, but are low hanging fruit as such reports are usually part of the routine reading for competitive intelligence teams. The analysts who write these reports may also know additional customer names that they do not include in published reports but may be willing to share if asked.

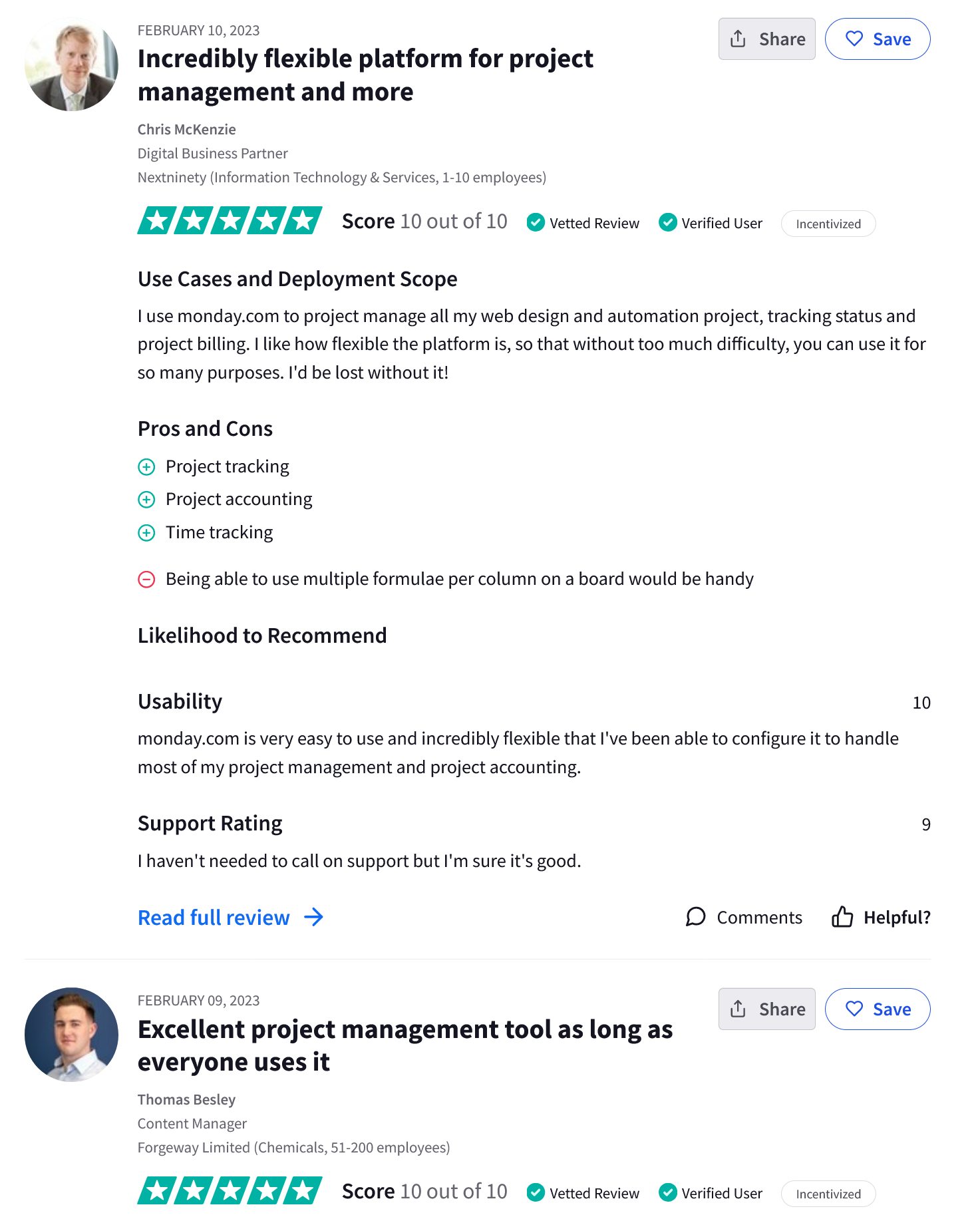

8. Review aggregator websites

Review sites like TrustRadius and G2 aggregate user reviews for B2B software companies. These reviews are mostly anonymous, but there are plenty that are not, or where you can work out who submitted the review.

