10 Market-Moving Trends to Shape 2023

Get the guide

Over the last three years, the COVID-19 pandemic brought new energy to manufacturing vaccines for a myriad of global diseases and health conditions.

New waves of virus cases and resulting death tolls were mostly predictable due to disease modelers being largely accurate–allowing everyone to, in some sense, know when a new wave was coming and its potential threat. But as new variants (i.e., Delta and Omicron) emerged, forecasting and preventing viral spread became an untenable goal.

Pharma C-Suite leaders are now asking: how will the world’s scientists defend against these new threats? The answer seems relatively simple: is relatively simple: vaccines and immunity from past infections. Today, major pharma companies like Johnson & Johnson, Pfizer, Roche, AbbVie, Novartis, and Merck & Co. are in a development and clinical trial race to see who can manufacture the next life-saving medicine first.

Moderna and BioTech, the pharmaceuticals companies behind the Moderna vaccines for the COVID-19 virus, just announced a new treatment this past December that would greatly reduce the chances of death from melanoma—stirring up substantial interest in investors to funnel capital.

Using the AlphaSense platform, we dug deep into new drug research and development areas that will likely shape the 2023 vaccine market.

Related Reading: The Evolution of Pharma Market Research

Moderna, BioTech, and Melanoma

It started with what scientists considered to be impossible this past December. Moderna Inc (MRNA.O) manufactured an experimental cancer vaccine based on the messenger RNA (mRNA) technology used in successful COVID-19 vaccines, which has been shown to work against melanoma—a.k.a. a potential cure for skin cancer. With the announcement, Moderna shares skyrocketed 20% higher, with biotechs working on similar treatments seeing similar market activity.

What’s in the miracle vaccine? A combination of Moderna’s personalized cancer vaccine and Merck & Co’s (MRK.N) blockbuster immunotherapy Keytruda, which actively cuts the risk of recurrence or death of the most lethal skin cancer.

The study published by Moderna supports their evidence: Merck and Moderna enrolled 157 people with stage 3 or 4 melanoma in the open-label phase 2b trial to receive either mRNA-4157 and Keytruda or the checkpoint inhibitor alone after complete surgical resection.

The combination of Keytruda and mRNA-4157 reduced the risk of recurrence or death by 44% compared to Keytruda alone. Industry leaders have hailed these findings as “the first demonstration of efficacy for an mRNA cancer treatment in a randomized clinical trial,” laying the groundwork to expand into other cancers, according to fiercebiotech.com.

Moderna shares were up nearly 23% at $202.80 shortly after the study was announced, while Merck’s shares rose 1%. Shares of BioNTech SE, which also has a successful mRNA vaccine technology, also saw an increase of 6%. Gritstone Bio Inc, which is developing a cancer vaccine, saw a 20% increase to $3.09.

Vaccine Market Growth

As drugs and clinical trials develop across the pharma industry, major investment firms and governments around the globe are funneling capital into vaccine manufacturers—effectively swelling the vaccines market growth to unprecedented levels.

In 2021, roughly 16 billion vaccine doses, worth US$141 billion, were administered—almost three times the 2019 market volume (5.8 billion) and nearly three-and-a-half times the 2019 market value (US$ 38 billion). COVID-19 vaccines accounted for the majority of the profits, which further illustrates the financial gains that can be made in providing a solution to a global health crisis.

