As we inch closer to an increasingly severe degree of economic uncertainty—one many have forecasted as the next recession—financial experts are hyper-analyzing the recent past to assess whether the Federal Reserve System should raise its inflation target.

From a historical standpoint, some suggest that the US economy never fully recovered from the Great Recession, citing sluggish productivity and low unemployment defined by a decrease in labor-force participation that is still present in 2023. However, when the COVID-19 pandemic hit in early 2020, the Federal Reserve responded promptly and decisively.

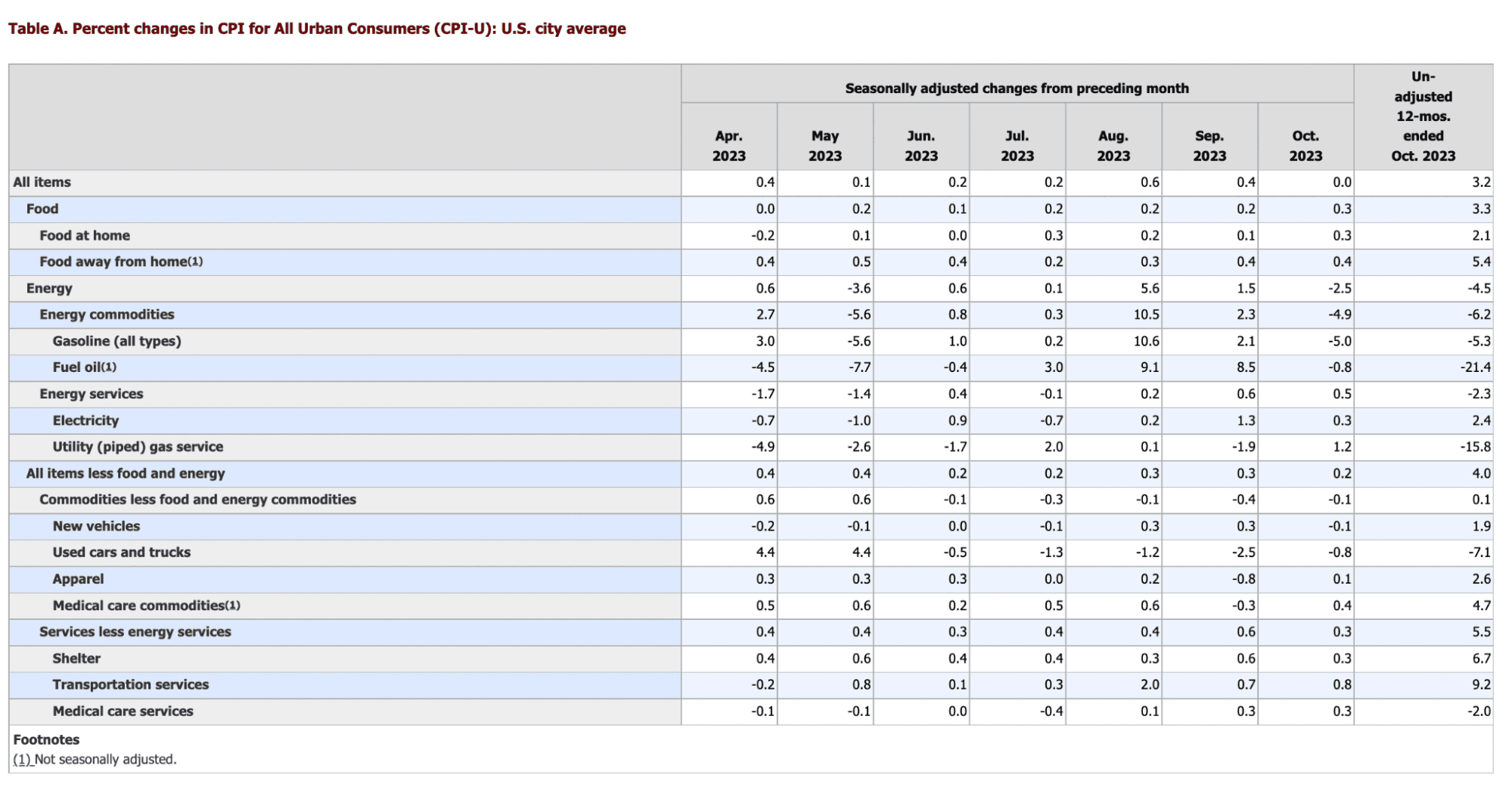

It slashed its short-term interest rate target to nearly zero in March 2020, maintaining this level until March 2022 and resuming substantial purchases of U.S. Treasury and government-backed mortgage bonds through “quantitative easing.” Coupled with significant fiscal policy measures and the rollout of newly developed vaccines, altogether this approach fostered a robust economic recovery. However, this recovery was accompanied by a persistent surge in inflation, with the consumer price index peaking at nearly 9% year over year in the summer of 2022.