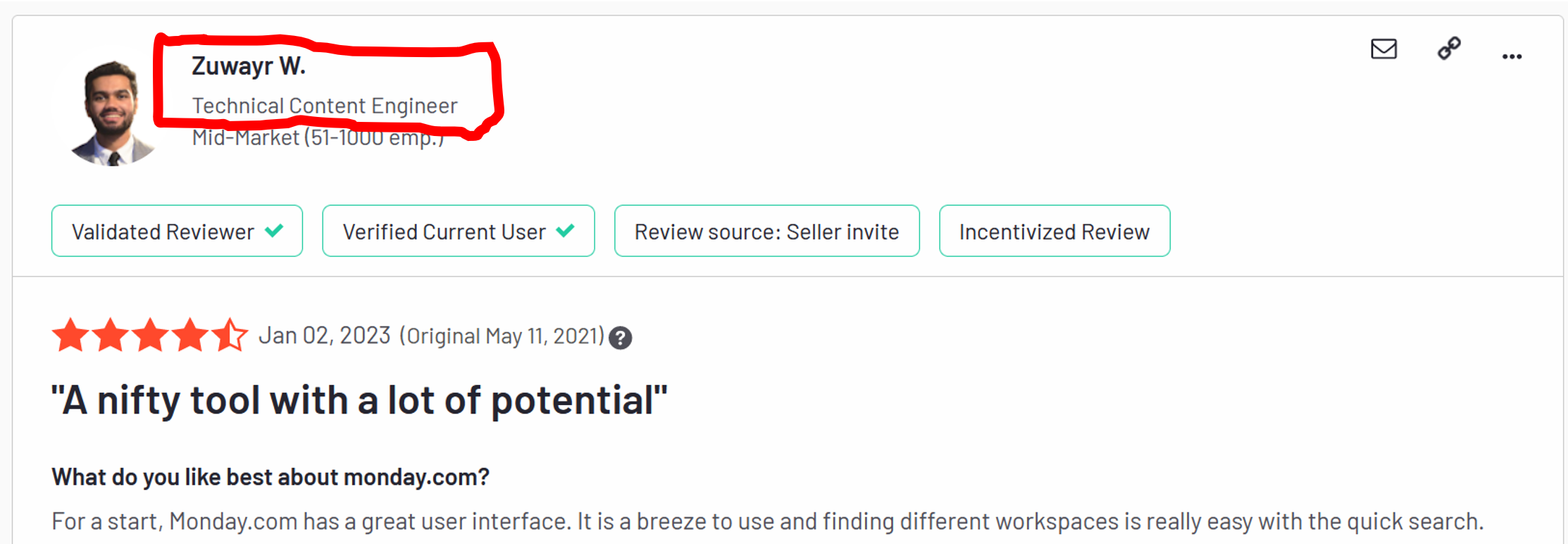

Below is an example of reviews for Monday.com taken from TrustRadius. The names of the users have been published, as have their companies, giving you the names of some Monday.com customers. There are thousands of Monday.com reviews, although most do not have names published.

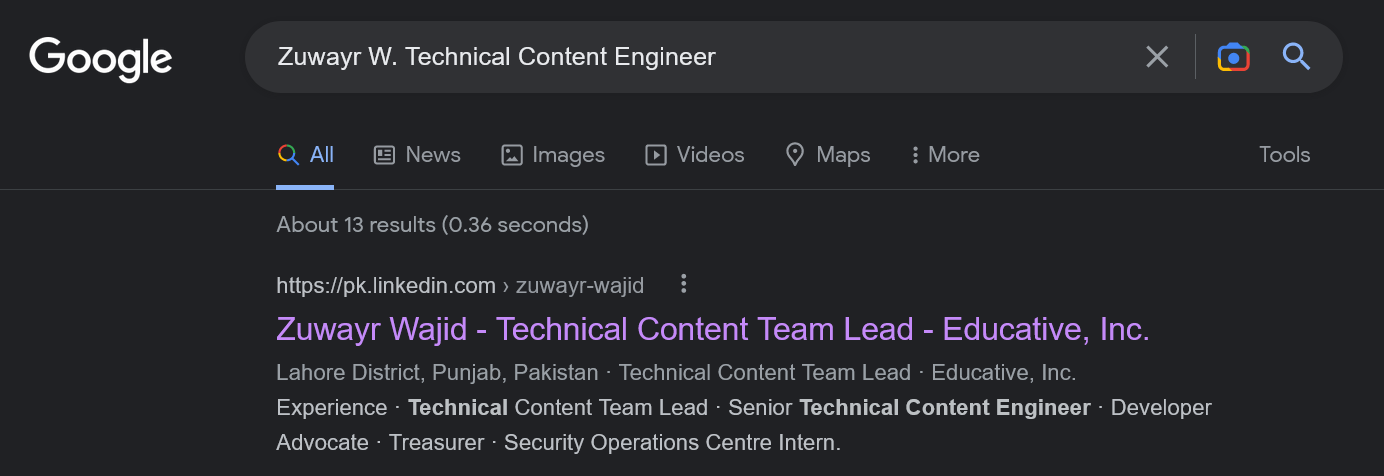

In other cases, the reviewer may partly publish their name, that may be unique enough for Google to point you to their LinkedIn profile. For example, here is a review for Monday.com from G2, with a partial name.

And here is Google finding that employee’s LinkedIn profile (and more importantly for this purpose, their employer), based on their partial name.

In some cases, where no name at all is published but the review has a thumbnail image of the reviewer, it may be possible to reverse search that photo using Google Image Search, if the reviewer has used the same photo on their LinkedIn profile.

These are some good ways of finding your competitors’ customers. Whether it be the broad and shallow approach of a source like BuiltWith or the narrower and much more specific results of a source like LinkedIn. Good luck with your competitor research.