Most businesses will agree that their market landscape is increasingly competitive, fragmented, and complex these days. Customers are spoilt for choices. New competitors aren't just appearing sporadically but emerging at an incredible pace. This is largely driven by the rapid technological advancements reducing entry barriers across industries.

For example, in 2021, nearly 5.4 million applications were filed in the US to form new businesses, marking a 53% increase from 2019 and the highest number recorded in any year. In 2022, 5.1 million, the second-highest ever.

Source: https://www.census.gov/

Therefore, yesterday’s competitive differentiation and competitive intelligence strategies will not be sufficient to tackle tomorrow’s challenges. It’s time for a new take on competitive intelligence.

In this article, we’ll discuss eight effective strategies and tools for identifying new competitors. In addition, we'll discuss how to evaluate and how to track emerging competitors.

Let’s first understand why new competitors pop up. It’s not always technology innovations.

Why do New Competitors Pop up?

Markets consist of multiple participants engaging directly (vendor-customer) or indirectly in a sequence to create value chains. The nature of these engagements is not static. Each participant tries to maximize both its market share (maximize revenue) and profit margins (minimize cost). This changes the market landscape, and everyone tries to adapt to the evolving business environment. This is the game.

These changes create gaps in the market that are sometimes not addressed for a long time and opportunities that the incumbent players do not immediately capture. Incumbent players, because of their inertia, are sometimes slow to react. These gaps create room for the fast-moving agile companies - new competitors.

Following are a few examples of the changes that create such gaps and opportunities:

1. Evolving Consumer Needs: New competitors arise to fill gaps in the market created by evolving consumer needs. For example, initially, businesses managed their IT infrastructure in-house, which was costly and complex. AWS and Azure recognized this market gap – the need for scalable, flexible, and cost-effective IT solutions.

2. Technological Innovations: Tech innovations make products better, cheaper, and more efficient. For example, the emergence of fintech startups challenging traditional banking models is a testament to this.

3. Regulatory Changes: Regulation could change for several reasons - to protect customers or the environment or to break monopolies. Such changes open the markets for new competition. The deregulation in certain industries, like telecommunications and pharmaceuticals, has historically led to the entry of numerous new competitors.

4. Globalization: The increasing interconnectedness of global markets allows companies from one region to enter new geographies easily, bringing new competition to established local businesses. For example, companies like Spotify and Netflix have successfully entered various international markets, reshaping the local music industry.

5. Evolving Cultural Trends: Slow shifts in consumer behavior, driven by generational changes and evolving cultural trends, create opportunities for new entrants. The success of direct-to-consumer brands in various sectors, from eyewear (like Warby Parker) to mattresses (like Casper), illustrates this trend.

Now, let’s figure out ways to spot these new competitors before it is too late.

How to Identify New Competitors

Based on our experience, these are eight effective techniques to spot emerging competitors.

1. Sales Calls

In the B2B world, the most valuable insights about the market often emerge from the interaction between your sales team and customers. Sales teams are on the front lines, engaging with prospects and clients, and this interaction is a crucial source for identifying new competitors. These new competitors must be taken seriously because they have already entered your prospects’ consideration set.

Your sales teams should be trained to delve deeper whenever the prospect mentions any new competitor. They should try to unearth as much information about them as possible. You need to know what these newcomers bring to the table and how they're positioning themselves in the market.

Regularly scrutinizing sales call recordings serves as an early warning system for new players entering the market. In addition, this data can also highlight shifts in customer preferences, your competitive alternatives, or new products and services by your competitors.

2. Analyst Reports

Market research firms such as IDC, Gartner, and Nielsen are trusted sources offering deep analysis into market segments and comprehensive views of the entire market landscape.

These reports also include all the market participants, their evaluations, and ratings. By mining these reports, you can uncover emerging competitors, gaining a clearer picture of their strengths and weaknesses. These new competitors cannot be taken lightly because prospective customers often refer to them for guidance.