Consequently, the Federal Reserve’s current cycle of rate hikes has reached 5.25%, with the central bank suggesting that only one more increase is on the table. While inflation stands well above the Fed’s official 2% target, the Fed will likely raise its inflation target in the coming years to between 2.5% and 3%.

But what does an increase in the Fed’s inflation target mean, and what are the implications of it on consumers, industries, businesses, and the economy as a whole? Below, we dive into the economic activity shaping a 2% inflation target rate, what this goal sets for a 10-year outlook, and whether this goal is achievable in the eyes of financial experts.

Resetting Rates

According to the Federal Reserve’s Summary of Economic Projections, policymakers have indicated that the long-run neutral federal funds rate, referred to by economists as r-star, has risen towards 3%. Consequently, this projection—based on the American economy’s performance—has led investors and the like to reset rates to a higher level.

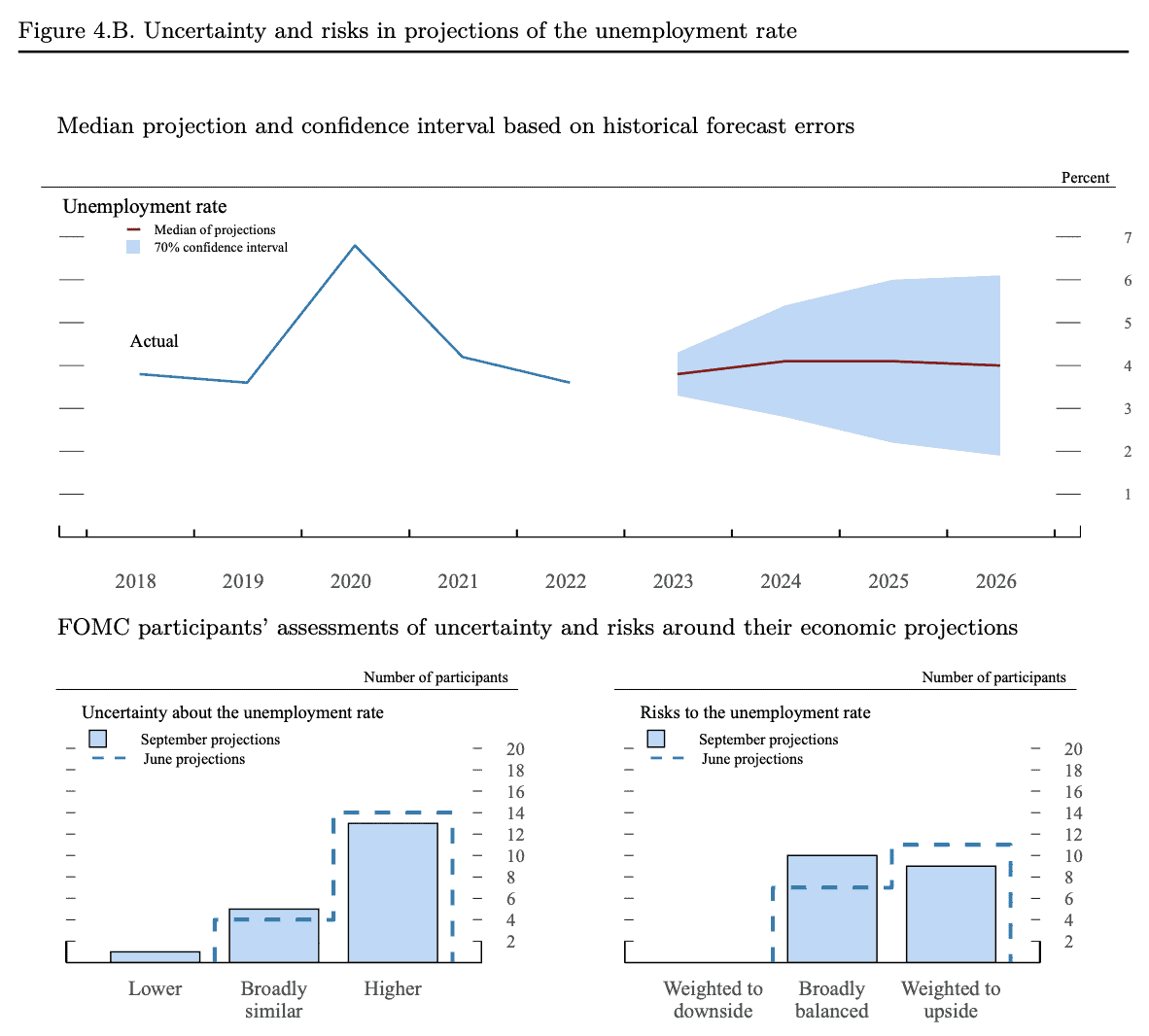

In terms of nationwide employment, the economy has consistently generated roughly 233,000 jobs per month over the last six months—despite the disruption brought on by the COVID-19 pandemic and subsequent inflation.

