10 Market-Moving Trends to Shape 2023

Get the guide

After 2020 was lost to COVID-19 and 2021 merely scratched the surface of recovery, 2022 held great promise as travel restrictions were slowly lifted and mask mandates ceased almost entirely. The expectations for the year were simple: stability and revival. Hopes were high for a more predictable world, but ended up coming to pass as we face another year of disruption and uncertainty.

Between the Russian-Ukrainian war, supply chain disruptions, record-breaking inflation, and extreme market volatility, dreams of normalcy quickly vanished into thin air. People, companies, and governments yet again scrambled to make sense of it all, understand the full impact of unstable global markets, and make decisions despite uncertainties everywhere.

As we move into 2023, market volatility is only expected to worsen. To combat this unpredictability, our State of Market Intelligence benchmark report found that 98% of respondents resort to using consumer-grade tools to make decisions. The ability to swiftly pinpoint trends and effectively analyze them is a core function of market intelligence efforts on all corporate levels, from strategy, to business development, to IR, all the way to consulting.

Ultimately, companies need a way to stay smarter, more agile, and continuously informed about their industries and the business world at large. AlphaSense proves to be just that – an award-winning research platform that allows users to gain a unique perspective and help them respond better to new information impacting their businesses, markets, and lives.

Below, we used our platform to comb through thousands of corporate call transcripts, interviews from our expert call library, research documents, and more (all located within our vast content universe) to identify the top 10 key trends to keep an eye on for 2023.

Related Reading: 10 Market Research Tools to Trial in 2023

10 Trends to Watch in 2023

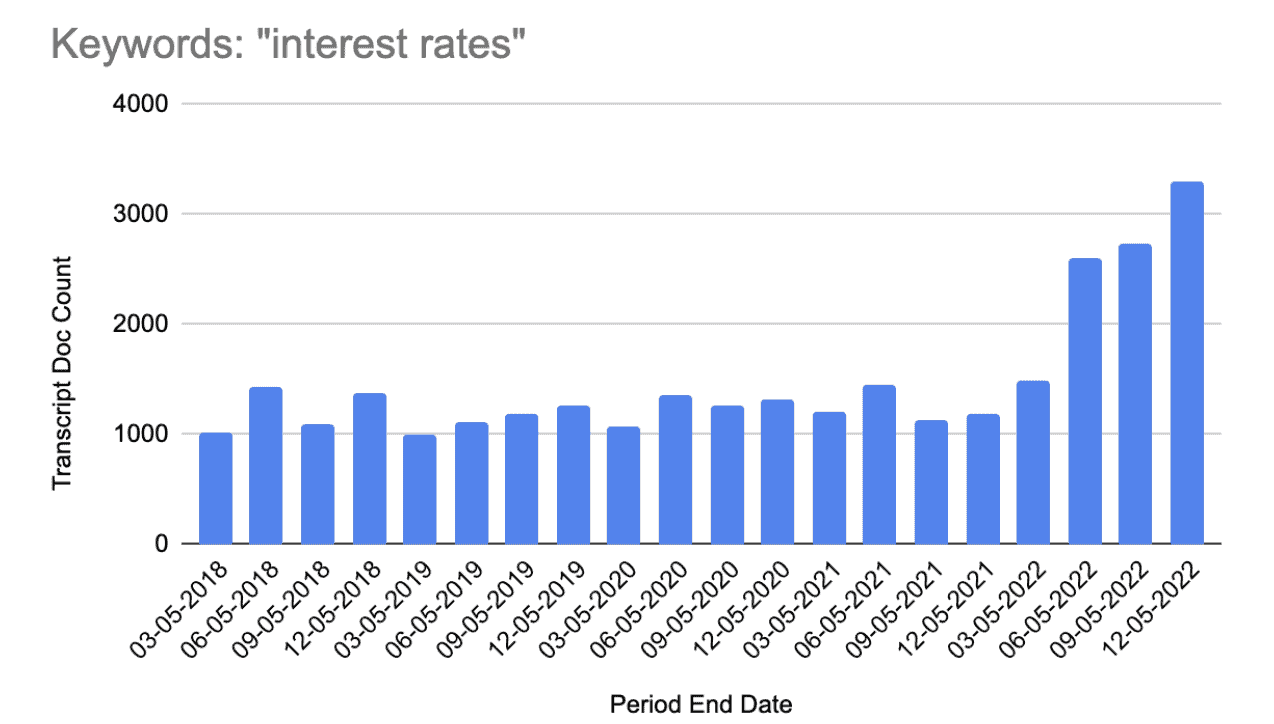

Climbing Interest Rates

Interest rates are just the price of money, and money got more expensive in 2022. Central banks around the world engaged in aggressive rate hikes during the year, as chronicled by the International Monetary Fund. Though the effect of the hikes as a policy transmission mechanism varies substantially, the prevalence of floating-rate borrowing varies significantly from country to country.

“High inflation, rising interest rates and a slowing economy, combined with ongoing geopolitical turmoil, have created an extremely difficult environment for investors to navigate.”

– Stephen Schwarzman, Blackstone Inc., Chairman, CEO and Co-founder, October 2022 | Earnings Call

“When we see these price spikes, it stretches everybody very thin on working capital. That is an issue, particularly, right now, is when you have a perfect storm with interest rates going up and it just makes it a little bit more expensive to participate in that space.”

