Few things can be more daunting—or exciting—than a blank research slate. Whether you’re entering a new market, investigating nascent growth opportunities, or crafting a strategic recommendation, the first step to transforming that blank slate into a successful outcome is undoubtedly understanding the market landscape.

But with the sheer amount of information available, conducting market landscape analysis isn’t always straightforward—even the term itself is vague at best. To fuel smart decisions, mapping the landscape typically involves three key steps: 1. Identifying the key players within a given sector (along with their revenue streams and product offerings), 2. Understanding the economic potential and growth levers within this space, and 3. Analyzing how this impacts your own company and its strategic decision-making.

Distilling what matters most in order to drive confident decisions requires access to diverse market perspectives and the right tools to prioritize, ingest, and analyze the most relevant insights across this content. Below, we will explore how the AlphaSense platform enables you to surface the intelligence and insights you need to master market landscape analysis in three easy steps.

Step 1: Mapping the Market

To start a landscape analysis, it’s important to focus on the market’s key components: think total addressable market (TAM), key organizational players, outlook, and customer base. Not only because these are often the top-line metrics that will resonate with decision-makers, but also because understanding the current state of the market helps us set a good foundation for spending our time wisely moving forward in our research.

Market Sizing

Some of the most valuable content for quickly ascertaining the TAM of a sector or product is broker research. Broker research, produced by the world’s leading banks to keep their clients abreast of industry outlooks and to drive investment decisions, is also invaluable for market sizing.

