The consumer and retail (C&R) industry is evolving rapidly due to a combination of new innovations and technologies, shifts in consumer preferences and behaviors, and macroeconomic events hindering sector growth.

To stay competitive in the current economic climate, companies need to conduct comprehensive and efficient market research. Likewise, executive leadership must have a thorough understanding of the competitive landscape they are operating in while staying keenly aware of evolving consumer trends. Similarly, investors and venture capitalists who are interested in the C&R space should be leveraging insights on market share, segmentation, and total addressable market (TAM) to identify emerging opportunities.

But slow manual market research processes will hinder your ability to make timely decisions and, ultimately, prevent you from staying ahead of the industry and your competition. That’s why many leading organizations rely on artificial intelligence (AI)-based market research tools to help them separate signals from the noise and extract the most meaningful insights from vast quantities of data.

AlphaSense is a market intelligence platform used by over 4,000 enterprise clients, including 88% of the S&P 100 and 80% of the world’s top investment firms. Users rely on AlphaSense for aggregated market research (spanning over 10,000 premium, proprietary, public, and private content sources) and smart artificial intelligence (AI) search technology that increases research comprehensiveness and confidence.

Whether you’re looking to find growth opportunities, improve your marketing strategy, or scope out potential investments within the C&R space, a tool like AlphaSense will ensure you have a comprehensive view of the sector without wasting unnecessary resources on low-yield tasks. With our advanced AI technology, you’ll eliminate the manual parts of your research processes, leaving more time and resources for strategic decision-making.

Below, we discuss the components of effective C&R research and how the AlphaSense platform can provide you with a competitive edge.

How to Conduct Effective Consumer and Retail Market Research

For consumer and retail companies today, staying on top of consumer behavior, market trends, and the competitive landscape is essential to avoiding information blind spots and mitigating the risk of falling behind.

This means having access to the right information, but also being able to separate crucial insights from irrelevant noise. AlphaSense makes this burdensome task simple with our premium content sets and proprietary AI search technology, designed to pull out the most relevant insights by filtering out extraneous information. That way, you can spend less time manually parsing through endless data and more time on high-level analysis and strategy.

Here is how the AlphaSense platform supports you in every step of your market research process:

Premium and Proprietary Content

AlphaSense sources information from the four key perspectives of research—company, analyst, journalist, and expert. Our extensive content universe includes over 10,000 sources of private, public, premium, and proprietary content—indexed, searchable, and all in one place.

Here’s how the four perspectives inform and support the market research process:

Company

The company perspective includes any documents released by a company—global and SEC filings, ESG reports, earnings transcripts, company presentations, press releases, event transcripts, and more. With these documents, professionals can get smart on competitors, while analysts can use them to understand the financial standing and strategic priorities of a particular company.

Analyst

Broker research, also known as equity research or industry analyst research, is imperative to investor and hedge fund manager workflows, helping them stay on top of the ever-evolving investment landscape.

These days, cutting-edge corporations also utilize broker research and reports to understand analysts’ expectations on market trends and industry and peer performance.

AlphaSense’s premium broker research offering, Wall Street Insights®, is the only collection available for the corporate market that aggregates reports from all leading global banks, including Goldman Sachs, Citi, Bank of America, and Bernstein Research. That, paired with AlphaSense’s Smart Search technology, allows you to easily parse through thousands of reports and glean crucial insights in a fraction of the time.

Journalist

News insights often reflect public sentiment and can often be a good way of keeping track of influential shifts in consumer attitudes or preferences. They can also be useful for getting high-level information on an industry player, trend, or event and tracking how the wider world reacts to that information. While broker reports allow you to go granular on a topic, it’s equally important to step back and see the larger picture.

Journals allow you to keep up with the fast-changing and fast-moving narratives of market events in real time. Yet relying on the same few top news outlets for all your information is risky, as you may miss pivotal information reported by other outlets.

This perspective also encompasses regulatory information, which includes crucial insights such as product recalls, consumer reports, inflation and interest rate guidance, etc.

With AlphaSense, you get access to top-tier news sources and trade journals from every major industry, as well as relevant regulatory documents. And with customizable alerts, you will never miss a pertinent news report about the topics or companies you care about.

Expert

The expert perspective is integral for getting a deep and differentiated look at a company, topic, or trend. Industry experts have first-hand experience within the industry, and their insights can provide a necessary complement to quantitative insights and data.

Additionally, our expert transcript library contains insights you won’t find anywhere else, giving you a competitive advantage over your peers. AlphaSense Expert Insights provides access to tens of thousands of expert calls, as well as the opportunity to conduct your own 1:1 expert calls for less.