– DTE Energy Trading, Former Vice President, November 2022 | Expert Call Transcript

See the search results for “inflation rates” within the AlphaSense platform

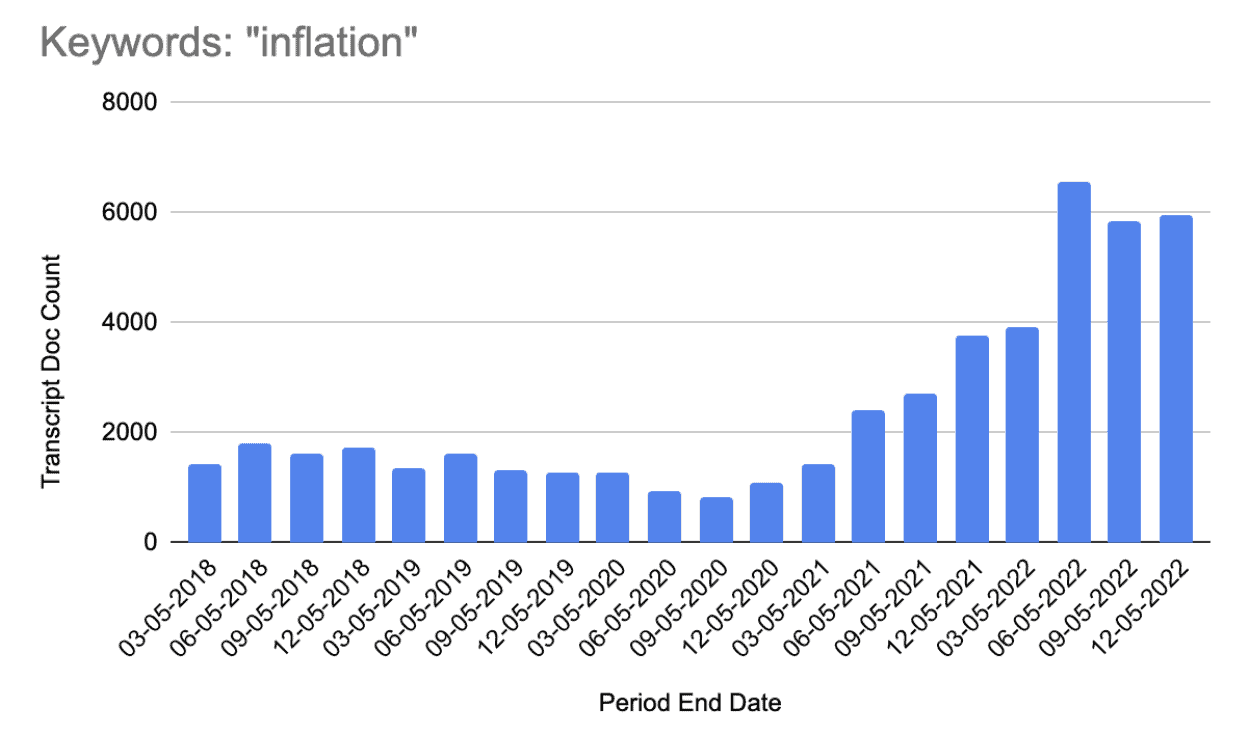

Skyrocketing Inflation

High inflation–the rapid increase in general price levels–is what led to the recent global rate hikes. Inflation has been fueled by a number of factors: energy scarcity, supply chain issues, Covid-related government stimulus programs, and tight labor markets. Inflation in Germany hit a near 50-year high, while it made 40-year highs in the US, Japan, and the UK.

“We have the first land war in Europe in 70 years, the highest inflation in 40 years, and the Fed had to move.”

– James Gorman, Morgan Stanley, Chairman and CEO, October 2022 | Earnings Call

“Also, the manufacturing is not just energy. It’s a lot of labor. This is then the other question mark around labor inflation. If this ends up in the spiral of increasing labor, giving pay rises to help people to cope with inflation, which is causing more inflation, which is then fuel these interest rates on the central banks.”

– PepsiCo, Former Supply Chain Finance Manager UK and Ireland, September 2022 | Expert Call Transcript

