The manufacturing industry has contended with countless issues in recent years—economic uncertainty, labor shortages, supply chain disruptions, and inflationary pressures, to name a few. To some degree, these challenges have been a result of uncontrollable macroeconomic events and circumstances, but they were also in large part due to the industry’s adherence to severely outdated practices and systems.

The manufacturing industry is historically one of the most slow and resistant to change. This is understandable, given that making any facility and equipment reconfigurations has traditionally necessitated severe cost and time sacrifices. For most manufacturers, the drive to evolve, innovate, and pivot simply did not exceed the motivation to keep things moving smoothly and predictably.

However, the events of the past few years have shined a light on the cracks in the foundation, demonstrating the substantial long-term costs and risks that manufacturers are taking on by trying to avoid short-term challenges. This has prompted both government and individual company action aimed at increasing resiliency and laying the groundwork for long-term transformation in the manufacturing sector.

Entering 2024, the manufacturing industry has positive momentum, spurred on by recent legislation that aims to rebuild infrastructure, advance clean energy initiatives, and build out the domestic semiconductor industry. These laws—the Infrastructure Investment and Jobs Act (IIJA), the Creating Helpful Incentives to Produce Semiconductors (CHIPS) and Science Act, and the Inflation Reduction Act (IRA)—have already resulted in record private sector investment in the manufacturing industry.

Still, the industry is not out of the woods just yet. While poised for cataclysmic change, the fate of the manufacturing sector still ultimately depends on individual company commitment to pivot, adapt, and evolve in new ways.

Below, we cover the key trends shaping the manufacturing industry in 2024, including everything you need to know to be on the leading edge of this industry’s transformation.

Top Trends in the Manufacturing Industry

Generative AI and Data Utilization

With the recent boom of generative AI (genAI), manufacturing companies are taking a good hard look at their data capabilities and how well they are implementing data across the organization. The possibilities genAI opens up in the manufacturing industry are endless.

For example, machine learning algorithms can boost innovation by analyzing vast amounts of data—including market trends, customer preferences, and historical performance—to identify patterns and generate new ideas faster and more effectively than humans can alone.

Generative AI can also be used for predictive maintenance in factories—analyzing real-time data from sensors and equipment to detect anomalies and potential equipment failures before a breakdown occurs. This can be monumental in cost saving and enhanced operational efficiency.

Finally, leadership in manufacturing companies is becoming aware of how generative AI can contribute to better decision-making by analyzing vast amounts of historical data in seconds—such as market trends, customer feedback, and inventory management—and generating insights that manufacturers can then use to optimize strategy and operations.

Yet we are still far from full adoption of generative AI in this industry. Most manufacturers agree that they have the right data, but they do not yet have the necessary infrastructure to utilize that data most effectively. Ultimately, it’s up to leadership to build sustainable strategies for implementing generative AI and advancing data capabilities.

“Talent development and upskilling are crucial elements to succeed in the rapidly evolving Generative AI landscape.”

– The Generative AI Imperative for Production | Genpact Ltd. (Company Publication)

Digitalization and the Rise of Smart Factories

More and more manufacturers are transitioning to smart factories, which integrate advanced technologies such as AI, 5G, Internet of Things (IoT), data analytics, and cloud computing. The benefits these technologies bring to factories are boundless, from gains in asset efficiency and productivity to cost reduction and improvements in safety and sustainability.

According to a recent study, 83% of manufacturers believe that smart factories will transform the way products are made in five years. And indeed, their proliferation in the industry is hardly surprising. In an age of economic uncertainty, tight labor markets, and rising costs, manufacturers are constantly looking for ways to boost efficiency and resilience in their operations. Smart factories are an ideal way to do so.

While digital strategy is an investment, it’s one that is worth making. The short-term obstacles such as training the staff, switching out equipment, etc. should not overshadow the long-term benefits of digitalization—future cost savings, greater efficiency and productivity, and a strong competitive advantage.

Artificial Intelligence and Virtual Processes

In addition to generative AI’s possibilities with data utilization and the rise of smart factories, artificial intelligence is opening up unprecedented workflows, such as remote monitoring, servicing, and equipment operation. With technologies such as digital twins, machine learning, augmented reality (AR) and virtual reality (VR), manufacturers no longer need to even be on site to ensure safe, effective, and smooth production processes.