By listening to insightful interviews with former employees, executives, customers, competitors, and C&R industry experts—analysts and decision-makers in the C&R space can glean valuable knowledge that truly moves the needle.

A recent expansion to our expert transcript library, Voice of Customer (VoC) transcripts are interviews with customers from specific sectors. Businesses can use them to decipher how customers interact with their products or services across various touchpoints, which in turn can enhance their strategic decision-making.

AI Search Technology

AI is the secret weapon behind every organization that is outpacing its competition. AI both speeds up and enhances the research process by surfacing key insights and filtering out the noise.

Here is how AlphaSense’s proprietary AI search technology supports your market research:

Semantic Search

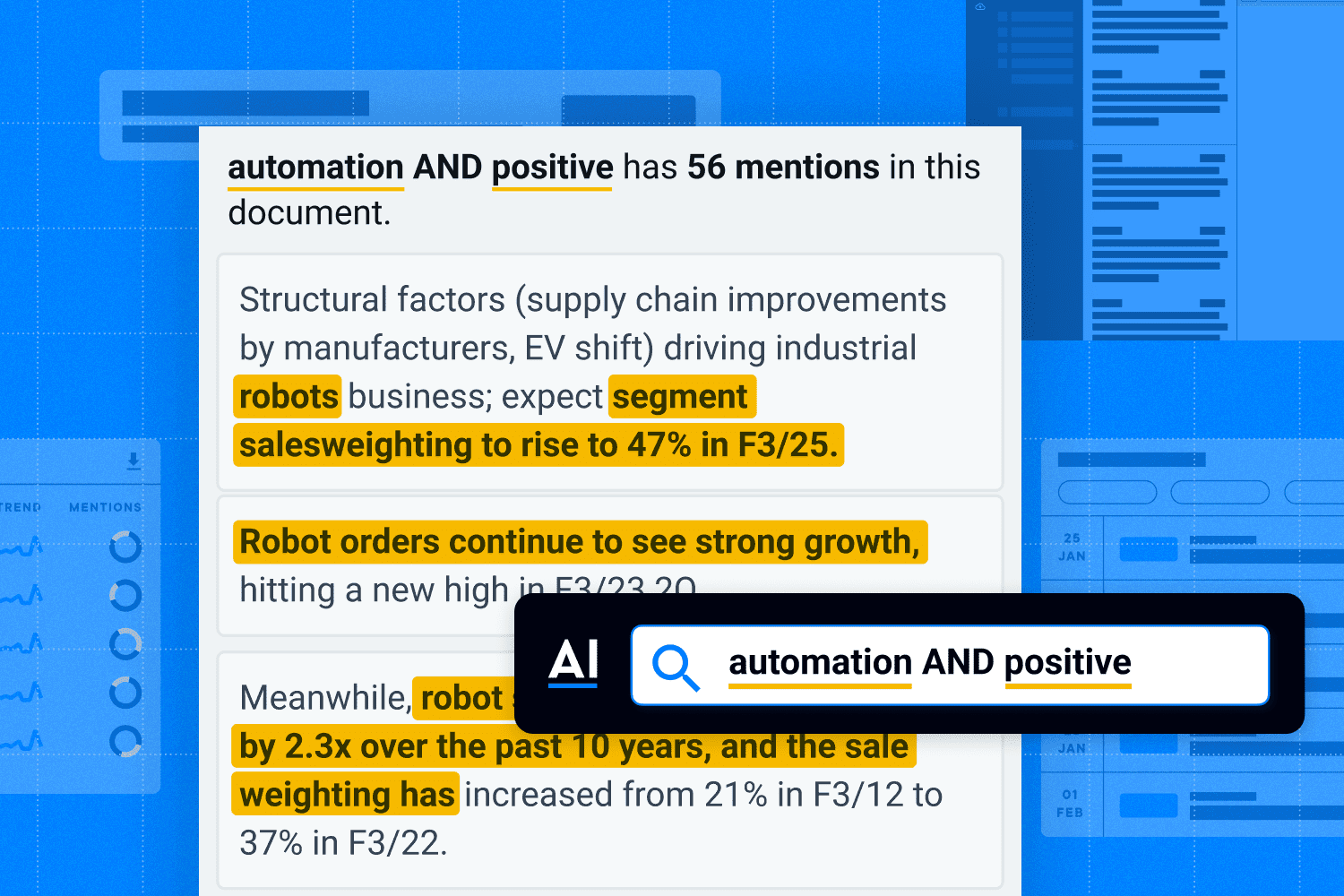

AlphaSense’s smart AI search technology recognizes the intent of your search and surfaces key insights without you having to perform multiple manual searches or spend time reading through the entirety of multiple long documents.