See the search results for “inflation” within the AlphaSense platform

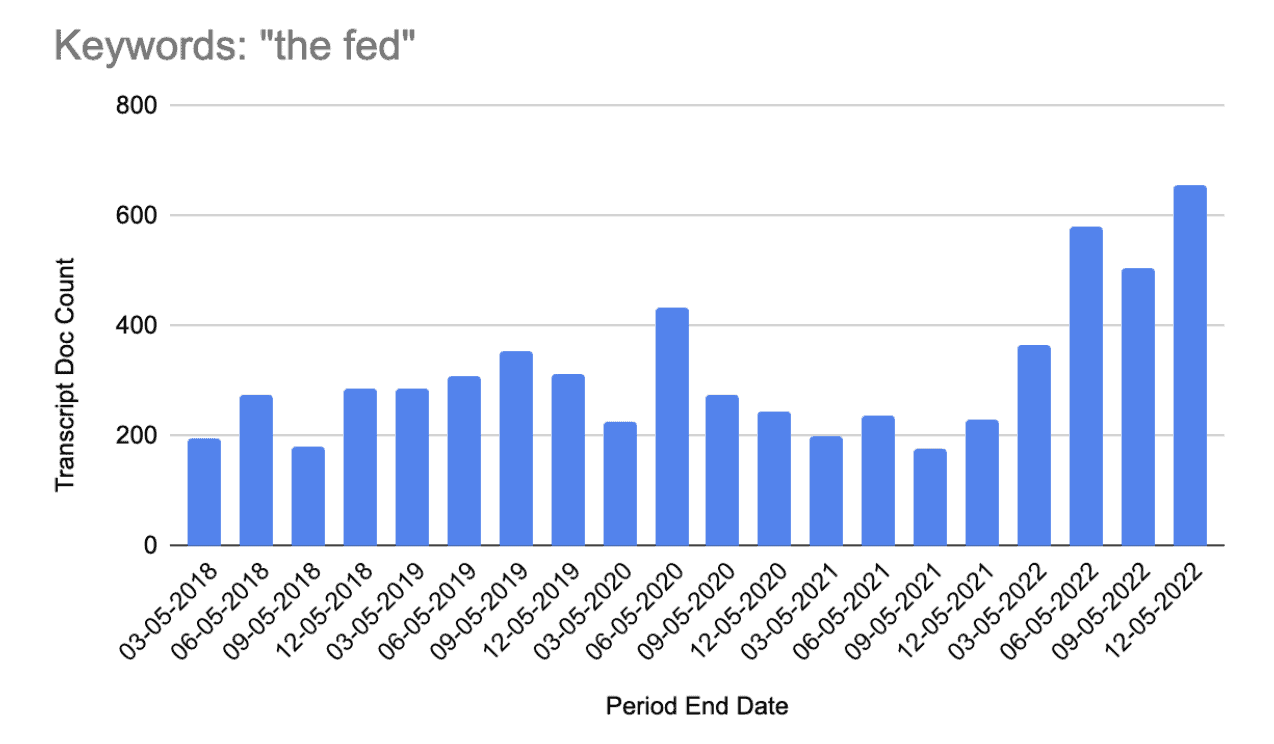

FRS Friction

The US Federal Reserve System (FRS) has been hiking rates in 75 basis points (0.75%) increments throughout 2022 after the COVID-19 rate cuts. With US rates at a 14-year high, flow-through effects have cropped up, such as mortgage originator layoffs due to lower demand and a cooling housing market. Read more here about how these climbing interest rates have played into the deterioration of bond value, and how that contributed to the Silicon Valley Bank collapse.

“You have aggressive action from the Fed. You have global geopolitical events happening. And so we’re just being, what I’ll describe as appropriately conservative.”

– Marvin Ellison, Lowe’s Companies, Inc., President, CEO, and Chairman, November 2022 | Earnings Call

“I think the Fed is going to be in a tough position as to what they’re going to do because once you keep raising rates to this degree and certainly this is more aggressive than we’ve seen maybe even in my lifetime. You have to worry about the fear of recession and how do you balance those things out.”

– BlackRock, Former Director of Business Development, July 2022 | Expert Call Transcript

See the search results for “the fed” within the AlphaSense platform

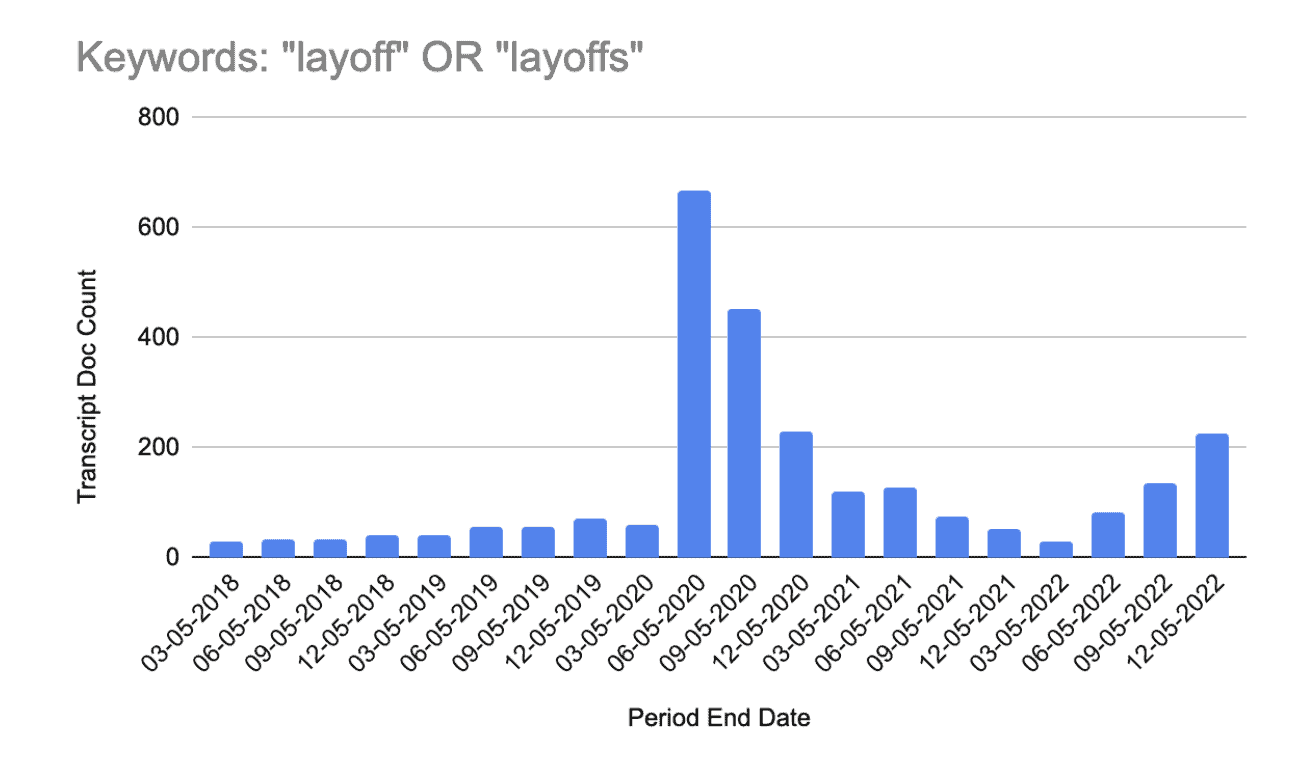

Layoffs

While the US job market has rebounded in many ways, there have been a slew of hiring freezes and layoff announcements within the technology sector. 2022 has not been kind to technology companies’ valuations since these companies are seen as “long duration” assets, or companies where cash flows to the owners are further out so the discount to present value is steeper as rates rise.

