In the realm of investment research, staying ahead of the curve requires access to reliable and comprehensive private market research.

Private market research refers to the analysis and assessment of non-publicly traded assets, such as private companies, venture capital, private equity, and other alternative investments and is paramount in identifying untapped opportunities, mitigating risks, and enhancing decision-making for successful investments. Unlike public markets, where information is readily available, private markets often lack transparency, making it a challenge for investors to access reliable data.

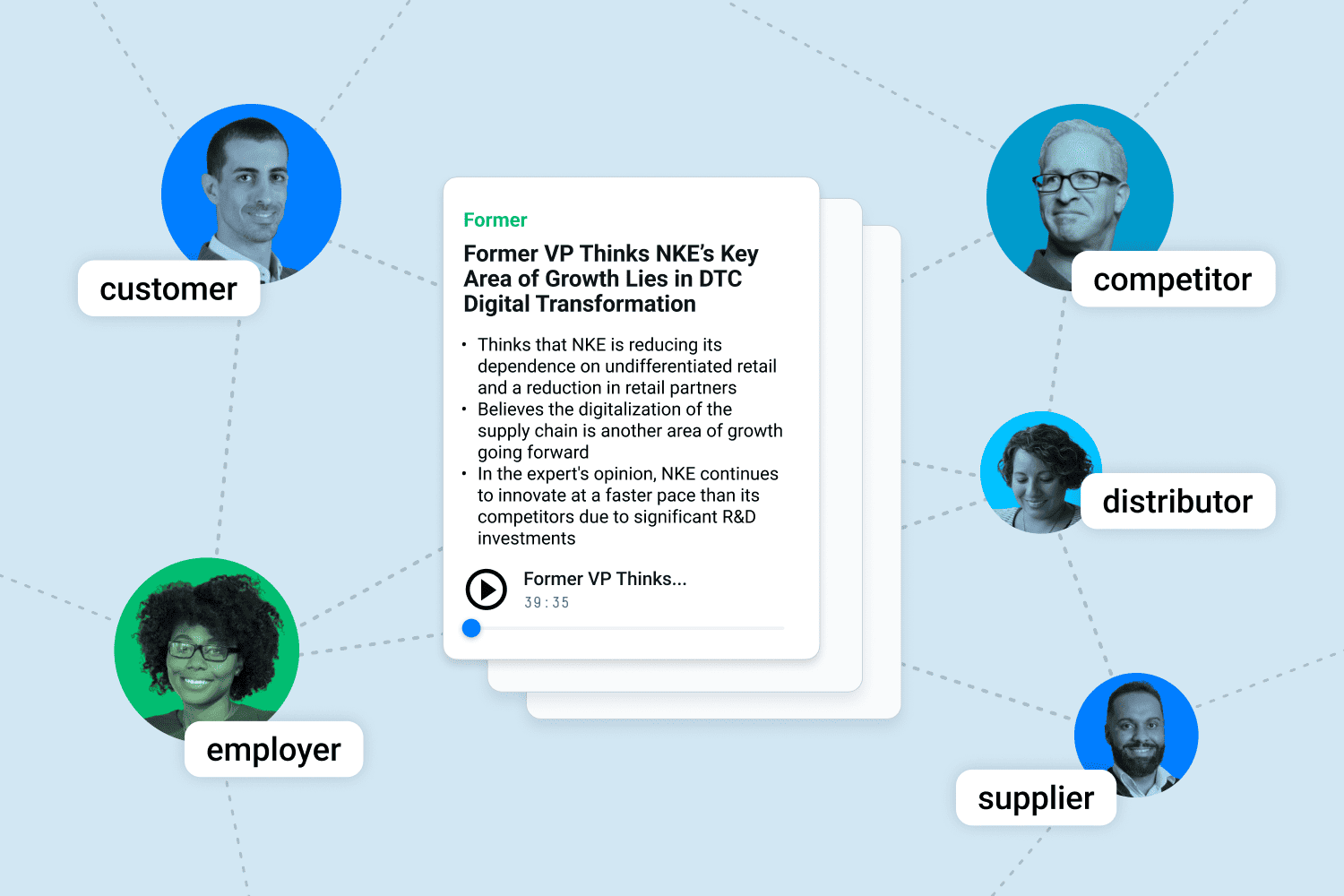

One powerful tool that has emerged in recent years are expert calls—a direct line to industry specialists and thought leaders in private markets. Below, we explore how AlphaSense’s expert calls can provide a competitive advantage in the investment landscape of private equity.

Expert Calls in Private Market Research

Private market research involves the analysis and evaluation of privately held companies and investments that are not publicly traded. Unlike the public markets, private market research relies heavily on alternative sources and specialized knowledge to uncover deeper insights.

Expert calls are one-on-one interactions with industry experts who have extensive expertise in a particular field and offer a unique opportunity for investors to interact with experts who possess in-depth knowledge of specific industries or emerging trends.

Where traditional research methods may fall short, expert calls provide access to first-hand, up-to-date information that can be invaluable in making informed investment decisions. A fully realized investment strategy incorporates expert calls to unlock granular insights to enhance research and maximize return on investment.