Our Smart Synonyms™ technology analyzes speech patterns across tens of millions of search documents, resulting in a robust library of synonymous words. The platform ensures you get all the relevant search results—without any of the excess noise or extraneous effort.

Trending Topics

Our Trending Topics tool is key for unlocking critical insights from a vast body of data—in seconds. This AI tool, accessible via the main dashboard, allows you to see the top 100 topics that are trending for a single company or a group of companies in a watchlist or industry. Simply type in a keyword relevant to your industry in the search bar, and our AI search will surface the most critical insights from millions of documents, in seconds. Try this feature for free here.

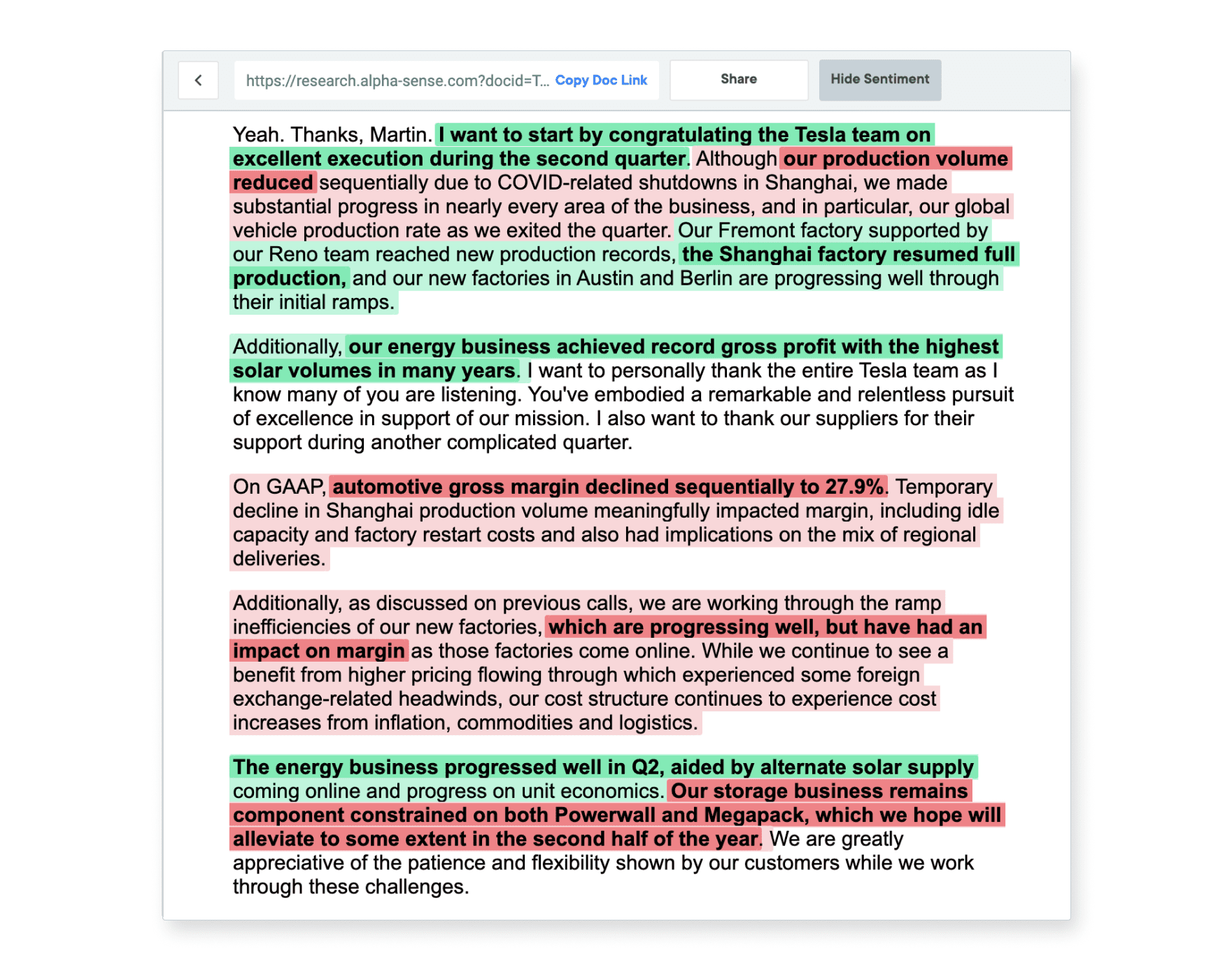

Sentiment Analysis

Our sentiment analysis technology utilizes natural language processing (NLP) to uncover market perceptions about any given topic. Further, it color-codes positive, negative, and neutral sentiment for easy recognition as you browse search results. These AI features are executed in seconds, saving analysts precious hours that would have previously been spent combing through multiple earnings call transcripts.