“So we’re actually speaking to our employees tomorrow about this. So I’d be reluctant to go into a lot of detail here until we’re able to talk to them. I would say that what we’re doing is rightsizing certain businesses.”

– Charles Robbins, Cisco Systems, Inc., Chairman and CEO, November 2022 | Earnings Call

“I really give it to this company because they didn’t do furloughs or layoffs. They pretty much said, “This is our opportunity to really explore everything within Humana. Look at the different programs we have. Maybe you’re interested in pharmacy or policy.”

– Humana, Former Lead Medical Director, February 2022 | Expert Call Transcript

See the search results for “layoff” or “layoffs” within the AlphaSense platform

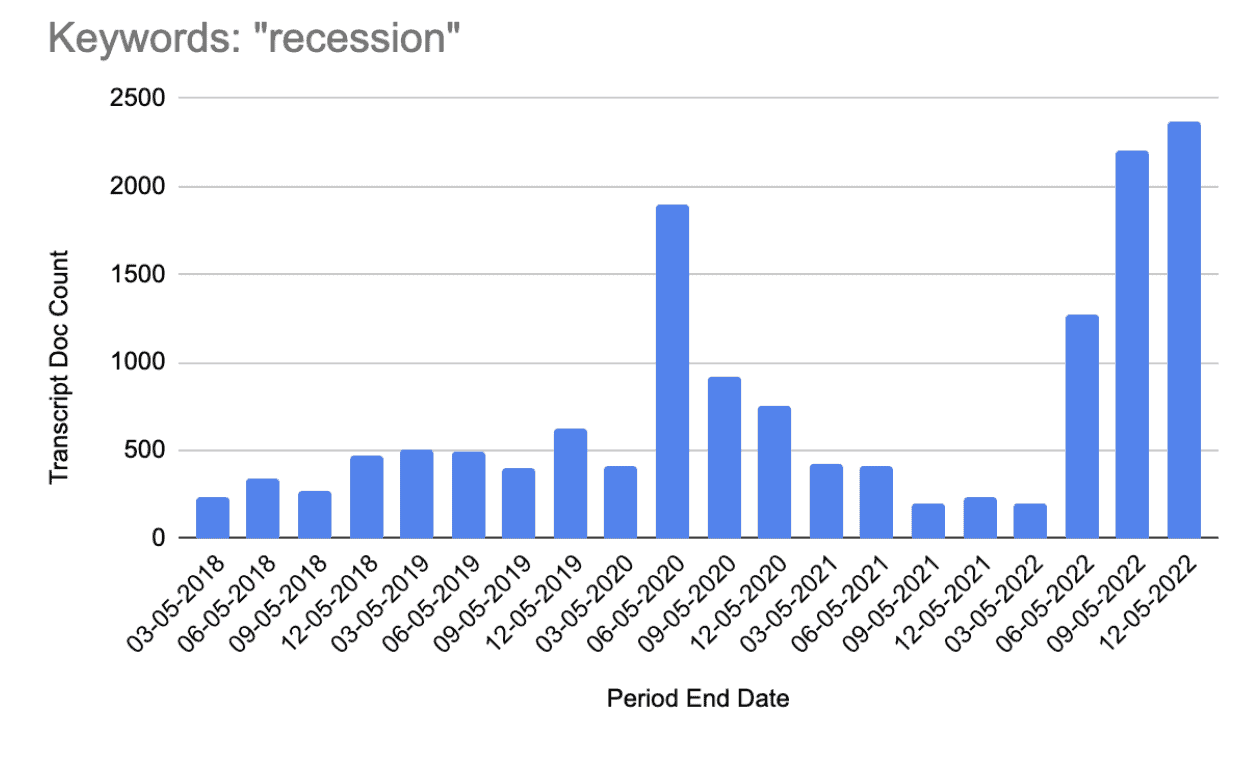

Oncoming Recession

While an official recession has yet to be declared, the US did record two consecutive quarters of negative GDP growth. And as Russian-related disruptions continue on, the EU is in even tougher shape.

“So there, clearly, whether it’s energy and security, cost of energy, cost of floating rate mortgages, the recession, unemployment, the effect of inflation on consumer behavior, it’s a pretty difficult environment, and one that in this combination has not been seen for a long time.”

– Ulf Schneider, Nestle S.A., CEO, Member of the Executive Board and Director, November 2022 | Earnings Call

“Historically, they’ve always seen animal health as a recession-proof sector. As a practicing veterinarian, I could definitely see that. I was practicing prior to 2008. Even during that time, my interaction with clients that were economically constrained, they were sometimes the most reliable as far as their accounts payable.”