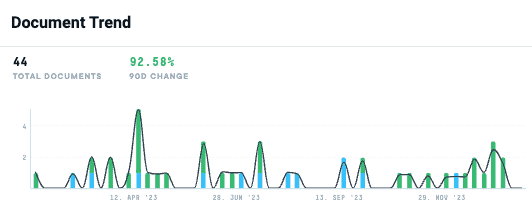

In the AlphaSense platform, we saw a 92.58% increase in “virtual processes” within news and company documents—a clear indicator of the growing popularity of this trend.

Focus on Sustainability and Carbon Neutrality

Manufacturing companies are more than ever prioritizing sustainability and carbon neutrality, as ESG and the pursuit of a net-zero carbon emission future continue to be at the forefront of investors’ and consumers’ minds. 2023 saw an influx of federal funds and incentives for electrification and decarbonization of product portfolios, such as IIJA’s investments in electric vehicle charging infrastructure and the IRA (aiming to accelerate EV adoption and boost battery manufacturing).

To meet these demands, manufacturers are turning to various strategies, such as partnering with external collaborators that are equipped to drive sustainability, investing in electrification and low-carbon or renewable fuel technologies, and even forming specialized verticals for zero-emissions products and technologies.

In 2024 and beyond, manufacturing companies can expect even greater pressure from government, municipal, and institutional contracts, as well as commercial customers, to align with climate-friendly initiatives and prioritize ESG practices.

Shifting Focus From B2B to B2C

Historically, manufacturing companies have always relied on retailers or distributors to sell their products to customers. But during the 2020 pandemic, many consumers shifted to doing their shopping online—a trend that has persisted into today.

With this e-commerce boom, manufacturers now have the opportunity to sell directly to consumers, which is appealing for several reasons. First, it gives them more control over brand and pricing, and second, it allows them to interact more closely with their customers and better understand their needs, so that they can deliver a more personalized buying experience. Selling directly to consumers also allows manufacturers to capture a larger share of the value chain, while avoiding some of the costs and complexities associated with traditional distribution channels. This, in turn, allows them to sell their products to consumers at lower prices, while still earning a profit.

Some examples of manufacturing companies that are selling their products B2C are Tesla—customers buy vehicles directly from Tesla instead of car dealerships, General Electric—customers can now purchase appliances and parts directly from GE, and Warby Parker—a glasses manufacturer that sells their products exclusively in their own stores.

Supply Chain Reorganization and Reshoring

Ever since the start of the COVID-19 pandemic, manufacturing companies have been navigating continual supply chain disruptions, affecting production schedules, lead time, delivery time, and company spending. Even now, 38% of manufacturers report that supply chain issues are among the top issues they face today.

Many of these issues are due to the fact that two decades ago, most manufacturers outsourced parts and electric manufacturing in order to cut costs. But with geopolitical tensions and energy shortages, manufacturers have increasingly been looking into establishing domestic supply chains, so as to increase resiliency and decrease dependence on other nations.

To that end, there have been multiple legislative initiatives aimed at providing incentives for reshoring, including the CHIPS Act, IJIA, and IRA. Furthermore, 90% of manufacturers are committed to building a diversified supplier network that includes local and regional suppliers.

Additionally, digital supply chain solutions are also helping build up supply chain resilience. According to a Deloitte survey, 76% of manufacturers are adopting digital tools to gain enhanced visibility into their supply chain.

Combined with reshoring, adopting these digital technologies is an integral way for manufacturing companies to safeguard their supply chain ecosystem against future disruptions and uncontrollable macroeconomic factors.

Addressing Labor Shortages

Labor tightness in the manufacturing industry has persisted for the past several years, beginning during the pandemic due to production rate slowdowns and generous government pay-outs. According to a study conducted by the National Association of Manufacturers, almost three-quarters of surveyed manufacturing executives reported that attracting and retaining a quality workforce is their top business challenge.

Quit rates for manufacturing were at 40% in 2023, with the common pattern being that new workers enter, go through training, and leave soon thereafter, to be replaced by new workers who need to be trained again.

As such, manufacturers are focusing on actionable strategies for attracting and keeping new employees. Many are seeing the power of technology and artificial intelligence to keep workers engaged and motivated. This means reconfiguring training and workforce development strategies to focus more on data analytics and artificial intelligence. Additionally, proper utilization of technology and automation can also allow manufacturing companies to augment human labor, so that there is less necessity for hiring additional workers.