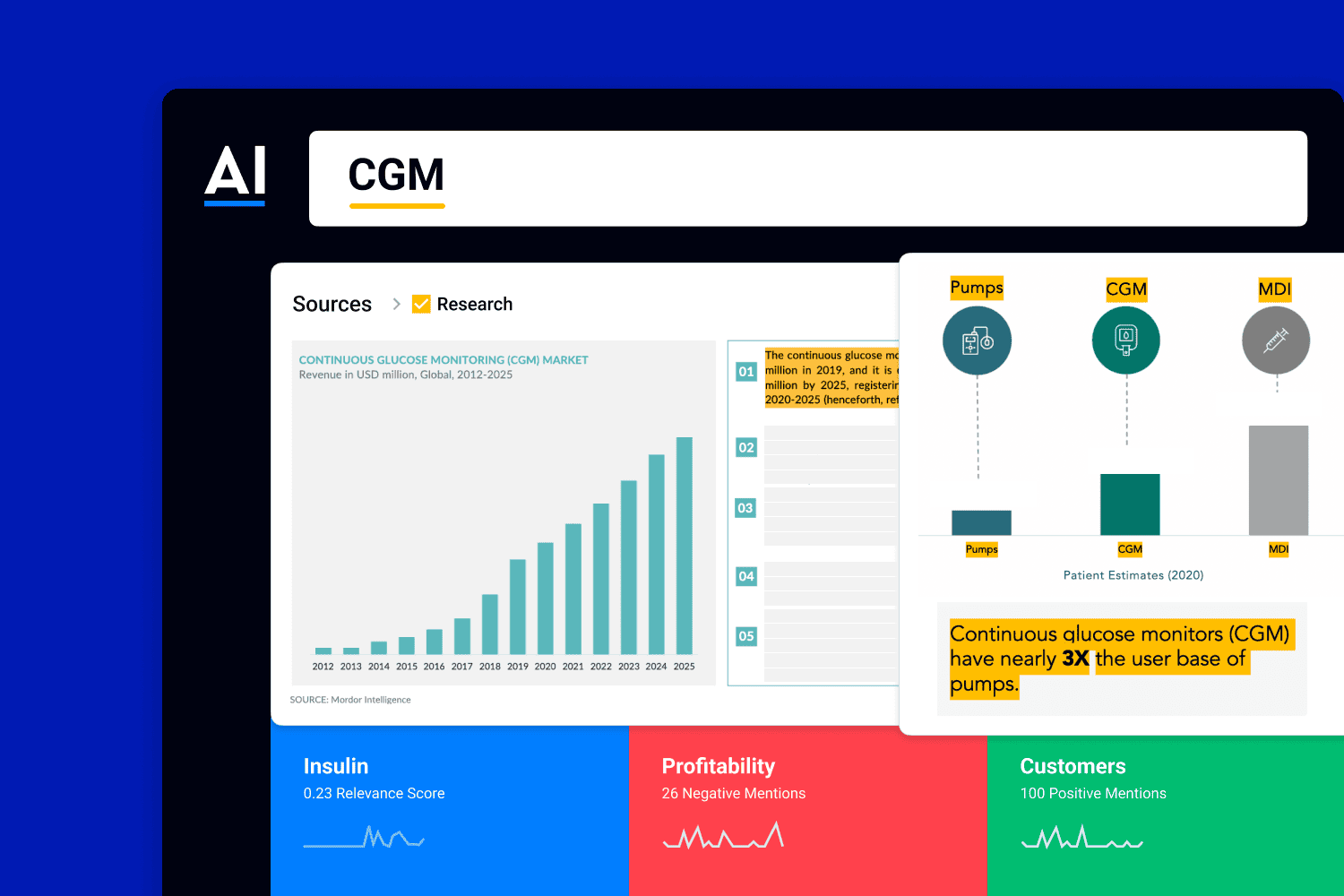

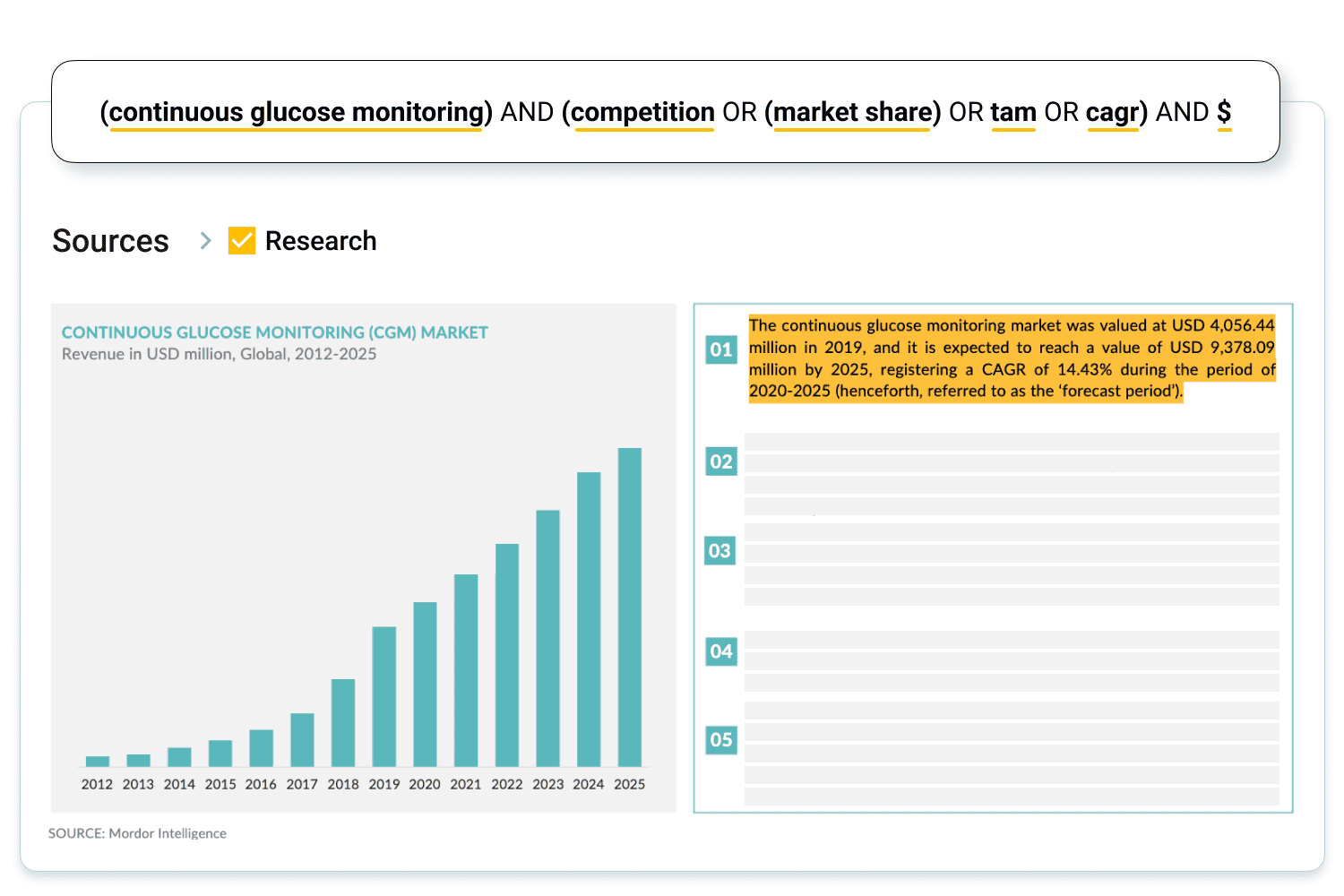

In this example, we’re looking to size the market for continuous glucose monitoring (CGM) — identifying and verifying the size and growth potential of the CGM market in less than a minute using Boolean search. Those familiar with the AlphaSense platform will recognize the yellow underlines as an indicator of Smart Synonyms™—results with synonymous terms that wouldn’t ordinarily be picked up by CTRL+F-ing your way through a document. Including the “$” symbol is also an essential characteristic of this search, allowing us to quickly narrow down results that are specific to dollar amounts as they relate to TAM.

“The U.S. TAM for CGMs is large at +145MM patients, which we estimate was just ~2.5% penetrated in 2023 with TAM penetration of all Type 1+Type 2 at ~11%…By our estimate, the global CGM market stood at $10.0B in 2023 (up 23.5% y/y) that is poised to grow at a mid-teens CAGR to $27.3B in 2030E.”

Source: RBC Capital Markets

Explore this search further in AlphaSense.

Key Players & Market Share

Now it’s time to better understand how this TAM breaks down across various players. Broker research can also assist us in understanding both market share and player positioning.