– Zomedica, Former President and Chief Medical Officer, November 2022 | Expert Call Transcript

See the search results for “recession” within the AlphaSense platform

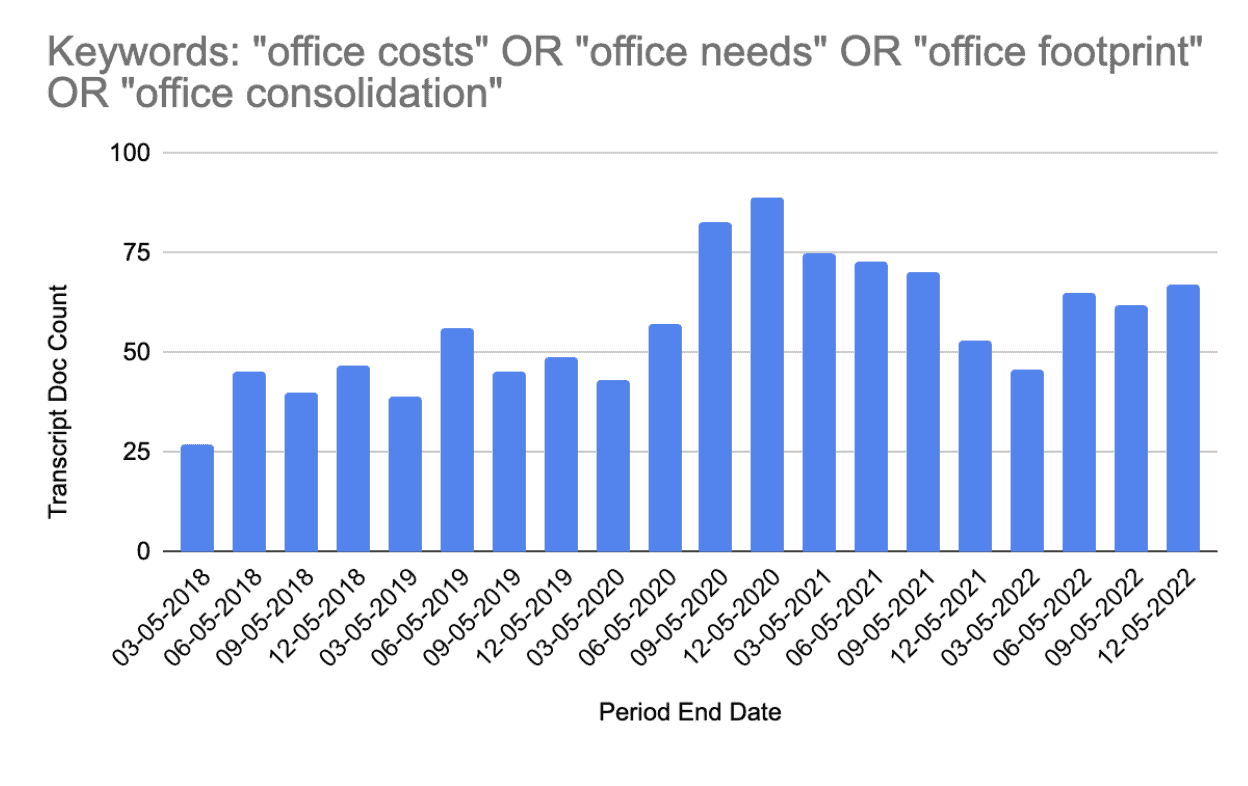

Waning Office Footprints

The rise of remote office work during the pandemic put a big question mark on the future of the office sector. We are seeing persistently high vacancies in major cities like NYC, where occupancy barely recovered to 40% this summer, and San Francisco severely lagged behind in October. According to a new report by Colliers Canada, the national office vacancy rate could peak at approximately 15% by the end of 2024 as the rise of hybrid work models prompt companies to reduce their office space.

“We’re moving fast on our office integration plan and consolidated 10 of our office locations around the world, lowering our real estate costs. We completed our major New York City consolidation and are on track to complete our London consolidation in the fourth quarter.”

– Douglas Peterson, S&P Global Inc., President, CEO and Executive Director, August 2022 | Earnings Call

“Other sectors that are less growth-oriented, more bottom-line-oriented will look at this as an opportunity to cut office space. They may do it by making office collaboration important, but they may not require CBD premium class A as the necessity.”

– Boston Properties, Former Finance Executive, October 2022 | Expert Call Transcript