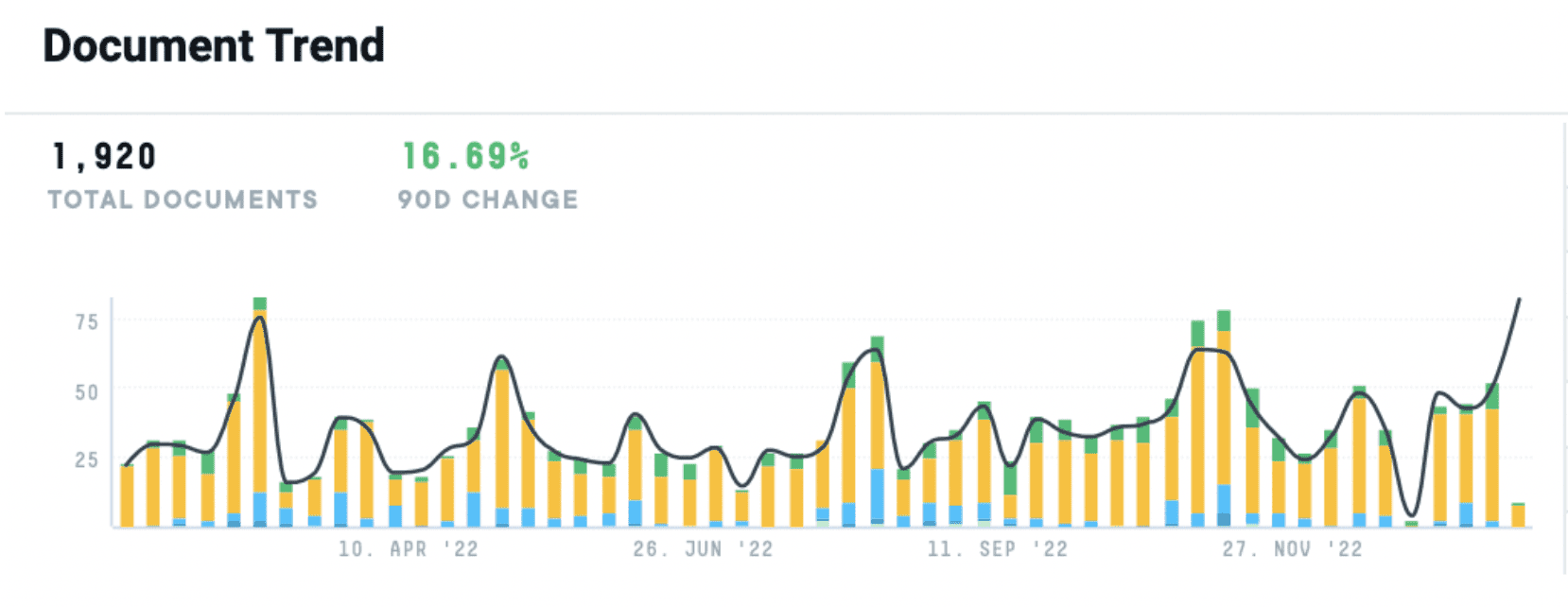

In the last twelve months, we’ve seen a nearly 17% increase in documentation discussing the “vaccine market” and how Pharma C-Suite leaders and manufacturers plan to enter or act in the market. And while vaccine manufacturing capacity worldwide has grown, it still remains highly concentrated.

In fact, only ten manufacturers provide 70% of vaccine doses (excluding COVID-19), and several of the top 20 most widely used vaccines (such as PCV, HPV, measles, and rubella-containing vaccines) currently depend on two suppliers.

The COVID-19 virus laid a precedent for how quickly a vaccine could be developed and distributed, as the process typically ranged from four to ten years. However, the global pandemic compressed the vaccine-manufacturing process to 11 months, again showing investors and pharma companies that vaccines are more than just a cash-cow commodity, but instead are a fundamental and cost-effective public good.

“As we turn to 2023, we anticipate that the COVID-19 vaccine market will start to shift toward a hybrid public-private market, with some geographies, namely the United States, likely shifting to a commercial contracting model in 2023. In the United States, we and our partner, Pfizer, expect the list price for a single dose vial of adult vaccine to be in the range of $110 to $130 per dose, reflecting both the cost-effectiveness and public health value of our vaccine.”

– BioNTech SE | Q3 2022 Earnings Call

Leaders in Vaccine Development

While some pharmaceutical manufacturers are strategizing and preparing for potential future diseases, most major vaccine developers are reprioritizing existing diseases and ailments.

The flu, RSV, and HPV seem to be top of mind for C-Suite leaders. All three have experienced an increasing number of cases over the past few months, especially in China, India, and countries within Asia Pacific where these diseases are seemingly ubiquitous.