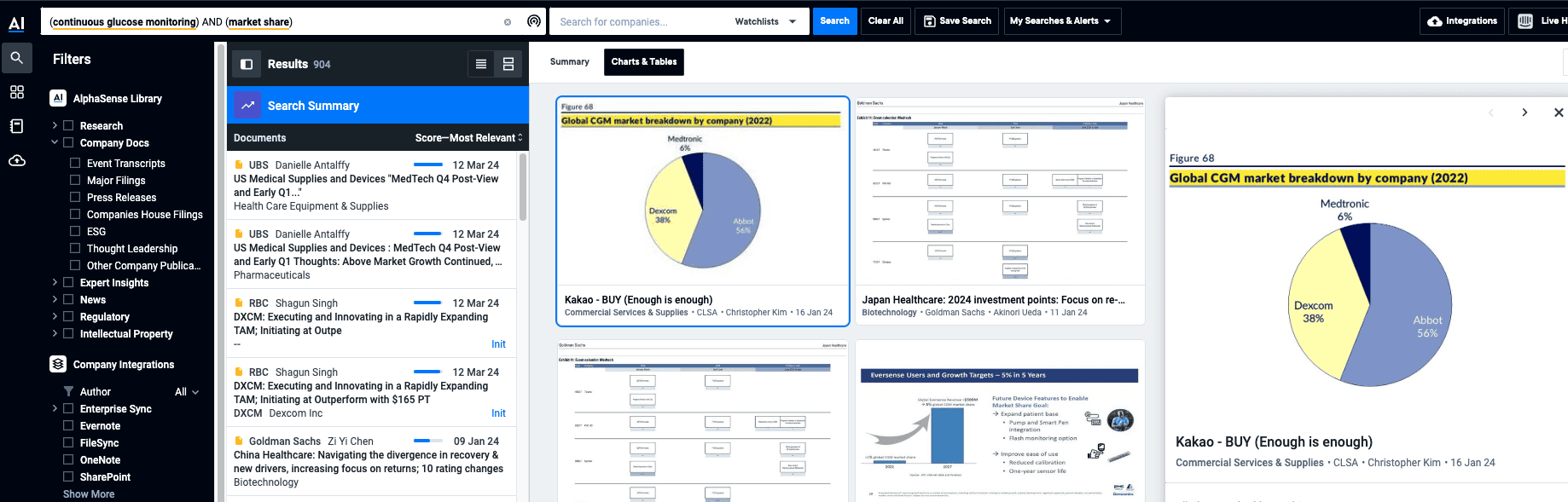

As a visual learner, I prefer to start off with a graphical representation of what this market share looks like. In AlphaSense, we can quickly find the best visuals around CGM market share using the Charts & Tables search.

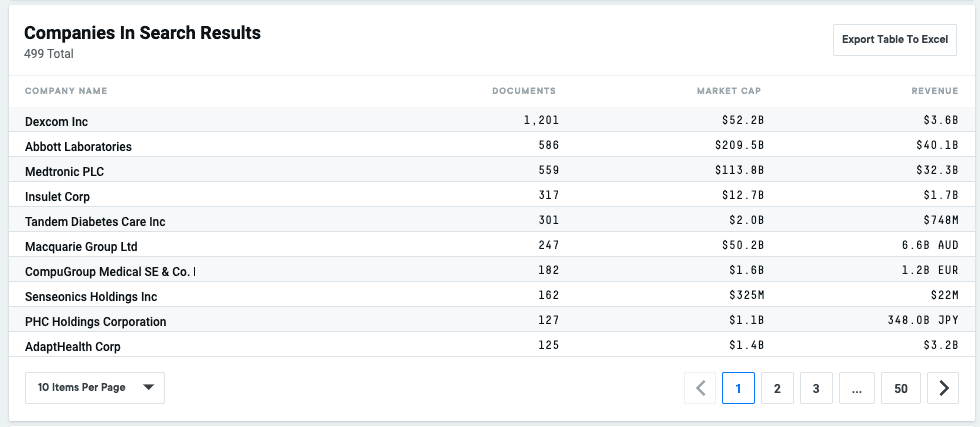

This gives us a great jumping off point for understanding the key players with significant market share: Medtronic, Dexcom, and Abbott. For a more complete picture of all players in the global CGM space, we can simply search for “CGM” and scroll down to “Companies in Search Results,” where major players are listed with their respective market cap and revenue.

Tip: Once we’ve identified the biggest players within our target market, we can add these companies to a watchlist to easily search for any topic across this list, or create a dashboard to stay up-to-date on recent events and news.

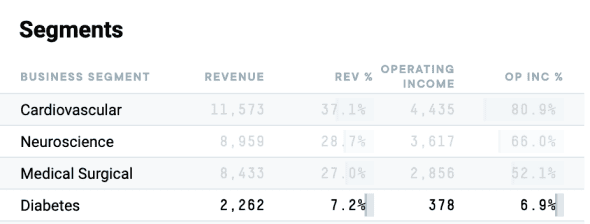

An interesting observation here is that while Medtronic has a market cap of $113B (more than double Dexcom’s), less than 20% of its market share is for CGM (as seen in the chart found above). We can easily interrogate the why behind this percentage by exploring products and revenue streams in the Financials & Estimates tab of Medtronic’s Company page. Upon further investigation, we can see that the Diabetes business segment only accounts for 7% of Medtronic’s total revenue.

We’ll cover this workflow more in depth in the next section.

Customer Base

In some cases, the target customer profile for this market may be obvious (i.e. even before starting research on CGM, we likely know that these products are intended to serve people with diabetes). But whether we’re looking to verify our existing hypotheses, or dive deeper into various audience segments, leveraging AlphaSense’s expansive search capabilities can help us efficiently create a robust customer profile.