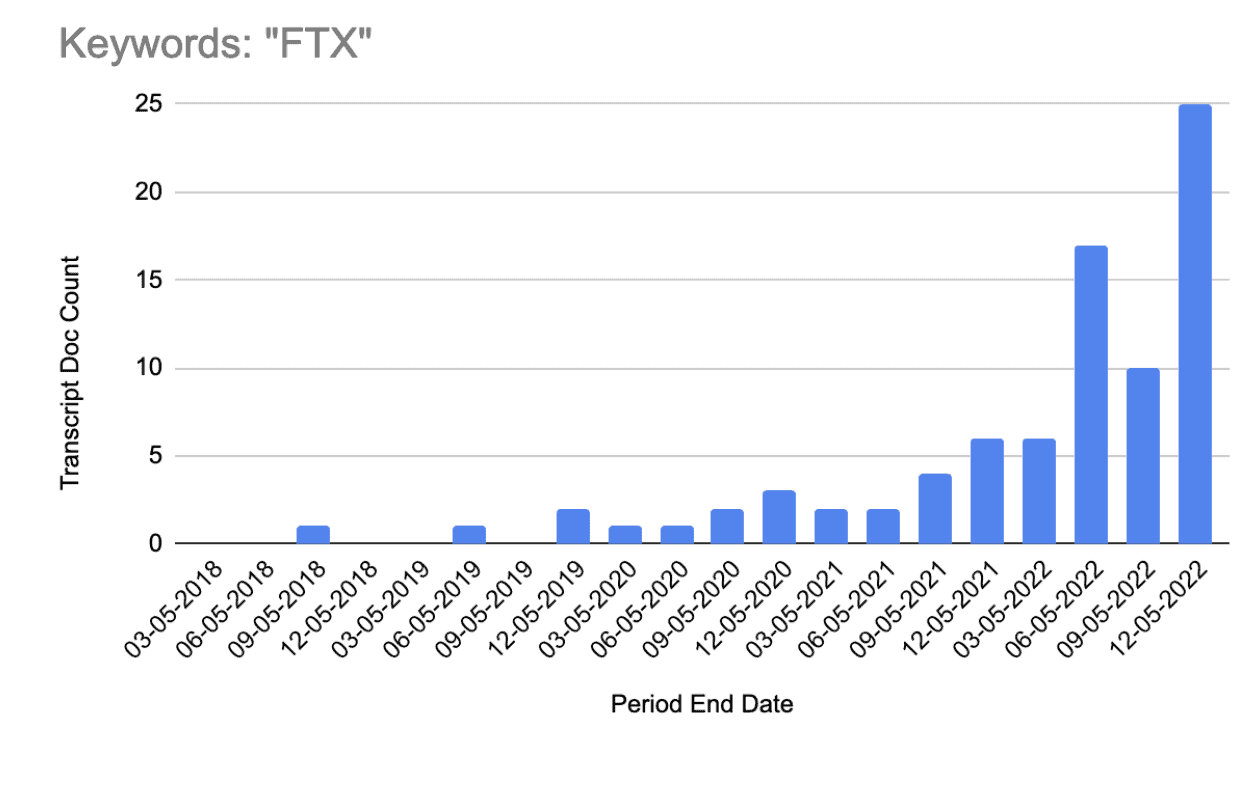

The Collapse of FTX

The formerly high-flying cryptocurrency exchange FTX filed for bankruptcy in November, leading to considerable uncertainty across the entire crypto space. Major players sought to distance themselves from the situation, with Gemini rapidly building Trust Center, a live data dashboard, and Coinbase explicitly describing their business model differences.

“So our main priority right now for these couple of weeks is to manage risk, reassure our customers, our partners, our employees and the general public that crypto is safe ongoing base, that this is not a reflection of crypto overall. This is a reflection of one company’s poor risk management processes, and that we are fundamentally different in everything we do than how FTX apparently had operated. So as we look ahead, we think there are opportunities to capitalize.”

– Alesia Haas, Coinbase Global, Inc., CFO, November 2022 | Earnings Call

“I think it’s a fair play to say regulation will absolutely have a seat at the table for anything that touches the consumer product for the next few decades at least. We’re seeing it with crypto, obviously. FTX is a disaster.”

– Cybersource, a Visa Company, Former Vice President, Global Enterprise Client Support, November 2022 | Expert Call Transcript