3. Industry Events and Conferences

Attending industry events, conferences, and trade shows is not just a choice but a strategic necessity to stay competitive in your market segment. It's also an important source to identify new competitors and get hands-on experience with their products and services.

But it's not just about their products. It's the conversations, the demos, and the interactions that truly matter. These events offer the best opportunities to understand how emerging competitors position themselves, their unique selling points, and their strategies.

4. Social Media

You must track discussions and updates on competitors’ social media profiles to identify emerging competitors engaging with your target audience. This includes participating in industry-specific LinkedIn groups and following influential voices on Twitter.

Here, you might stumble upon mentions or comparisons of emerging players. Sometimes, a simple comment with a link to a new competitor's website can open doors to fresh insights. The comment would only say, “You should check out,” and a link to the competitor's website.

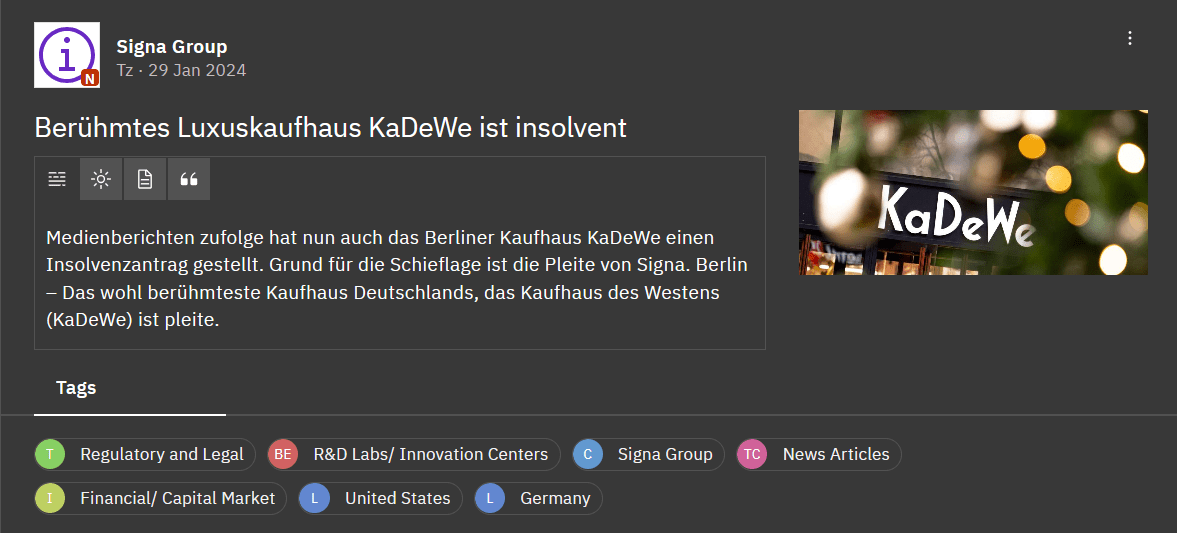

5. Press Releases and News Articles

Tracking press releases and news are table stakes in any competitive intelligence. New competitors usually announce on these channels when they release a product or raise capital before entering your market segment.