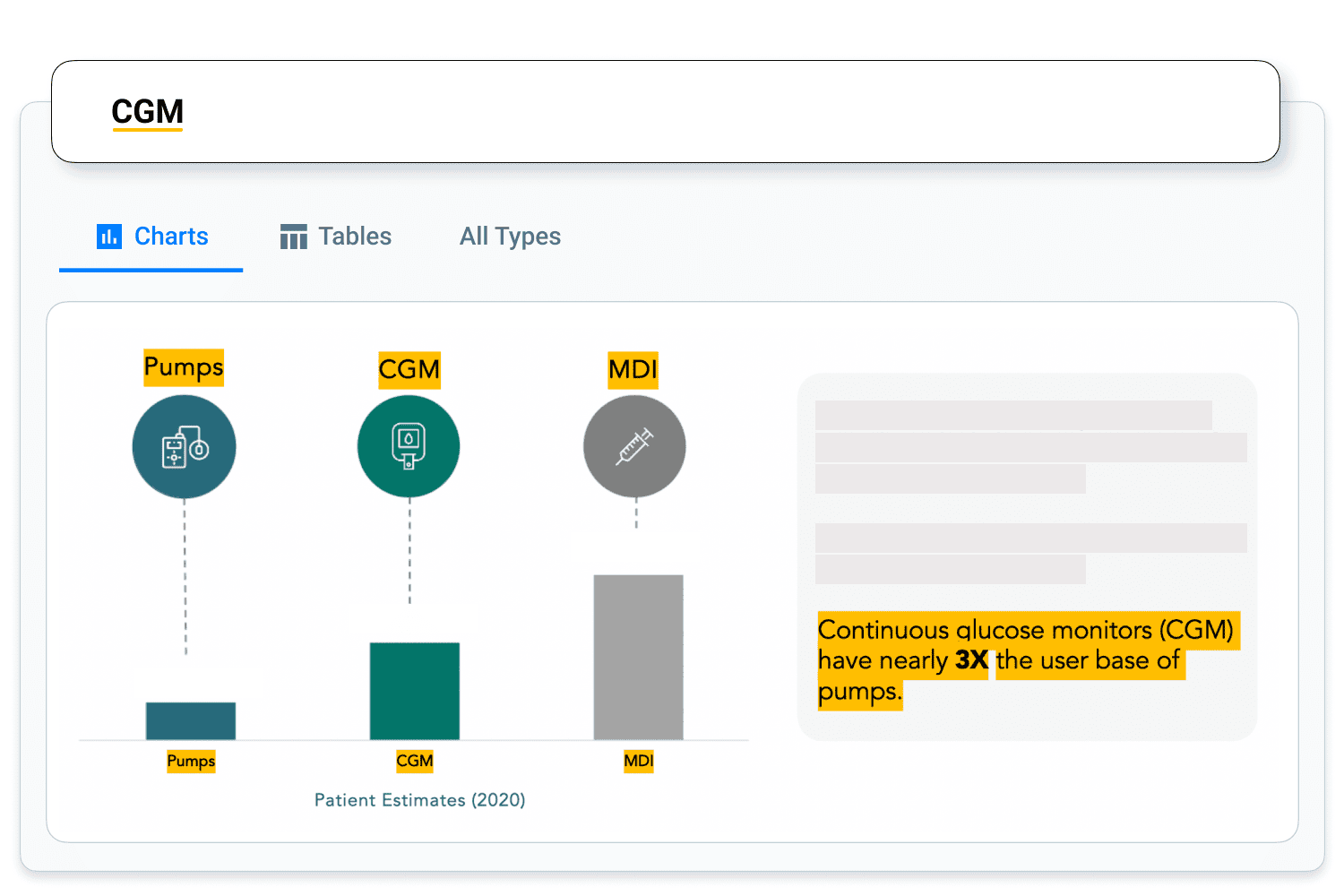

For example, by using a general thematic search for CGM and browsing our image search results, we can quickly gather key information about potential and current customers for CGMs—including the nuances among CGM, injection, and pump users, and how GLP-1s can impact CGM usage.

These nuances within an audience group will further help us in Step 3, where we’ll identify areas of opportunity for us to capitalize on.

Step 2: Deep Dive into Key Players

Now that we’ve started to piece together the big-picture of the market, we can take our research a step further and dig deeper into each of the major players we identified in Step 1. In this step, we’ll look to paint a detailed picture of each company, including their revenue streams, product offerings, and executive priorities.

Segments & Revenue Streams

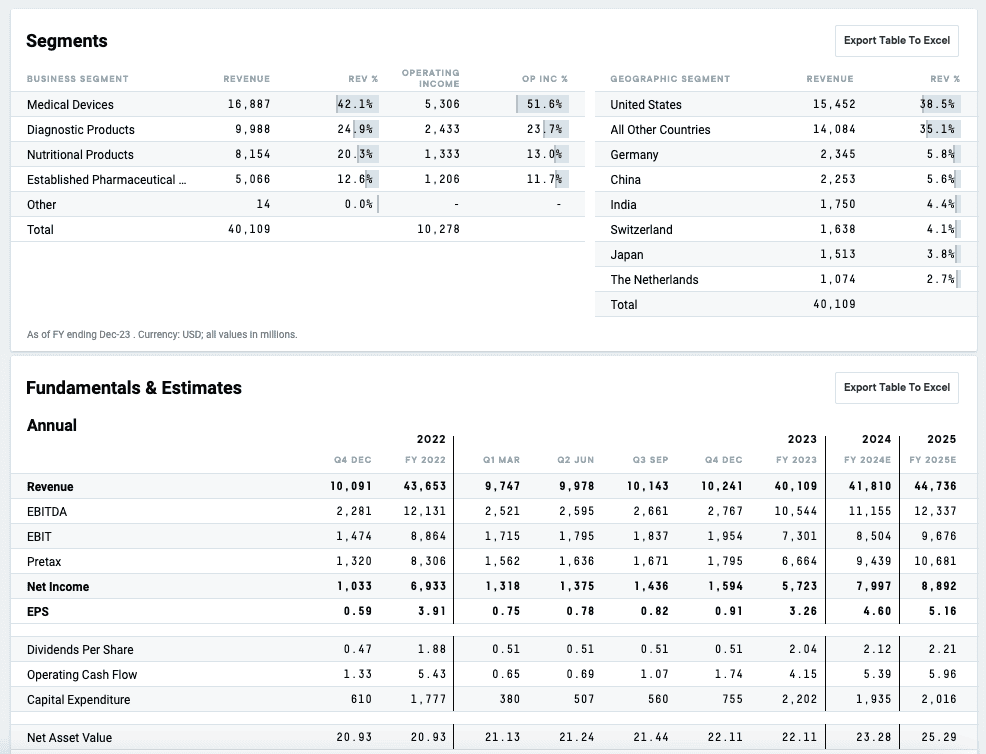

With Company Tearsheets, we can quickly get up-to-speed on the must-knows about each of the players we’ve identified. The Financials & Estimates tab gives us insight into product and geographic segments, along with key earnings performance metrics like EBITDA. By looking at Abbott’s company page, for example, we can see that medical devices (including CGM) brought in just under $17B in 2023, representing about 40% of total revenue—and that this revenue is globally distributed.