Humanoid robot workers are also making their grand entry into the manufacturing workforce this year, with automaker BMW utilizing a Figure robot for assembly work. These human-shaped workers are expected to be staffing warehouses within a decade or so, according to a Silicon Valley startup working toward that vision. Clearly, we are entering a new age where humans will be working alongside technology in previously unprecedented ways, and manufacturing companies are beginning to prepare for that future.

Impacts on the Consumer and Retail Industry

It’s important to note that manufacturing and the consumer industry are intricately connected—many of the manufacturing trends above also pertain to the consumer and retail space. Most consumer and retail companies do work with manufacturers, or they have manufacturing processes in-house.

For a more in-depth dive into best practices for consumer and retail companies during economic uncertainty, that can also apply to manufacturing companies, read our post: How Consumer and Retail Companies Can Better Navigate Economic Uncertainty.

If you’re interested for a more comprehensive consumer market overview and outlook, check out our CPG Market Overview and Outlook for 2023 and Beyond.

If you are curious about how AlphaSense can support retail market research, check out our Retail Market Research page.

Manufacturing Industry Outlook for 2024 and Beyond

The manufacturing industry is currently in an era rife with challenges, but also, unprecedented opportunities for transformation. The workflows, strategies, and processes that worked for decades are now showing their holes, and companies that want to survive must be willing to pivot and adopt new ways of doing things.

Embracing digital transformation and new technologies is the most integral way to remain competitive in today’s world and not only survive, but thrive. These technologies not only provide solutions to the most rampant manufacturing issues—supply chain disruptions, labor shortages, and the ongoing pressure to meet climate goals—they have the power to completely revolutionize the industry.

We are shifting into a time where manufacturing companies no longer have to be relegated to the background, their fate entirely dependent on sellers, suppliers, and the state of the market.

By leveraging technologies like AI, genAI, machine learning, and more, manufacturers can take back control over their supply chains, create more direct and synergistic relationships with consumers, and optimize their operations and product quality.

But we are currently just in the beginning stages of this evolution. In 2024, manufacturing companies will continue grappling with the push-and-pull forces of change implementation. They will keep focusing on understanding and implementing data more effectively in their organizations. Those that are able to lean into the digital transformation and implement data-centric growth strategies will be much better positioned to stay resilient in the face of potential future disruptions and turbulent markets. Those that resist these changes will have a much harder time navigating future headwinds and will be powerless in the face of market shifts and volatility.

Stay on Top of the Evolving Manufacturing Landscape with AlphaSense

Staying ahead in the manufacturing industry requires diligent research efforts and confidence in decision-making. AlphaSense is a leading provider of market intelligence, including 10,000+ high-quality content sources from more than 1,500 leading research providers—all in a single platform.

From technology to sourcing, AlphaSense keeps you up to date on the latest manufacturing trends. With our AI search technology, you can quickly surface data points buried in earnings transcripts and SEC filings, and easily benchmark your own performance against your peers.

Specific types of content you’ll find on the AlphaSense platform include:

- Manufacturing and patent news, industry reports, company reports, ESG reports, and regulatory content from sources such as World Trade Organization (WTO), Manufacturing Dive, and more

- Over 1,500 research providers including Wall Street Insights®, a premier and exclusive equity research collection for corporate teams

- Expert call transcript library that gives access to thousands of insightful interviews with former employees, customers, competitors, and industry experts

Related Reading: Key Predictions for Energy and Industrials in 2024

The AlphaSense platform also delivers unmatched AI search capabilities and features for analyzing qualitative and quantitative research, and can mine unstructured data for the most critical insights, including:

- Smart Summaries, our first generative AI feature, summarizes key insights from earnings calls for faster analysis

- Smart Synonyms™ technology that ensures you never miss a source important to your research

- Automated and customizable real-time alerts for tracking regulatory filings, companies, industries, and potential investments

- Table export tools that support M&A workflows like target lists and due diligence

- AlphaSense Assistant (coming soon!), an AI-powered chatbot designed to answer your most pressing business questions, quickly and accurately

Stay ahead of the rapidly evolving manufacturing landscape and get your competitive edge with AlphaSense. Start your free trial today.