Additionally, the Gross Domestic Product (GDP) surpassed 3% in Q3 2023, with momentum expected to persist until year-end. With rising productivity and full employment (u-star) at 4%, the U.S. economy is poised to outpace the current long-term growth rate (y-star) of 1.8%.

The bottom line: the US economy is entering a new phase, one where access to easy money and secular stagnation characterized by near-zero interest rates and unconventional policies aimed at preventing a depression is coming to an end.

Instead, a rapidly evolving framework is emerging, one where investors assign positive term premiums to debt, reflecting higher long-term trend growth. It’s a framework where the policy rate is not zero on a nominal basis and is negative when adjusted for inflation.

Further, debt will be priced within a risk matrix that acknowledges federal deficits, political dysfunction, and potential inflation-related losses. Consequently, there is a decline in bond prices and an increase in yields across the entire Treasury curve.

While acknowledging that the long-term demographic challenges associated with the global savings glut persist, which dampened rates over the past two decades, there is a sense that the prolonged downward pressure on growth, inflation, and rates is easing.

Calculating Interest Rates

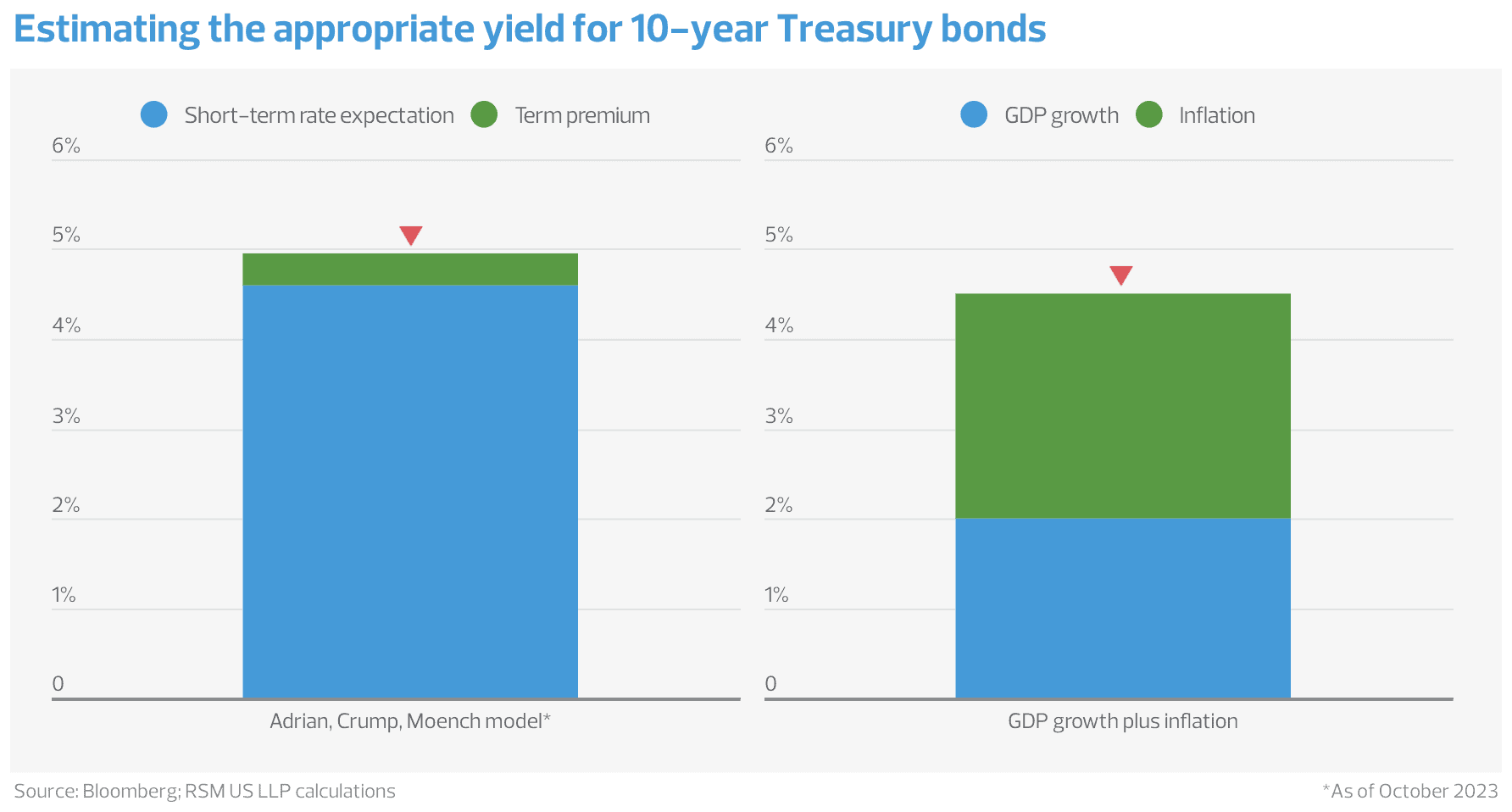

A straightforward method for estimating long-term interest rates involves adding real GDP growth to the expected rate of inflation. For instance, with a growth rate of 2% and inflation settling between 2.5% to 3%, this implies a 10-year bond yield ranging from 4.5% to 5%.