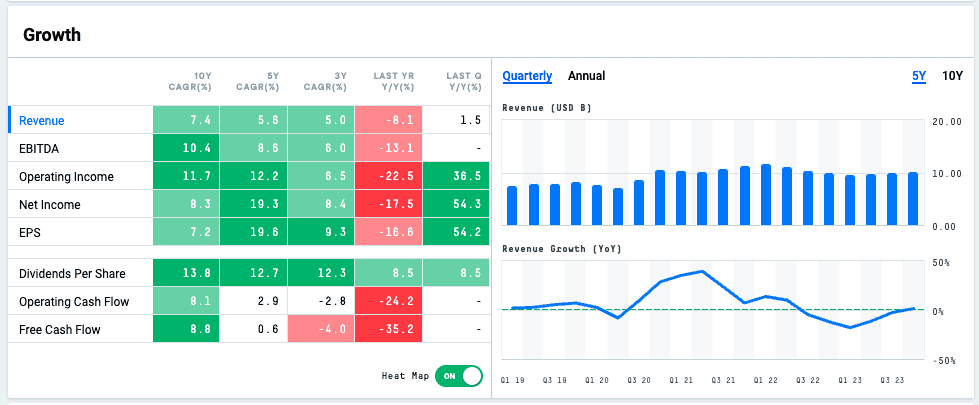

We can also compare key growth metrics over a 5Y or 10Y historical period:

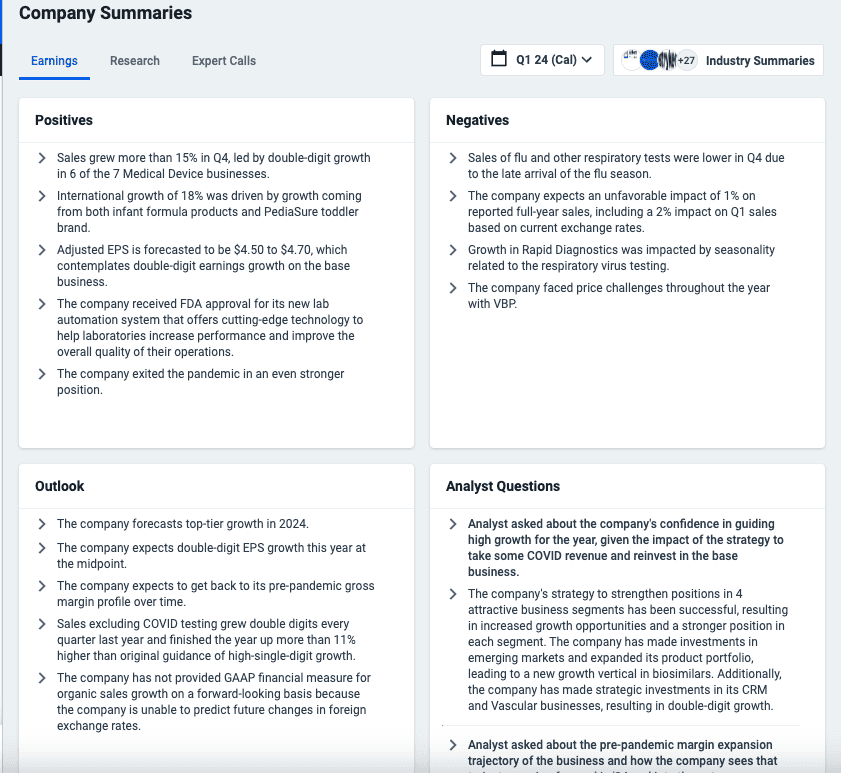

Finally, we can dive deeper into this financial performance using Smart Summaries for Companies. These generative-AI powered summaries feature the key highlights and lowlights from a company’s earnings call, allowing us to glean additional context into the “why” behind the financial data. Within Company Summaries, I can also explore when and why certain brokers have upgraded or downgraded their ratings of Abbott—which can indicate market sentiment for a company’s financial performance and outlook for upcoming quarters.

Tip: Click into any of our AI-generated Smart Summaries to access the exact snippet of text from which it was sourced.