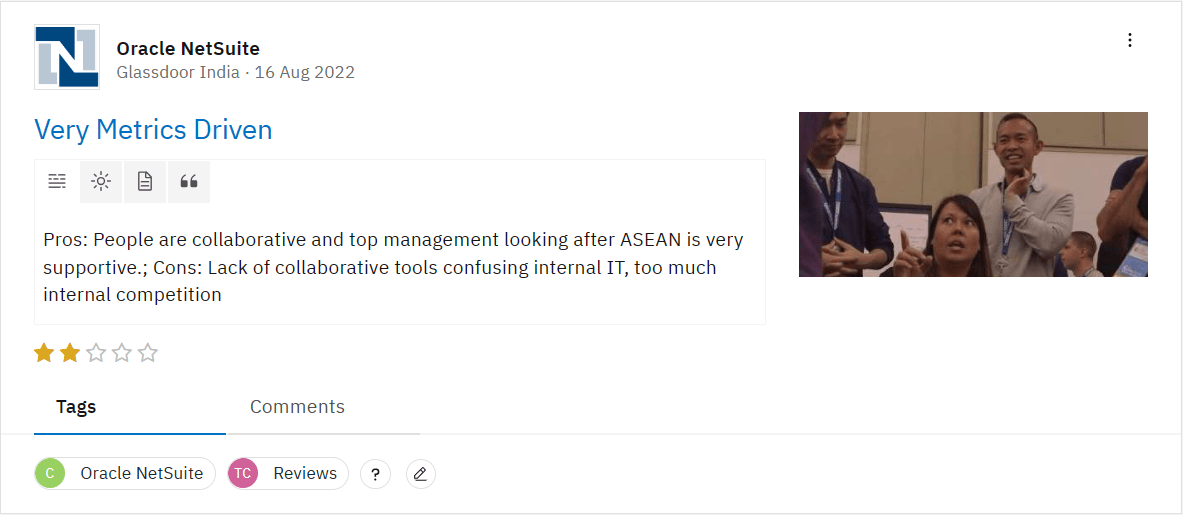

6. Customer Reviews

Delve into customer reviews on platforms like G2, Peer Insights, TrustPilot, and others. Also, pay attention to your customer service interactions. These sources often harbor nuggets of information about companies within your categories. They can provide valuable user perspectives on emerging competitors.

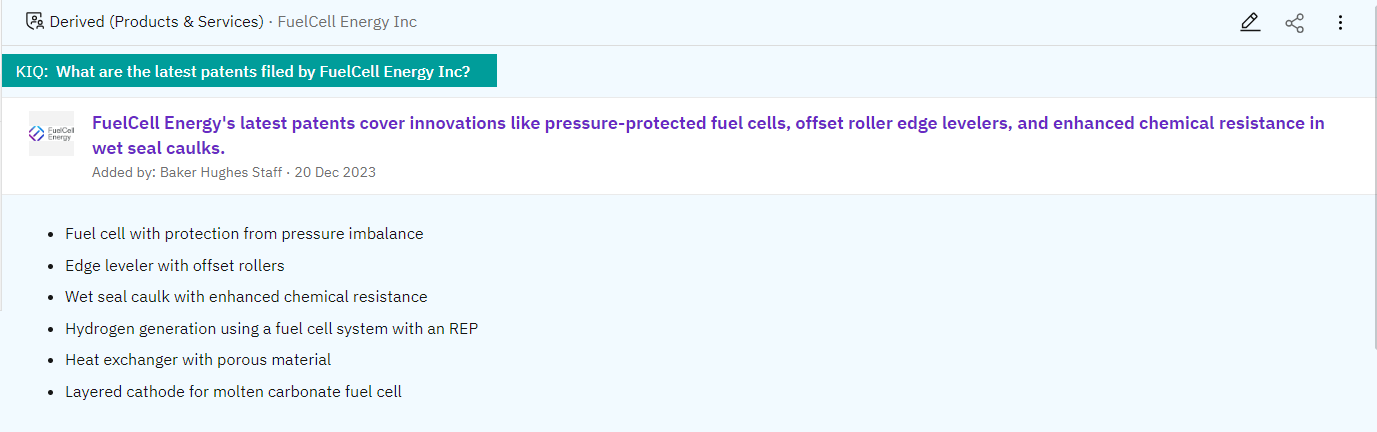

7. Patent and Trademark Filings

Monitoring patents and trademarks could give you a window into upcoming innovations and potential new competitors. Databases like the USPTO or the European Patent Office (EPO) can be used to track these filings.

The key is regularly searching for new filings in your industry segment and technology domain to spot new competitors. This requires a certain level of technical understanding to interpret these documents and understand their potential market impact.

By systematically applying these techniques, businesses can detect new competitors early and start to understand their potential impact. The next step is to evaluate these newly identified competitors.