Related Reading: Cryptocurrency, Blockchain, and NFTs: The Impact on Finance

See the search results for “FTX” within the AlphaSense platform

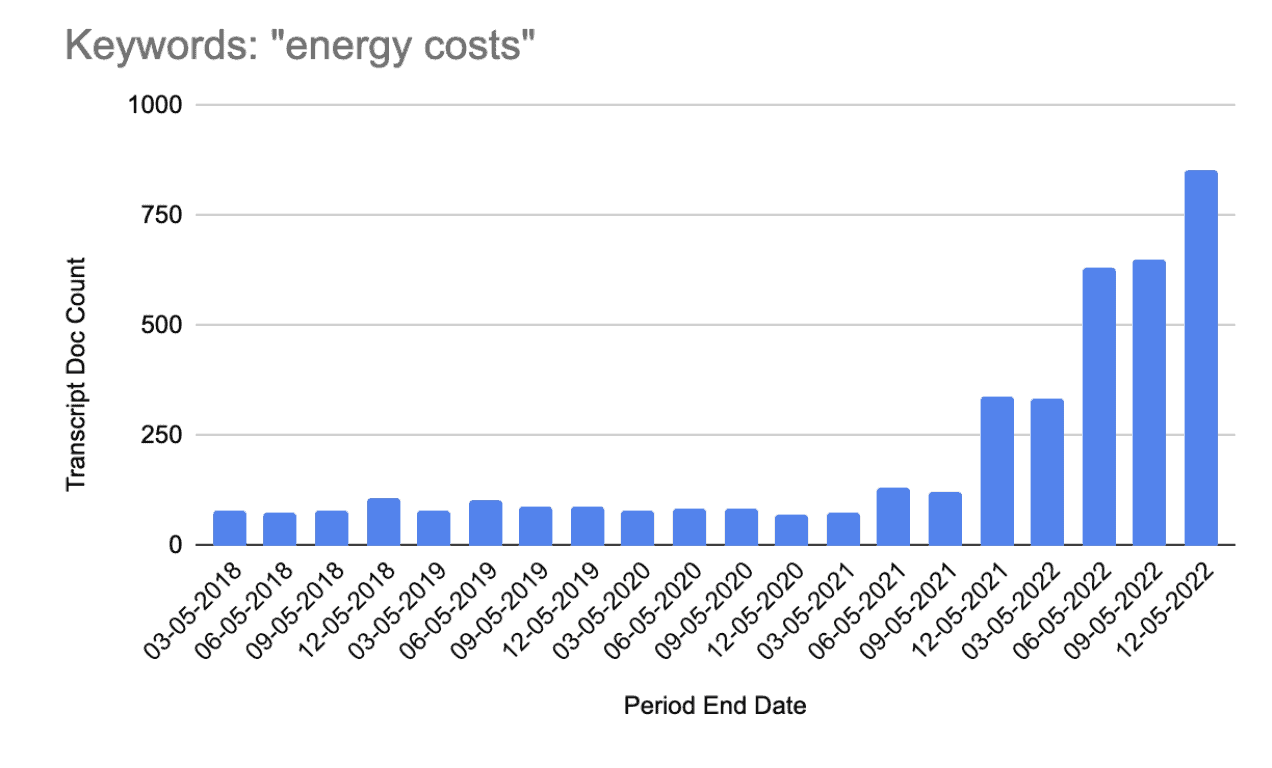

Rising Energy Costs

High energy costs were a persistent problem throughout 2022, even forcing the US government to release oil from the Strategic Petroleum Reserve, a move criticized as blatantly political. Globally, over 90 countries experienced protests over rising fuel costs. Within the US specifically, energy costs are projected to stay at their historic high well into 2024.

“We’re coming off a strong quarter and we feel very good about our competitive position, and we have not yet seen any signs of slowdown. That said, we don’t have any crystal ball around the external factors, whether it’s FX, whether it’s inflation, whether it’s the impact of energy prices on consumer spending.”

– John Donahoe, NIKE, Inc., President, CEO and Director, September 2022 | Earnings Call

“In general and with the energy costs and fuel costs, costs of products are going way up as well. Yeah, the people spend, people starting trying not wanting to buy at those prices, then you affect purchasing. Obviously, pricing power has gone down.”

– Amazon, Former Head of EU Central Operations, December 2022 | Expert Call Transcript

See the search results for “energy costs” within the AlphaSense platform

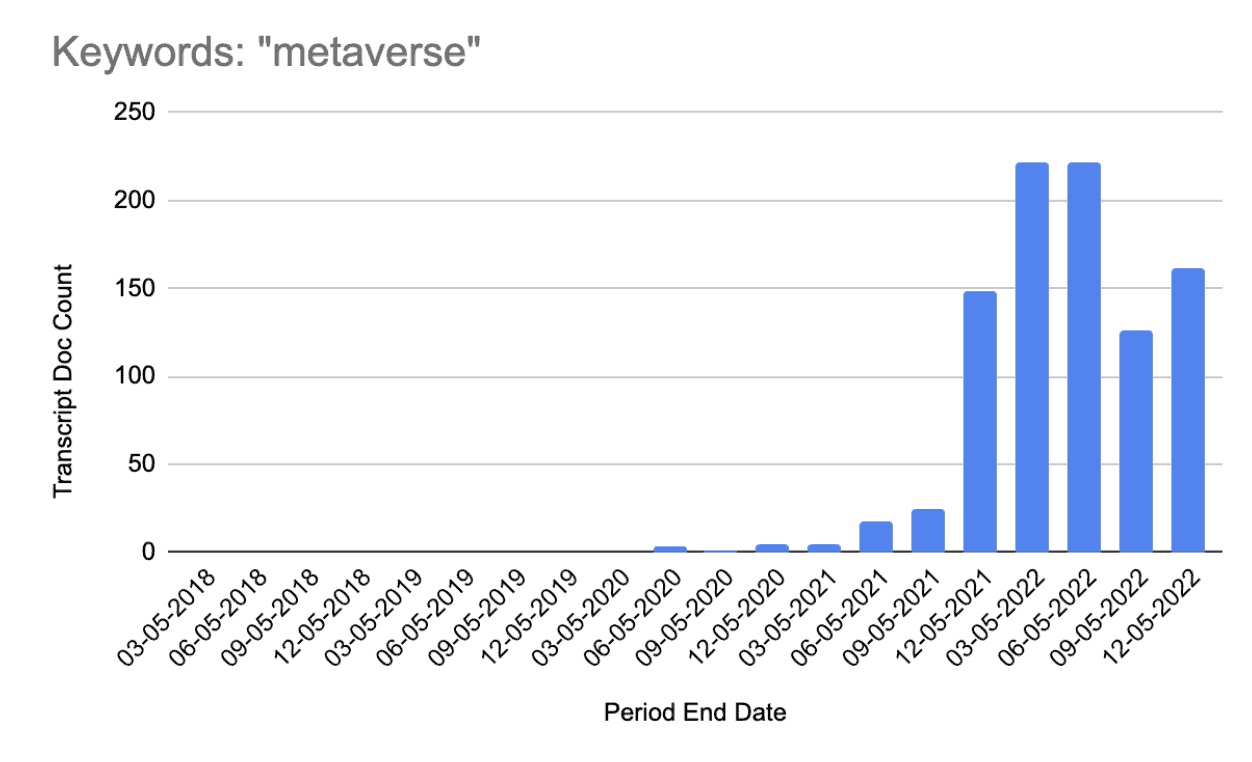

A Metaverse Future

One of the largest bets in technology currently is the success of the metaverse: the endeavor is so important that Facebook changed its name to Meta Platforms in late 2021.

“The last area that I want to discuss today is the metaverse. We just had our Connect conference and announced Quest Pro, which we just started shipping. It’s our new high-end VR headset that delivers high-resolution mixed reality so you can blend virtual objects into the physical environment around you. It’s pretty amazing when you see it, and it’s going to enable all kinds of new experiences and socializing, gaming, fitness and work.”

– Mark Zuckerberg, Meta Platforms, Inc., Founder, Chairman and CEO, October 2022 | Earnings Call

“The metaverse certainly isn’t an application that’s really blown up yet. That as a theory and as a platform for opportunity for all sorts of things, whether that’s gaming or another thing, I think is undeniable. At the moment there just isn’t that application that means that people are jumping into that environment. Personally, I think it’s still quite early and people should be cautious on the metaverse.”