Generative AI

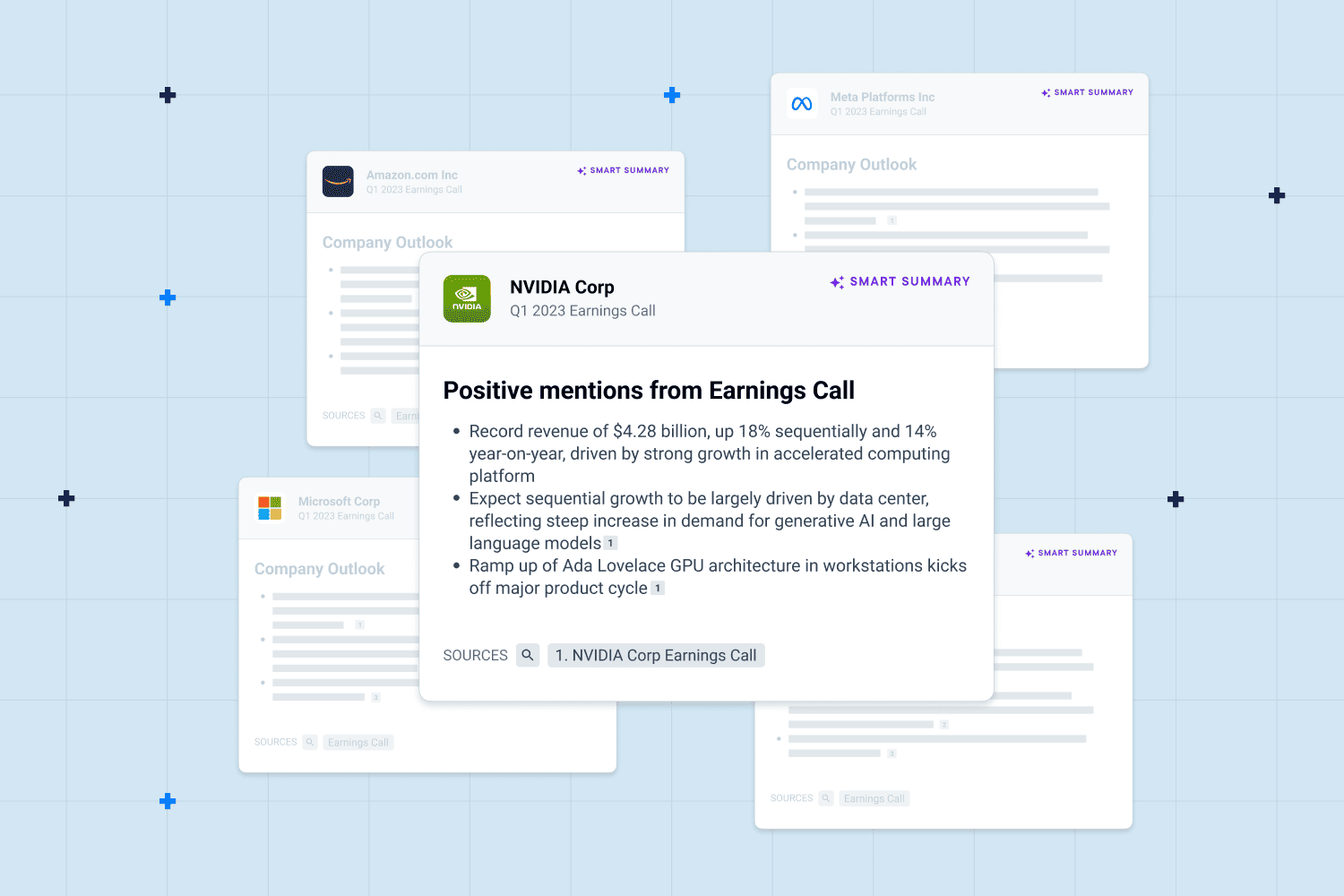

As a platform purpose-built to drive the world’s biggest business and financial decisions, our Smart Summaries feature leverages our 10+ years of AI tech development and learns from a curated collection of high-quality business content.