8. Non-English Sources

If your customers are spread across multiple geographies with different languages, ensure that you track not just English sources but local non-English sources. This is crucial to identify emerging competitors in new geographies. These potential competitors may soon start selling to your English-speaking customers.

How to Understand New Competitors

Do not limit your understanding of new competitors to who they are or what they bring to the table. Evaluating these new players is crucial to developing a long-term view of your market. You must try to understand how they might reshape the entire competitive landscape. Let’s unpack the four key areas to focus on:

1. Value Proposition

Delve deeper into what the new competitors offer and what makes them unique. Connect the dots by triangulating information available on their website, LinkedIn profiles, social posts, and, most importantly, the background of the founding/ leadership teams.

Get hold of their marketing collaterals, pitch decks, and product demos and critically analyze all aspects of their offerings. Additionally, conduct customer interviews and surveys to understand the most valuable aspects of competitors’ offerings and compare them to yours.

Understanding their value proposition will enable you to anticipate their impact on your customers and identify areas for you to watch out for.

2. Positioning & Messaging

New competitors’ positioning and messaging offer a window into their strategic thinking. Pay attention to their marketing campaigns and public relations efforts. What messages are they emphasizing? Are they focusing on product quality, customer service, price, security, technology, or something else?

How they define their brand identity and discuss their offering and (your) customers’ problems could reveal their target market segment. Analyzing their positioning and messaging could potentially help you identify gaps in your marketing strategy and inspire new ideas.

3. Customer Reviews

New competitors usually have fewer reviews and feedback. However, even if fewer in number, these reviews are crucial in understanding them and their customer base.

To assess new competitors, examine their customer satisfaction ratings, reviews, and scores on platforms like G2, Trustpilot, Peer Insights, and customer testimonials on their website, including within case studies and press announcements.

Positive feedback helps to understand their offerings that resonate with the customers, and comments about missing features and wishes indicate the gaps in their offering and possibly their product trajectory. These wishes could provide valuable input to your battlecards and new ideas for your product roadmap.

4. Pricing Strategy

Analyzing new competitors’ pricing reveals their strategy, market positioning, and target customer segment. One common strategy new competitors follow is to capture customers by undercutting incumbent prices. And if their offering is better and prices are lower, you’d have to lower your prices to retain your customers.

You could rely on your loyal customers to share these details to find new competitors' pricing. Or, you could hire a third-party CI company to get their pricing details. You could also try your luck and directly call them and ask for the prices of their offerings. Sometimes, over-enthusiastic sales reps share detailed pricing models and other useful information.

Once you've evaluated new competitors and concluded that some of them could become a real threat in the future, you should include them in your market intelligence program and start monitoring them.

Monitoring new competitors requires a strategic yet measured approach, distinct from how you track your primary or direct competitors. In-depth competitive intelligence demands significant time and effort. Therefore, it's critical to select the primary competitors wisely and keep a high-level tab on secondary or emerging competitors.