Applying this approach, the recent increase in long-term interest rates, surpassing 4.8%, aligns with RSM’s projections. Ultimately, this would mark the first time in years that the risk premium has turned positive, signaling a crucial indication that interest rates are returning to a more normal state.

In the unlikely but possible absence of significant market events or domestic political instability, one can reasonably anticipate 10-year interest rates to persist within the 4.5% to 5% range, as long as the market expects the Fed to maintain its policy rate at 5.5%.

However, recent events pose a threat to this stability, ranging from the potential government shutdown in November to the Israel-Palestine war, leaving financial conditions susceptible to risks.

Already, the increase in real interest rates has elevated the cost of commercial and industrial loans for middle-market businesses. This surge makes it challenging for these firms to meet payrolls and fund their expansion. Additional economic shocks would only intensify the pressures these businesses are currently facing.

The Ideal R-Star

In 2009, short-term interest rates were initially brought down to zero due to the severe circumstances arising from the most significant recession since the Great Depression. The financial crisis, coupled with the concurrent decline of the U.S. industrial sector, led to fiscal austerity, a sluggish economic recovery, and the looming threat of deflation.

To prevent further harm to the economy, the responsibility fell on monetary authorities. The Federal Reserve, in explicit guidance, advocated maintaining its policy rate at these historically low levels until a full economic recovery was achieved. Consequently, with interest rates across all maturities constrained at the zero-bound, the appetite for borrowing and lending sharply decreased.

This environment persisted, causing 10-year Treasury bonds to fluctuate between 1.5% and 3% for nearly a decade. During this period, it was consistently emphasized that the opportune time for borrowing and investing in the future was amid these conditions. The exceptionally low interest rates meant that the cost of servicing debt would be in deflated dollars, even accounting for the lowest levels of inflation.

However, the landscape has shifted. The nominal 10-year rate is now approaching 5%, while inflation has eased to 3%, resulting in real interest rates hovering around 2%. As of October 6, the rate on the benchmark 10-year Treasury Inflation-Protected Securities stood at 2.48%, marking a significant increase compared to a decade ago.

Is a 2% Target Feasible?

Critics argue that the 2% figure lacks strict scientific grounding and may lead central bankers to overly focus on inflation at the expense of other economic indicators such as unemployment and growth. Although inflation remains a challenge in the post-COVID recovery, the latest consumer price index (CPI) report indicates a cooling trend, with U.S. inflation dropping from its peak of over 9% to around 4% in May. The Fed projects further cooling to approximately 3-3.5 percent by year-end.

This trend has led financial experts to question the need to raise the target federal funds rate further if inflation is on this downward trajectory, as doing so could risk recession and job losses. On the other hand, some experts are proposing a higher inflation target of 3 or 4 percent, even as others recommend a return to the Fed’s historical goal of price stability without a specific inflation target.

The bottom line: the Federal Reserve has recently shifted from a “hard” 2 percent target to a more flexible “average of 2 percent over the long run.” This implies tolerance for periods of inflation above 2 percent to offset times when it falls below that threshold. Even if one supports reconsidering the 2 percent inflation target, it might be imprudent for the Federal Reserve to abandon it entirely at present.

The Fed is actively combating still-elevated inflammation levels, and one of its primary goals is to anchor inflation expectations in the public. Most experts agree that any reconsideration of the 2% target should be postponed until after the current inflationary challenges have been addressed.

Forecasting Inflation in the Future

With AlphaSense’s vast content universe and advanced AI search technology, you can conduct deep, comprehensive, and accurate research—in a fraction of the time it takes your competitors. No matter the state of the economy, utilizing AlphaSense for your market intelligence will help you make better, smarter decisions and keep your organization on the leading edge.

Interested in learning more about market impacts of rising central bank interventions? Download our captivating webinar, Today’s Market Environment: Will This Time Be Different?, with Mike Green, Chief Strategist at Simplify Asset Management, and host Jamie Catherwood, President of Investor Amnesia, as they explore Sir John Templeton’s famous saying: “the four most dangerous words in investing are, ‘this time it’s different’” and whether elements of today’s market are indeed different this time.