Product Offerings & Executive Priorities

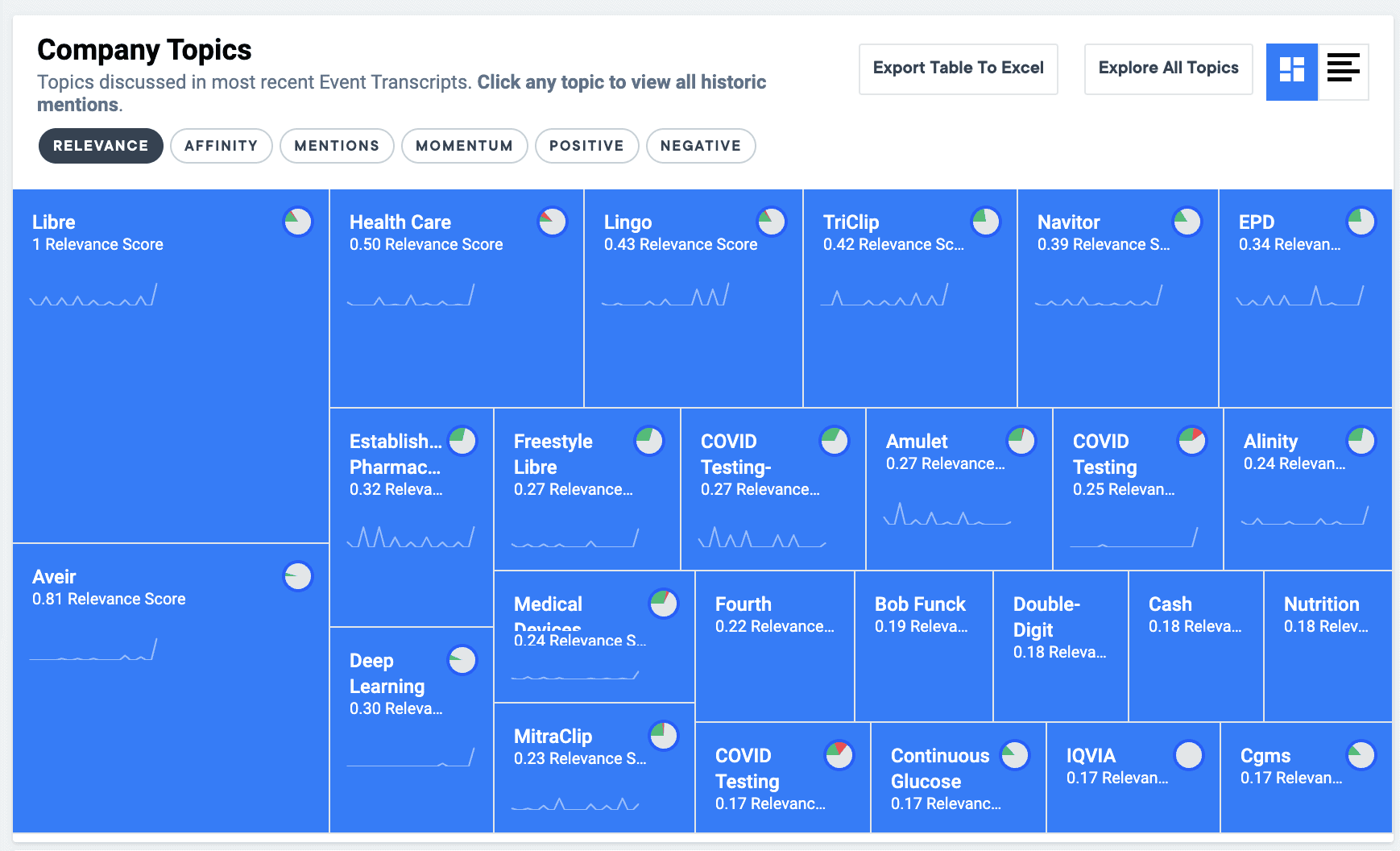

While financial metrics can tell part of the story about a company’s current position and performance, it’s just as important to understand their shifting priorities and products to address market conditions. Within the Company Tearsheet on the AlphaSense platform, just beneath the Smart Summaries modules, is Company Topics. This section can help us quickly analyze a company’s top priorities based on executive chatter in earnings calls.