How to Monitor New Competitors

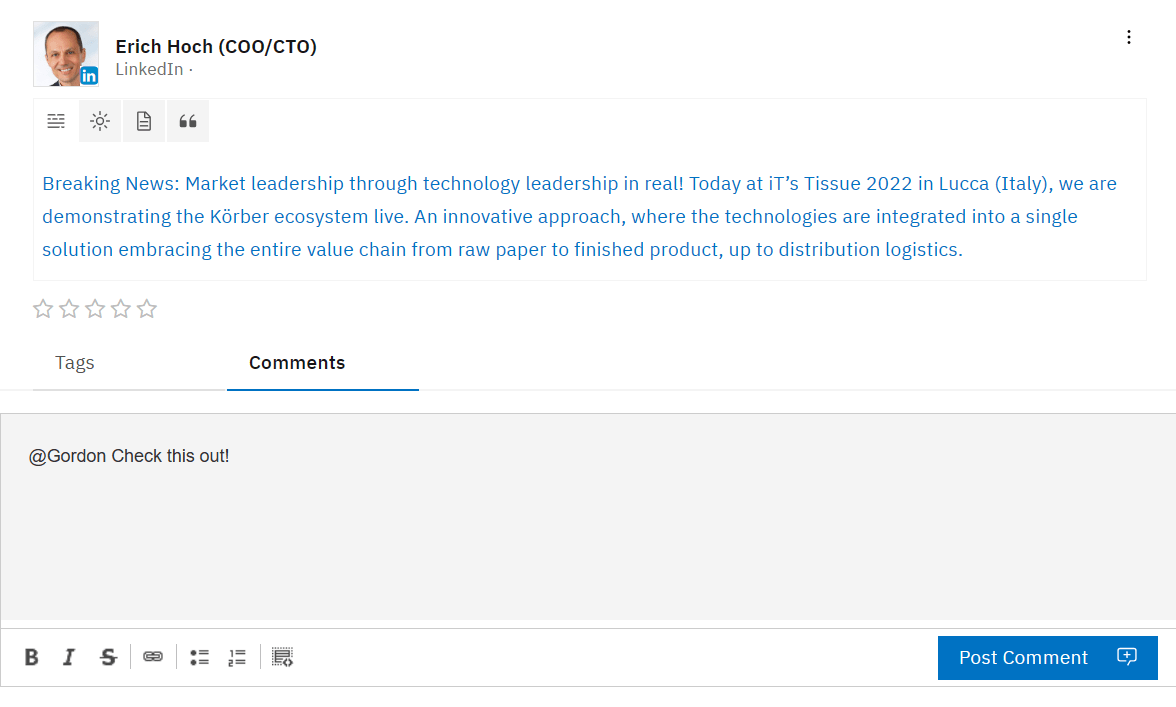

You should start by adding a new competitor as one of the options in your CRM so that the sales teams can tag it whenever it is mentioned on a call. You should analyze the transcripts of the sales calls with new competitors to collect intelligence about them.

This can be streamlined by integrating the sales call transcripts from the sales call recording system into your M&CI platform.

If you are not using a sales call recording system, your Market and Competitive Intelligence (M&CI) program is missing out on one of the most valuable sources of intelligence.