Below are a few ways you can use AlphaSense’s Expert Insights to elevate your private market research.

Assess the Competitive Landscape

It is imperative to assess the competitive landscape of any opportunity when formulating investment theses to identify growth potential and mitigate any industry-specific risks.

For example, let’s take a private equity (PE) firm that is considering an investment in a privately held technology startup in the field of artificial intelligence (AI). Even if the firm has conducted preliminary research into the company, they still need deeper insights to fully understand the competitive landscape of the market.

Initially, the PE firm can schedule an expert call with a veteran technology executive who has extensive experience in the AI industry. The expert will then provide critical insights into the current market dynamics, competition, threats, and potential opportunities. These expert insights give the PE team a comprehensive view of the landscape that the startup operates in and helps them assess the startup’s competitive position in the overall market.

One excellent resource to receive insights from researchers and other industry specialists is through AlphaSense’s library of over 30,000 expert transcripts and expert call services. By connecting with industry specialists through AlphaSense’s expert calls, investors and businesses can gain an understanding of the nuances and complexities within an industry.

Understand Growth Potential

After assessing the competitive landscape, it is imperative for the PE team to understand the growth potential of the opportunity. One of the significant advantages of leveraging expert calls is the ability to uncover niche market knowledge and identify emerging trends early on that might be overlooked by traditional research methodologies.

The same PE team mentioned above would need to consult with a leading AI researcher, who can provide insights into the latest trends and technological developments in the AI field. The researcher would then share their perspective on the startup’s product, its potential for growth, and areas where the startup could innovate to stay ahead of the competition.

Take this excerpt from an expert call transcript with a former engineer at NVIDIA who was previously responsible for developing deep learning libraries for NVIDIA hardware across the globe for example:

“If I am working at a start-up company right now and my manager asks me to run this or develop this deep learning application, I will buy NVIDIA’s device right now because I am more confident it will work out of the box with less amount of work for me.

“What will change my perspective is that definitely, if for example, OpenAI says we are running this application on AMD devices, it will change my attitude as well. I will download AMD’s software stack by their devices and if there is a bug I am encountering other posts online and somebody will fix it and the whole development acceleration is faster as more people get to try their devices and their software tools.”

– Expert Transcript | Engineer, NVIDIA (Prior)

Identify Industry-Specific Risks

Furthermore, experts can offer alternative perspectives to PE researchers that may challenge existing viewpoints, help mitigate potential risks, and identify potential red flags to make well-informed decisions.

By leveraging expert call services from AlphaSense, PE researchers can access specialized legal experts to identify potential red flags and develop risk-mitigation strategies to make well-informed decisions.

After a PE firm understands the growth potential of the technology startup, the PE firm should then consult a legal expert specialized in technology and Intellectual Property (IP) law. The expert can offer insights into potential legal challenges and regulatory changes that may impact the startup’s operations and growth. These insights help the team evaluate potential risks and develop strategies to mitigate them.

Investors could be at high risk when exploring investments in startups without an IP counsel. For example, one expert call transcript with a former IP attorney at Dennemeyer suggests that many startups are struggling to find attorneys and forgo keeping an in-house IP counsel as AI technology continues to improve.

“I think legal departments are getting smaller and GCs are having to take on more responsibility. Where a company that I worked with for many years, I would say almost all of them have a reduced number of GCs that they keep on staff. Very, very few companies, unless they have significant IP assets and they’re in a research development-heavy type of field, very few are keeping in-house IP counsel. That’s a little bit of a change, I would say.

I would say, though, that this is also due to the fact that these softwares and AI in the IP industry is getting better. I think that IP attorneys are more inclined to use technology as opposed to other types of attorneys, because many of us have a science background, so we’re more tech-inclined to things like that, so we’re maybe using software.”

– Expert Transcript | IP Attorney, Dennemeyer (Prior)

Therefore, leveraging expert transcript libraries and expert call services from AlphaSense can allow researchers to extract vital insights from IP attorneys without forgoing the consultation process entirely.

Validate Investment Theses

Investment theses often rely on assumptions and projections, especially in private markets where comprehensive data is scarce. Engaging with industry experts through AlphaSense’s expert calls and expert transcript library allows investors to validate their investment theses and receive critical feedback on their assumptions with alternative perspectives.

Using all the expert insights gathered, the PE firm can validate or adjust their investment thesis. For example, if the experts’ insights align with the team’s initial positive assessment of the startup, they could proceed with the investment. Conversely, if the experts raise significant concerns that the team hadn’t considered, they might reevaluate their decision.

After using Expert Insights to validate their theses, researchers can gain the competitive edge necessary to move strategically and outperform competitors in the private market landscape.

Unlock the Power of Expert Insights

As the private market investment landscape continues to evolve, leveraging AlphaSense’s expert transcript library and expert call services for private market research is imperative to build and execute on a successful investment strategy and enhance decision making.

Ready to use expert calls in for private market research?

Start your free trial of AlphaSense today.