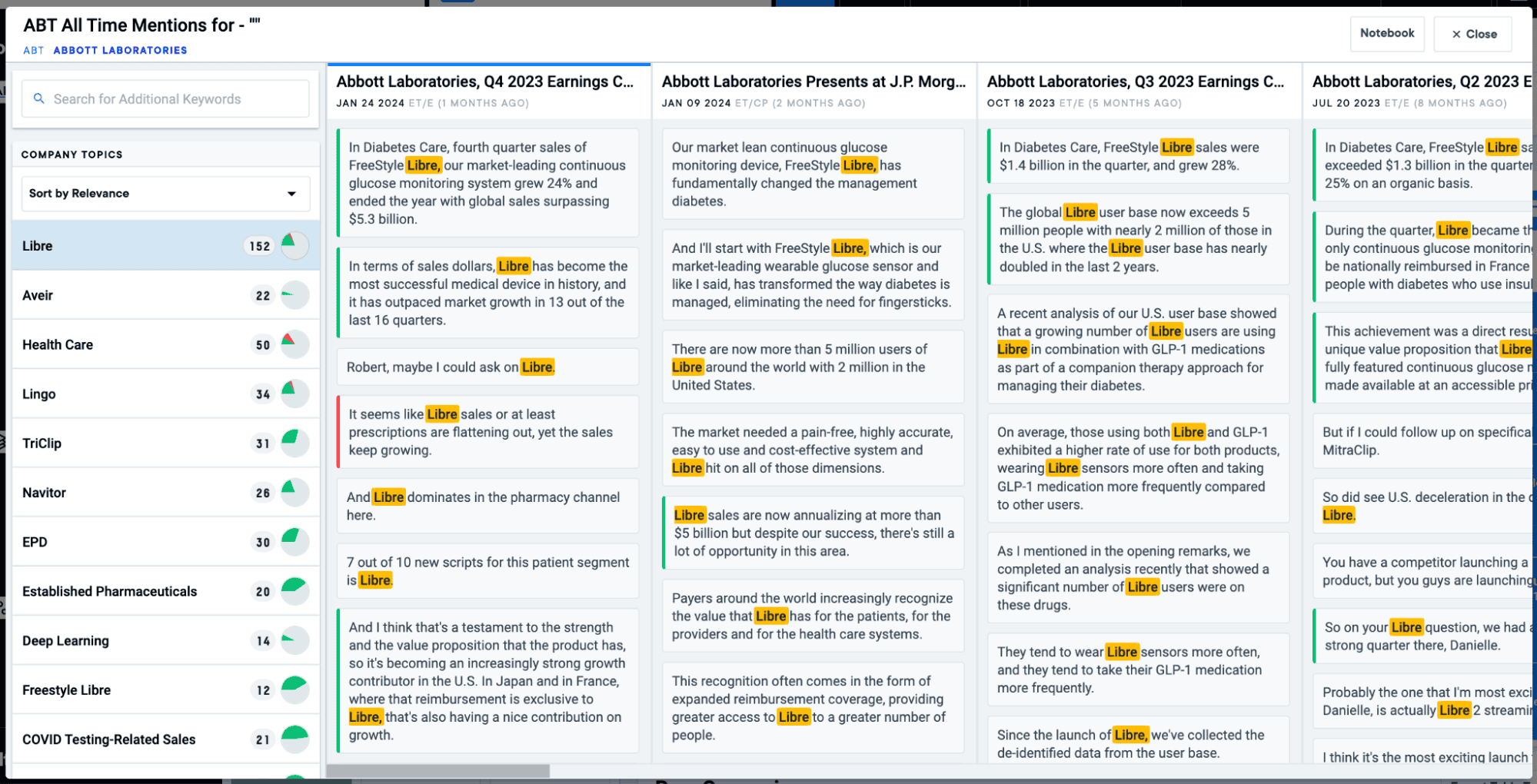

Clicking into any of these topics allows us to access Snippet Explorer, which maps all mentions of this topic over historical earnings calls, investor presentations, and more company events. This enables us to quickly understand how company sentiment or narrative has shifted around a given topic. In this example, we’re exploring historical mentions of Libre, which is Abbott’s flagship CGM device.

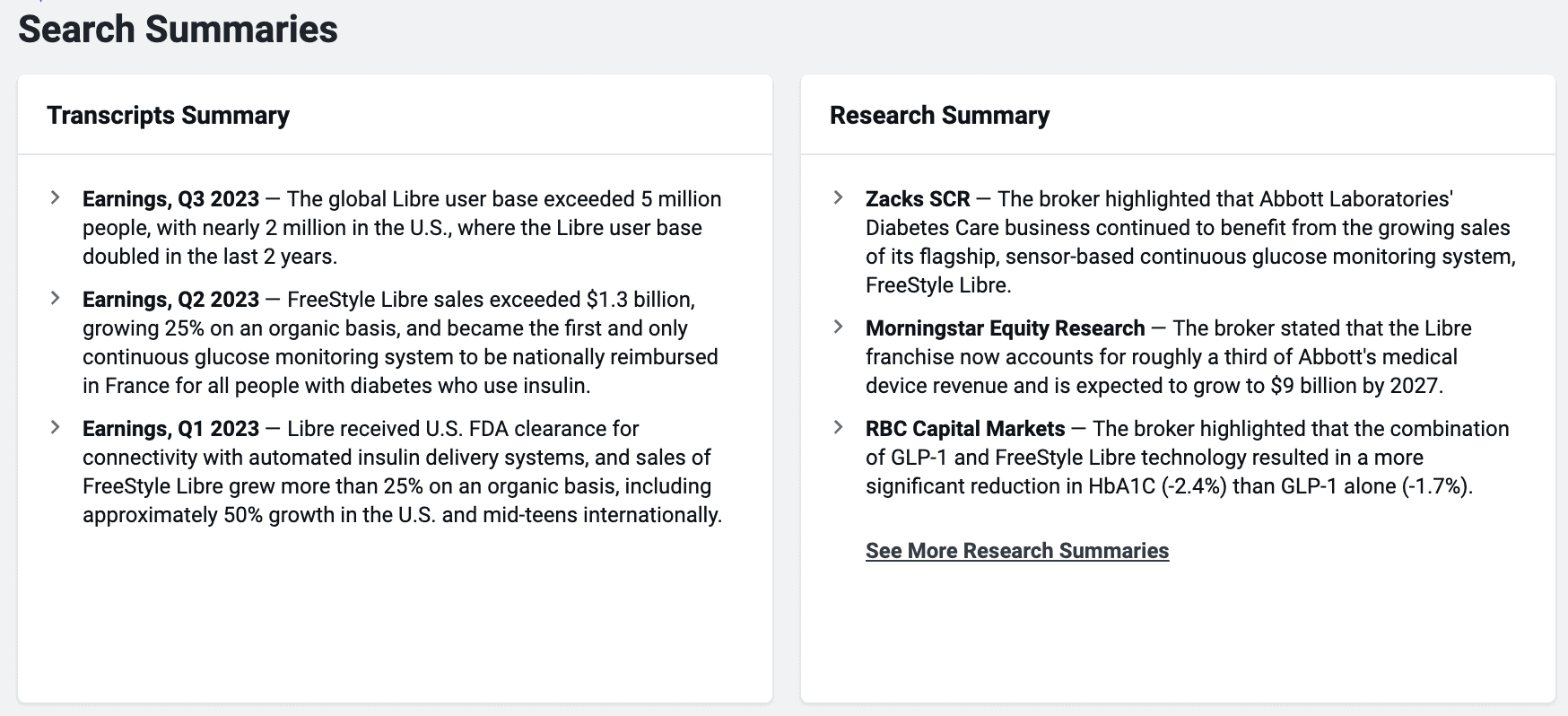

Finally, if I want to dive even deeper into specific product offerings discovered in this process, I can use the dual company and keyword search bars to search specifically for mentions of “Libre” across documents tagged to Abbott. From the Search Summaries module, powered by our Smart Summaries generative AI technology, I can immediately learn about Libre’s role in Abbott’s overall strategy.

Step 3: Analyzing Opportunity

In this final step, we build off of our foundational research to find specific gaps, challenges, and/or opportunities to cannibalize or grow market share. Much of this involves gaining a deeper understanding of the competitive landscape—each player’s relative strengths and weaknesses, as well as customer and investor sentiment.

Conduct a Competitor SWOT Analysis

Formalizing a SWOT analysis for key players in a market can bring clarity and identify opportunities for market penetration. We can use much of the information gathered in the second step as a jumping off point for analysis. For example, if understanding that Libre is critical to Abbott’s offering in the CGM space as step one, then a few examples of what we can do next include:

- Are there specific customer profiles where Libre is performing better than other CGM device offerings from other companies?