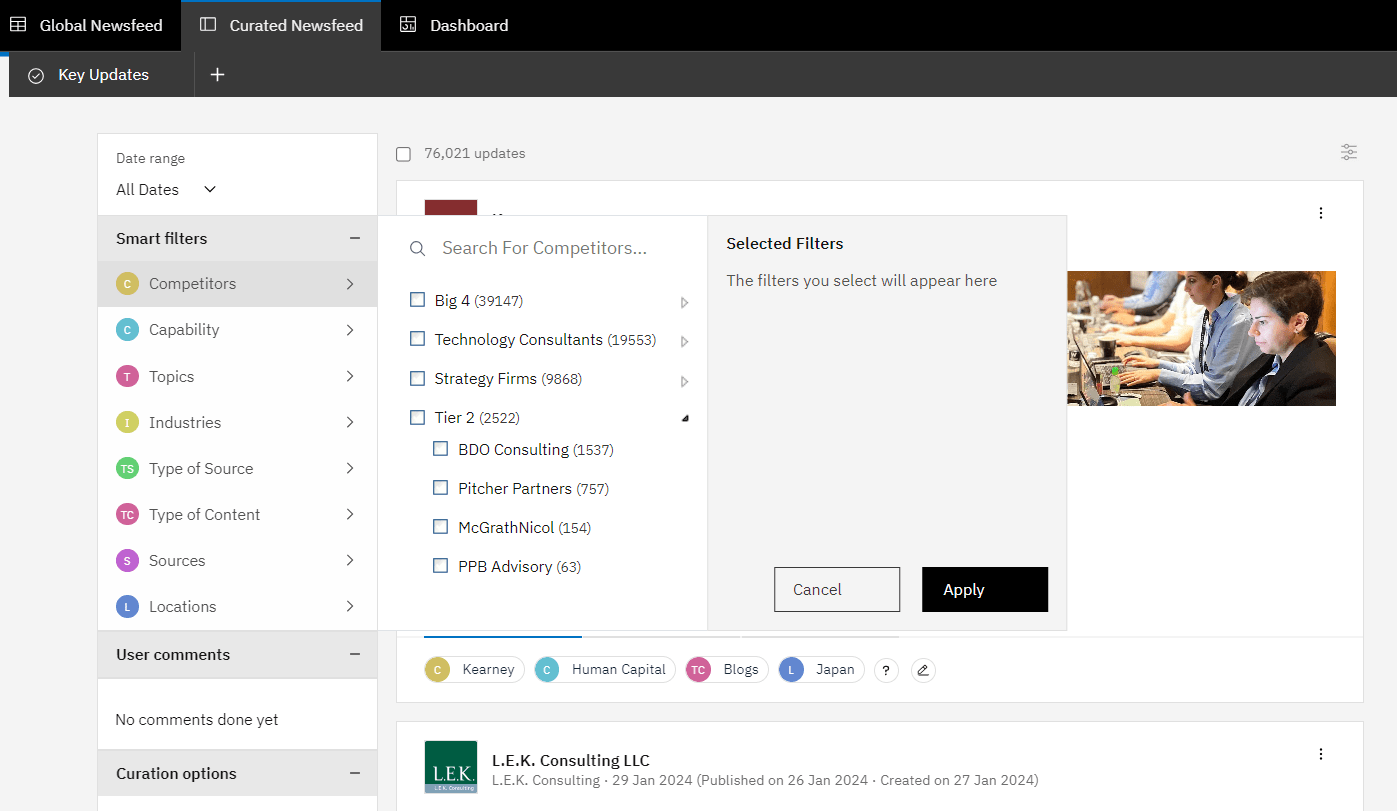

Also, include these new competitors in your standard monitoring of secondary sources for intelligence such as news mentions, press releases, and social media for insights into their management changes, product launches, customer feedback, partnerships, or funding announcements. This high-level tracking provides a helpful overview without the need for in-depth monitoring, such as website changes or job posting analysis.

You should include new competitors in the primary list only if you start losing deals to them. This triggers a need for a deep dive and thorough understanding of their strategies and offerings – followed by a detailed battle card against them. Balancing vigilance with efficiency ensures that you're wisely utilizing your energies by focusing on the most important competitors.

To stay ahead in this game, consider setting up custom alerts and notifications to track specific activities of new competitors, like new product launches, pricing changes, or changes in their executive team. Here's a pro tip: subscribe to their newsletters and follow their social profiles to keep a pulse on their latest moves.

You can also enhance your competitor monitoring by setting up alerts and notifications based on specific triggers, such as product launches, pricing changes, or leadership movements. Bonus tip: Subscribe to their newsletters and follow their page on all the social channels these new competitors keep updated.