– Activision, Former Commercial Director, UK and Ireland, November 2022 | Expert Call Transcript

Related Reading: Top 16 Metaverse Stocks to Watch

See the search results for “metaverse” within the AlphaSense platform

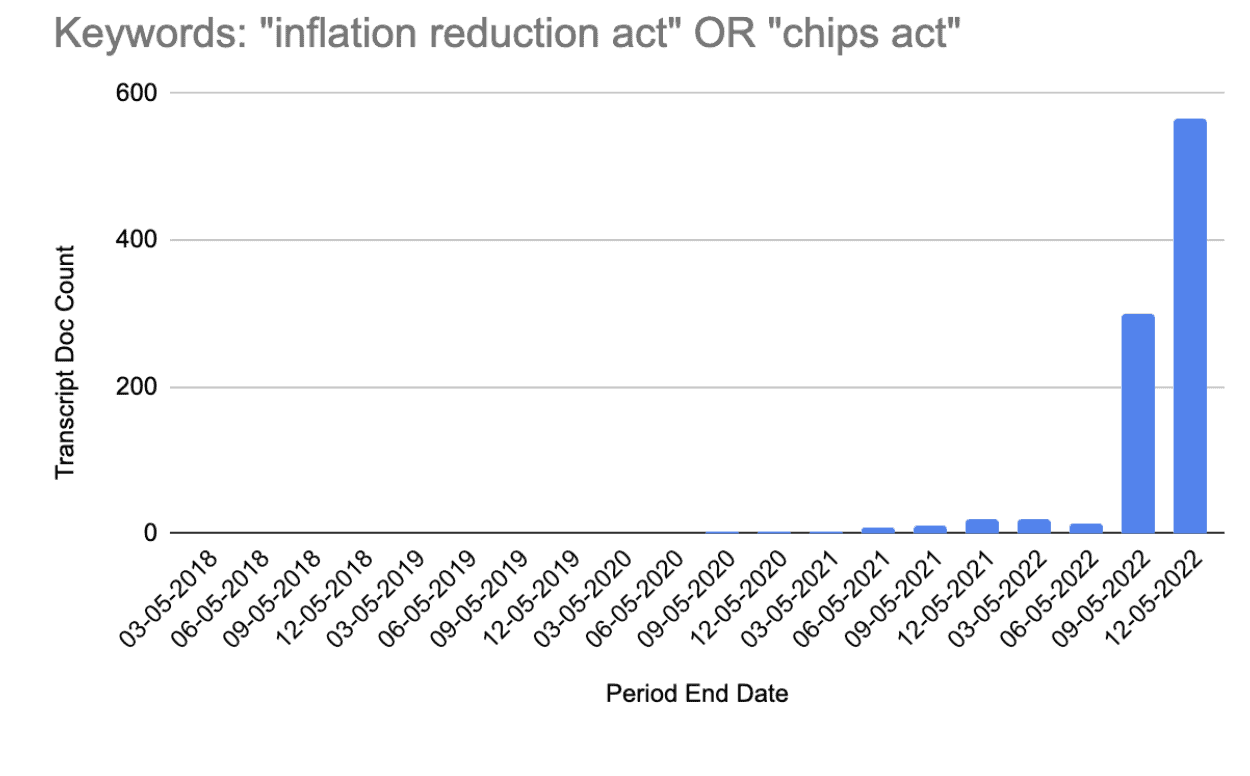

Inflation Reduction Act and CHIPS and Science Act

We’d be remiss to not cover two landmark pieces of US legislation, the Inflation Reduction Act (IRA) and the CHIPS and Science Act (CHIP Act). While the corporate sector has been parsing through implications of both acts, we have seen an increased level of global tensions arising from both. The semiconductor tensions between the US and China have escalated due to an export ban and a ban on US citizens working in the industry in China. The green subsidies in the IRA, on the other hand, have heightened tensions between the US and the EU.

Furthermore, to bolster the United States’ competitive standing in the semiconductor industry, President Biden issued an executive order in August. This order imposes targeted restrictions on specific U.S. investments in sensitive Chinese technology sectors while mandating government notification for funding in other tech domains, including semiconductors and microelectronics.

“And fourth, I just want to underline that there is a massive amount of opportunities in the market. We have seen a good ’22. And we continue to see a lot of programs the Inflation Reduction Act or the RePowerEU, which really foster the investment into energy infrastructure. And of this, we obviously want to benefit.”

– Christian Bruch, CEO, President and Chairman of Executive Board, Siemens Energy AG, November 2022 | Earnings Call

“There’s also the CHIPS Act in the U.S. that’s supposed to fund a lot of domestic semiconductor activities. It’s big, and it’s going to help a lot.”

– PrimeNano Inc., Current VP of Product Management, June 2022 | Expert Call Transcript

Related Reading: The CHIPS Act of 2022: How Are Nations Responding?

See the search results for “inflation reduction act” or “chips act” within the AlphaSense platform

Getting Ahead of Future Trends

With today’s volatile markets, research professionals need to prepare for the constantly shifting and evolving nature of conducting business today. Having access to a financial research platform that allows you to monitor and analyze trends ensures you make better-informed decisions and amplify your strategy to the next level.

For economic uncertainty, market volatility, and beyond, AlphaSense is a critical information source for managing these unique and challenging times. Don’t fall behind. Start your free trial today.

For even more on the top market-moving trends that will shape 2023, don’t miss our downloadable guide, 10 Market-Moving Trends to Shape 2023.