- Does the operating income that the Diabetes segment is working with give ample room for the growth projected?

- Are there weak points in the supply chain that present enhanced risk for Abbott relative to its competitors?

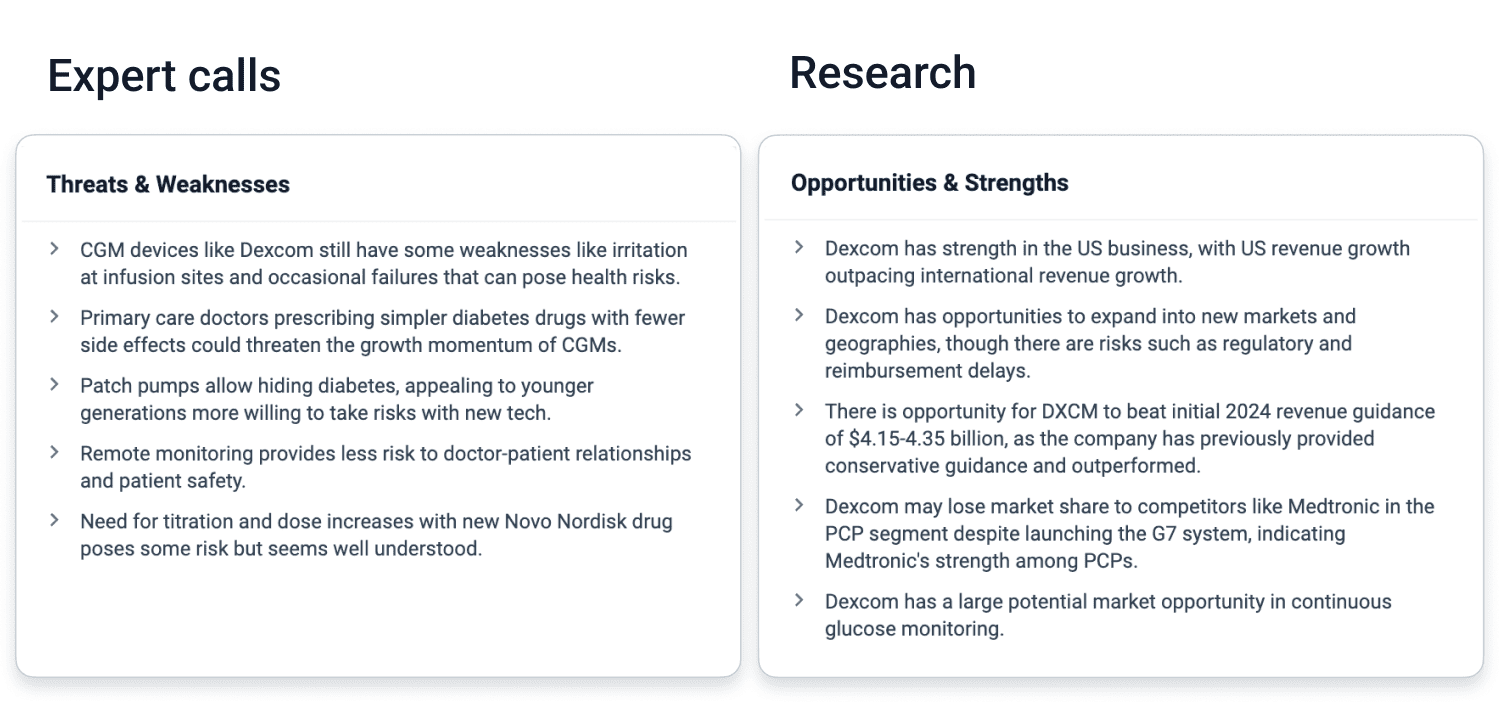

In AlphaSense, a great jumping off point for this SWOT analysis is heading back over to our Smart Summaries modules on the Company page. We can toggle to Research and Expert Call summaries, which have dedicated sections for Opportunities & Strengths and Threats & Weaknesses.

Research summaries help us understand investor sentiment, with a particular tilt towards predicting future stock performance. Expert Call summaries offer an inside track into customer and former employee perspectives, giving us boots-on-the-ground perspectives.

Explore Real-World Customer Feedback

While all of this secondary research is essential for us to map the landscape, we can’t forget about primary research. When it comes to market landscape analysis, primary data can range from surveys and market research, to expert interviews and customer feedback.

Expert Transcript Libraries are a great tool to tap into deep expertise from former executives, partners, suppliers, and customers for a specific company or product. This offers us multiple first-hand perspectives that we’d never get from secondary research alone. In this case, we’re able to explore an interview with a customer that uses a Free Libre device from Abbott, and is able to directly compare it to Dexcom’s devices from personal experience.

Additionally, one of our newest content offerings is AlphaSense’s Voice of Customer interviews. These exclusive interviews dive into the heart of customer feedback on product usage, value, and purchasing journeys and allow you to gain a comprehensive understanding of the competitive landscape and emerging trends.

Give your Landscape Analysis a Competitive Edge

The landscape analysis steps we’ve outlined can give you a great foundation for making strategic decisions about market opportunity,and this is just the beginning. Keeping your analysis current means spotting market trends, competitive movements, and macroeconomic shifts sooner—removing the cost of uncertainty in your decisions going forward. Save the searches you created during this process, add them to a dashboard, and even set alerts so that you never miss a thing. Plus, you can prepare and share the insights you collected throughout this process using our Notebook templates.

With access to diverse market perspectives and the right tools to prioritize, ingest, and analyze the most important insights, AlphaSense is the leading resource to help you defy doubt when entering a new market.

Want to learn more about how to supercharge your market landscape analysis? Attend our webinar on April 11th.

Ready to take your competitive intelligence to the next level? Start your free trial of AlphaSense today.