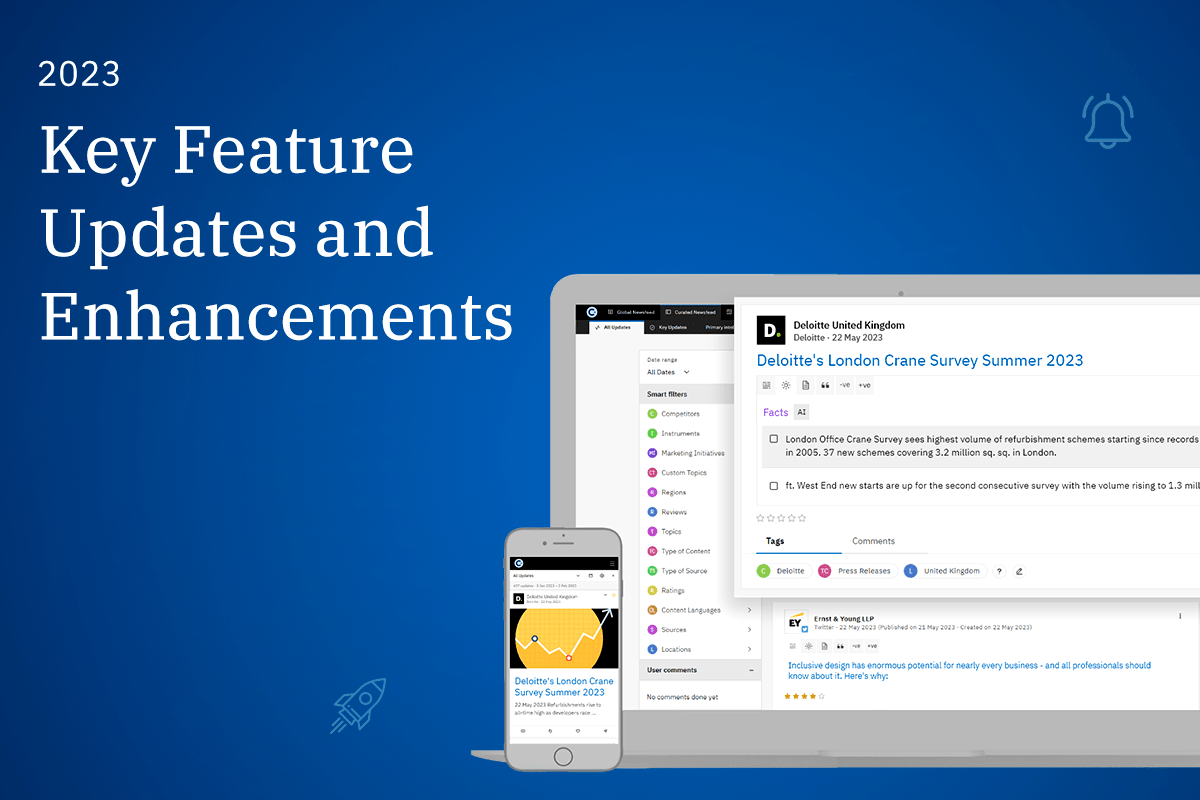

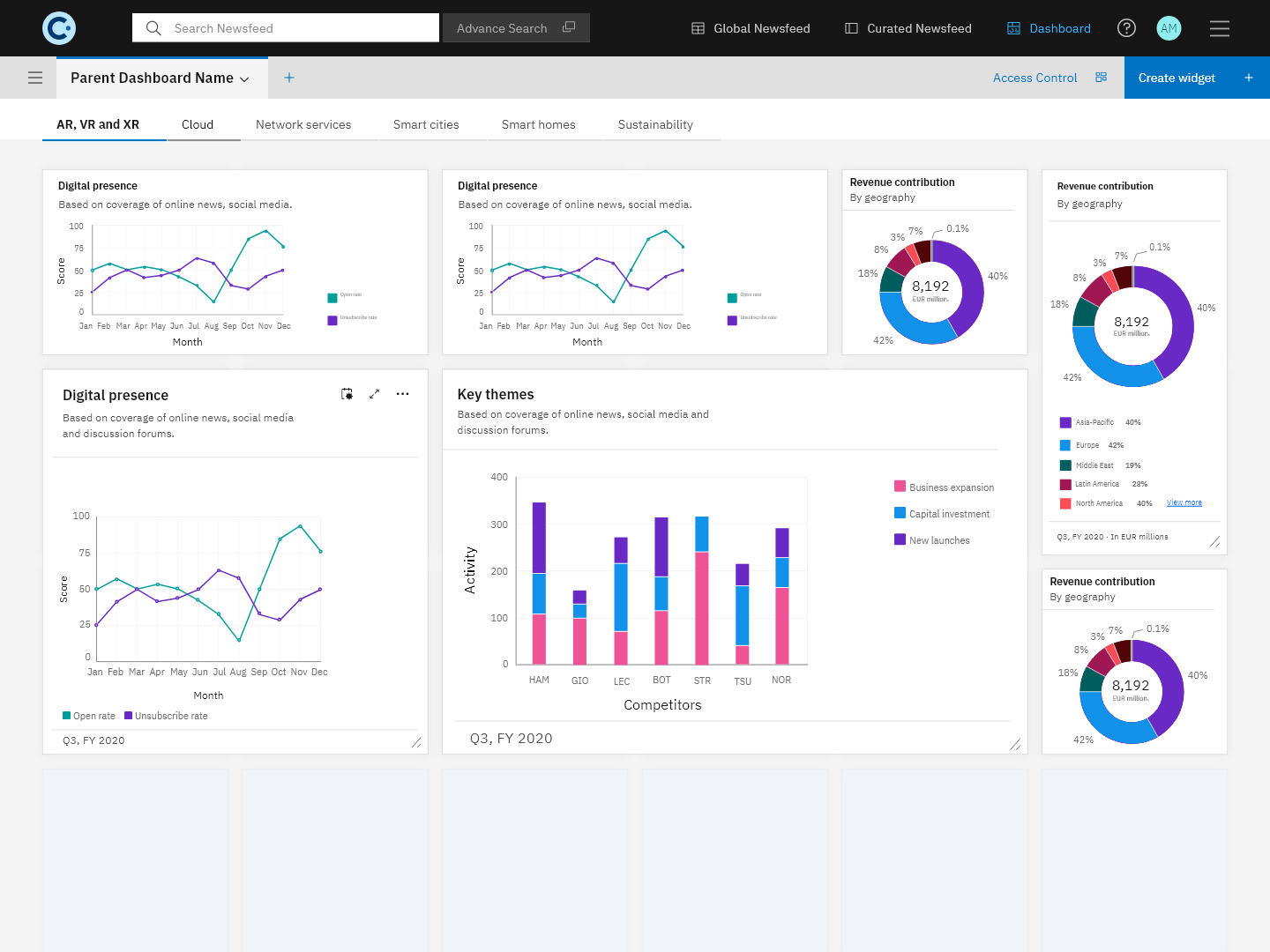

With a robust Market Competitive Intelligence (MCI) tool, you can efficiently gather insights on hundreds of potential competitors. This way, you're well-informed about them even before they start showing up in your sales team's competitive bids. This approach isn't just smart; it's essential for staying one step ahead in a fast-paced market.

The Role of the M&CI Platform

In addition to the tactics mentioned in the section ‘how to identify new competitors,’ you can identify new competitors by monitoring general industry developments beyond competitors. Therefore, your market and competitive intelligence platform must be able to monitor overall industry developments, and not just limit the scope of monitoring to named competitors.

Tracking new competitors is easy in Contify because it tracks over 500k+ sources by default. This is in addition to custom sources required for deep monitoring of your specific competitors.

We have not included an exhaustive list of all Contify features and capabilities to keep this blog concise and focused. If interested, you can review Contify’s full suite of capabilities in this interactive demo.

Conclusion

Starting a new business in today’s fast-paced markets is easier than ever. Technology breaking down barriers and the internet democratizing knowledge, combined with lower IT infrastructure costs and easier access to funding, has created a storm for disruptions in almost all industries. Therefore, competition is coming from all directions — new competitors seemingly coming out of nowhere.

But when your sales teams do not encounter a new competitor in the deals, is it still important to track them? The answer is a resounding “yes.” For one, they bring fresh approaches, innovative products, and unique strategies to captivate your customers. Secondly, their emergence can signal shifts in customer preferences or unmet needs in the market – insights that are gold for developing forward-looking strategies.

Implementing a Market and Competitive Intelligence (M&CI) program is crucial to thriving and surviving in this business environment. Such a program should be backed by powerful M&CI tools that harness the latest AI technologies to bring efficiency and let you easily expand the scope of your intelligence program.

Embracing advanced, technology-driven tools like Contify becomes indispensable in this context. This saves time and resources and provides deep insights for making strategic decisions in a market teeming with new competitors.

Explore the power of Contify today and redefine how you gather, analyze, and utilize market and competitive intelligence. Take a 7-day free trial .