Our Smart Summaries feature instantly summarizes earnings documents to provide you with actionable insights, allowing you to speed up your earnings research process and quickly understand company outlook—so you can spend more time on high-value tasks.

Theme Extraction

This tool allows users to extract the most important topics from earnings transcripts in the context of key metrics, such as quarter-on-quarter (QoQ) changes in mentions, positive/negative sentiment, and overall mentions.

With this tool, users save time, all while identifying the most relevant information at scale across every single competitor’s transcript. And because our model is trained specifically on financial language, it can pinpoint the most valuable and important company insights.

Consumer and Retail Market Research: Use Cases

Market Monitoring

AlphaSense allows you to monitor competitors and key topics all in one place with the following tools:

- Customizable dashboards create a centralized information hub for monitoring key companies and themes, while tailored real-time alerts provide real-time updates.

- Powerful collaboration tools like Notebook+ and commenting features help teams manage and share insights more effectively.

- Table Tools allow you to streamline your quantitative analysis by enabling you to export modeled time-series data on company financials.

- Image Search allows you to discover insights buried in charts to quickly capture data without reading through pages of documents.

- Snippet Explorer allows you to effortlessly look at any topic or theme and all its historical mentions in a single view.

- Automated Monitoring allows you to set up real-time alerts to receive instant updates on any relevant market movements, news, emerging trends, and competitor activities. The algorithm also generates snapshots of companies and topics regularly that keep you ahead of the curve with actionable insights.

Competitive Intelligence

With AlphaSense, you will always be first to know of any competitor updates thanks to our company recognition and Search Summaries features. Using our platform, you can create watchlists for all your peers, and be instantly notified when any relevant documents emerge from or about those companies.

Let’s say you want to identify growth investments or spending priorities for a competitor, key account, or investment target.

The following are pre-programmed searches that you can use within the AlphaSense platform to gain insights for your competitive analysis:

- Cost-Cutting Initiatives – Identify where companies are cutting costs, deprioritizing certain business segments, and reallocating capital expenditures.

- Investment Allocation Strategies – Identify which business segments or growth initiatives a company is increasing investment in, and where they are allocating capital amid budget reallocations.

- Project and Product Expenditures – Identify specific projects or products that the company is allocating budget and capital to.

Additionally, you can use AlphaSense’s company tearsheets to compile company profiles, which include segmented revenue, acquisitions/investments, strategy, partners, earnings calls, and industry context from broker reports and expert calls. You can also see the average sentiment of a company at a glance, how that score has evolved over time, and the topics that the company is discussing most often.

These insights enable you to develop recommendations on growth opportunities, benchmark against competitors, find partners and vendors, generate ideas for new product development, and identify competitive risks.

Partnerships and M&A

Let’s say you need to perform due diligence on some companies to scope out M&A viability. AlphaSense helps you quickly uncover the TAM, identify new targets, get information on comps, and conduct synergy analysis.

You can use AlphaSense’s NLP-based feature theme extraction to find financial metrics that are not found within standard 10-Ks or 10-Qs and parse through alternative information sources for companies not covered or that are part of an emerging industry.

When searching for any private companies within the platform, you can instantly access funding round information, including amount, announcement date, lead investors, and post-money valuation, without digging through multiple sources. Additionally, the company’s acquisition history and peer comparison charts are automatically generated and exportable to Excel.

Earnings Analysis

Earnings season is critical for anyone making investment decisions, creating an investment strategy, or looking to gain intel on the competitive landscape to inform the following quarter’s business decisions.

Because companies publish such a wide breadth of information during earnings season, it’s important to have systems in place that ensure you can efficiently parse through and analyze critical information.

AlphaSense is instrumental in developing and implementing these systems. Our vast content universe contains every piece of data pertinent to earnings analysis, and our AI-search technology enables you to get the insights your peers don’t have access to and establish a single source of truth.

Learn how AlphaSense helps clients collect, synthesize, and contextualize earnings data—swiftly and without the hassle—with this list of essential tools in the platform.

Additionally, sentiments conveyed in earnings calls often translate to shifts in the market, as sentiment analysis unearths deeper insights that go far beyond the surface of what a company is saying at face value.

Comparing changes in sentiment score from prior earnings call transcripts can help you piece together a larger narrative, allowing you to spot compromises in continuity that could indicate red flags.

Experience the AlphaSense Difference

AlphaSense is the must-have tool for business professionals conducting market research in the C&R space. Our vast content library, combined with proprietary AI search technology, streamlines, enhances, and speeds up research workflows—without ever sacrificing confidence or comprehensiveness.

Level up your research processes and gain your competitive advantage with AlphaSense. Start your free trial today.