Respiratory syncytial virus (RSV), human respiratory syncytial virus, is a common contagious virus that causes infections of the respiratory tract and is a major cause of respiratory illness in children. RSV manifested earlier and in significantly higher numbers at the outset of the 2022-2023 viral season, with hospitalizations climbing to a high of 4.9 per 100,000 in mid-November—a dramatic increase from last year’s mid-November hospitalization rate of 1.1 per 100,000. Drug developers are focusing on pediatric health, developing a respiratory franchise specifically for children:

“In addition, we are excited to share our development plans to build a leading respiratory vaccine franchise and establish a presence in the pediatric vaccine market in China and the Asia Pacific, which will further strengthen Clover’s competitive advantages and contribution to global health.”

– Clover Biopharmaceuticals, Ltd. | Press Release

“There’s a potential for a pediatric version. The idea from Moderna is to try to introduce it as a combination vaccine with flu and COVID. The idea there is that COVID, the flu is certainly an accepted vaccine to be real. I think there is a growing acceptance of COVID as a booster, and then RSV would be piled in to get people accustomed to the idea of immunizing against RSV. RSV does kill a lot of adults, it’s for real.”

– Former Senior Vice President of Moderna, Global Medical Affairs | Expert Call

Scientists are also discovering how to incorporate mRNA into various flu vaccines. This past January, Germany-based CureVac that it had conducted early-stage trials for its COVID-19 and seasonal flu shots, reporting good results for their products which use CureVac’s second-generation mRNA backbone. The small disclosure boosted CureVac’s shares by 17% to $7.49 Friday morning. While CureVac’s vaccine data has raised questions with investors, other manufacturers, like Pfizer, are still exploring mRNA’s involvement in a flu vaccine:

“Based on these preliminary data, the development of modified mRNA COVID-19 and flu vaccine candidates will be advanced to the next stage of clinical testing in 2023. “The positive results from this preliminary data analysis strongly validate the power of our proprietary mRNA-technology platform, opening the door to new opportunities in the development of effective prophylactic vaccines and also for the advancement of our robust oncology strategy.”

– CureVac N.V. | Press Release

“We have continued to advance potentially game-changing vaccines in the fight against respiratory disease by entering into a Phase III study for our mRNA flu vaccine candidate and initiating a Phase I study for a vaccine candidate that combines our mRNA flu and COVID-19 vaccine in one shot.”

– Pfizer | Q3 2022 Earnings Call

Nykode has also made news with VB10.16, the company’s cancer vaccine for the treatment of HPV16-induced malignancies. According to the World Health Organization, over 95% of cervical cancer cases are linked to infection with high-risk human papillomavirus (HPV). “While most HPV infections resolve spontaneously and cause no symptoms, persistent infections can cause cervical cancer in women.” In the Western Pacific Region, an estimated 145,700 women were diagnosed with cervical cancer in 2020, and 74,900 died from this largely preventable and curable disease.

“Today, we announce our expanded VB10.16 development plan underlining our confidence in the product candidate’s potential to treat a broad group of HPV-related cancer patients with significant unmet needs. These indications constitute a large potential market opportunity for Nykode.”

“The drug candidate has reported interim data from VB-C-02, a Phase 2 trial in heavily pre-treated cervical cancer patients. The analysis demonstrated a favorable safety profile, with responses observed in both PD-L1 positive and negative patients (ORR 27% and 17%, respectively). The vaccine-induced significant HPV16-specific T cell responses that were associated with clinical responses.”

– Nykode Therapeutics Asa | Press Release

Looking to the Future of Vaccines

As more vaccine manufacturers race to develop cancer- and disease-fighting vaccines that will serve to treat and preserve, investors and developers need reliable, quick market intelligence to stay at the forefront of their industry.

Not only is it imperative to have access to the drug developments and clinical trials of the pharma industry, you also need real time alerts on new developments and how your competitors are strategizing on movements in the market.

That’s why more C-Suite executives are implementing market intelligence platforms that leverage AI and automated features to quickly and confidently find the answers they need. The AlphaSense market intelligence and search platform provides this and more.

Curious to know how AlphaSense can help you find the industry information you need, even in the most unpredictable of times? Download our case study CI for a big Pharma Gains Foresight During Tumultuous Times to learn how CIs in big pharma are leveraging AlphaSense’s research and communication systems to keep on top of life science developments.

Start your free trial with AlphaSense today to see how our platform can help you filter through the noise, inform more confident decision-making, and make it easier to share market intelligence with your broader organization.