Achieving dependable and ongoing business growth can seem like a pretty big challenge, perhaps even impossible when the global business ecosystem is in a state of economic turbulence, with the threat of a major recession expected to hit in 2024.

McKinsey reports that about 25% of companies don’t grow at all, and between 2010 and 2019, only one out of every eight companies saw annual revenue growth of 10% or more.

Despite these daunting figures, McKinsey’s consultants affirm that every business can make a choice to grow, no matter what the economic or business conditions. One key factor that distinguishes businesses that grow from those that don’t is that growth-focused companies explore and invest in opportunities as they arise.

If you’re going to make fast and reliable decisions on what opportunities are worthy of pursuit, you need a framework in place to perform what’s known as an opportunity cost analysis.

In this sense, opportunity cost analysis is a vital, but often overlooked, tool for making informed business decisions. When you’re faced with multiple options but can only choose one, it’s easy to just wait until a decision is forced upon you. But doing nothing brings its own costs and disadvantages, which business leaders often downplay due to a sense of overwhelm.

Table of Contents:

- Foresight and formulas to make the right moves

- Determine what good looks like

- Get your timing right

- Expand your data

- Discover new possibilities

- Opportunity cost analysis isn’t an either/or affair

Foresight and formulas to make the right moves

Having the foresight to determine whether a strategic business opportunity is likely to be fruitful is what truly differentiates visionary stewardship from autopilot survivalism.

Neuroscience tells us that pain aversion is a more powerful motivator than the promise of potential success, but it’s only by performing an opportunity cost analysis that we’re able to decide which path ahead is most likely to be fruitful. At its core, opportunity cost analysis allows us to understand what we’re likely to lose by not taking action.

Could Blockbuster have known that streaming media subscriptions would replace physical media rentals? Could Polaroid have known that smartphone photography would replace self-developing film prints? If the right people at those companies had performed the right opportunity cost analyses at the right moments, then they might have been able to be first movers and staved off the historic eventual dominance of Netflix and Instagram.

Indeed, it’s vital to consider not just the risk of whatever course of action you follow, but also the benefits you could be missing from “the road not taken.” Opportunity cost analysis helps you to break through “analysis paralysis,” giving you a framework to compare the true costs and benefits of all the possibilities more thoroughly.

Opportunity cost is often expressed as this formula:

Opportunity cost = the forgone option (the returns expected on the option you’re not choosing) minus the chosen option (the returns expected on the option you are choosing).

This allows leaders to make active, informed decisions that don’t come through fear or inertia.

Imagine you’re choosing between investing funds in the stock market, or using funds to buy new equipment for your business. If you invest, you could see returns of 10% over the next ten years, and if you buy equipment, you could see returns of 8%.

Of course, to even get to the point where you can look at 10% versus 8%, you’ll need to do a whole lot of financial modeling, based on plenty of speculative projections, aimed at determining how your employees might manage without replacing that out-of-date office photocopy machine, for example. But once that’s all out of the way, the decision is pretty cut and dry, thanks to our formula, because 10% – 8% = an opportunity cost of 2% if you buy equipment, which means you’d lose money.

On the other hand, if the market investment would bring returns of 6%, you’d have an opportunity cost of -2%, which means you’d make money.

Here are a few things to keep in mind when using opportunity cost analysis to grow your business into 2024.

Determine what ‘good’ looks like

It’s virtually impossible to calculate opportunity cost until you know what a favorable outcome looks like. That generally means that you have to assign a dollar value to both the expected costs and expected benefits before you can complete the calculation.

You can’t do _that _unless you’re clear about your goals, both for the decision in front of you, and your business over the long term. Sure, we all want growth charts to look like a hockey stick, but on what scale, and according to what performance metrics?

This is where finding your own “North Star” can be especially helpful, as it puts all opportunity evaluations into proper context, forcing you to decide whether an opportunity is likely to bring everything you’re doing closer to that objective or if it might just be a distraction.

For example, imagine you’re an entrepreneur considering a number of different options for your proto-business. You need to know what you want your successful business to look like in five years’ time before you can choose the path that’s most likely to take you there.

Only once you know where you’re hopefully headed can opportunity cost analysis help you decide on each step to take you in the right direction.

Get your timing right

Opportunity cost analysis isn’t just about whether or not to add more equipment, open a new branch office, or invest in a particular direction. It’s also about identifying the best moment to make your move. You might have the best business strategy in the world, but that won’t help you much if you get your timing wrong.

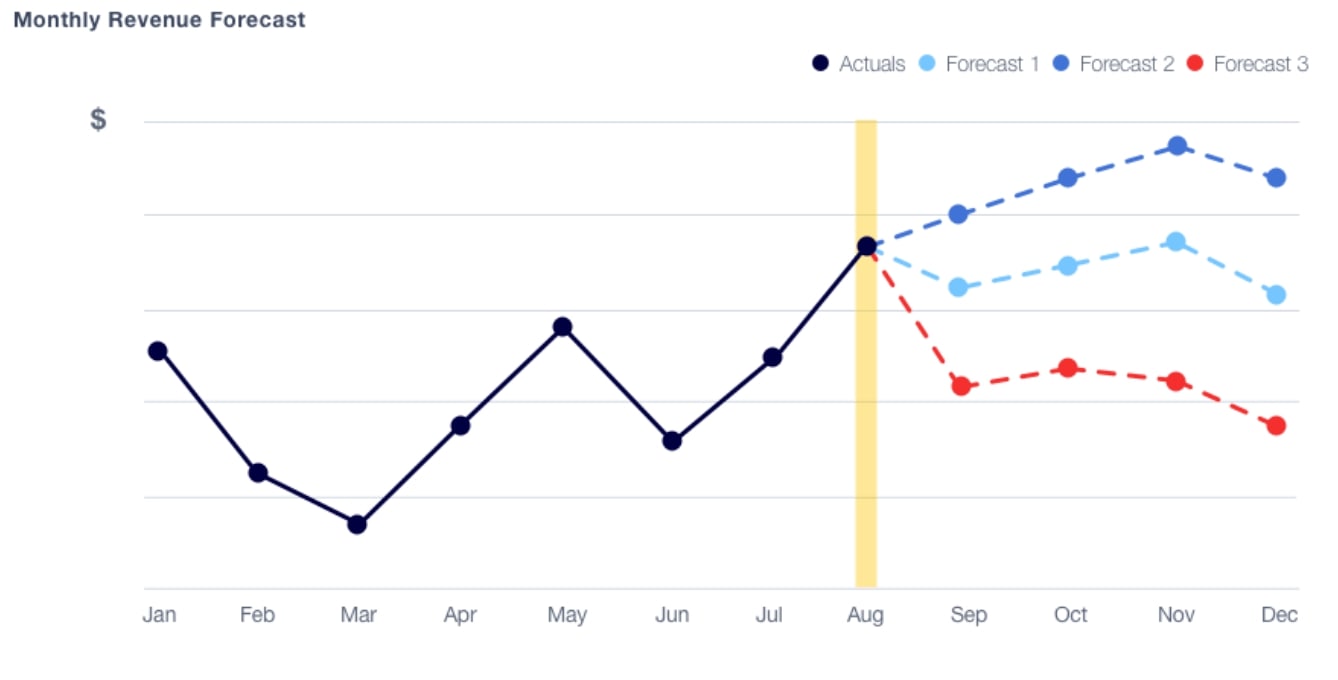

That’s why you need to be strategic about opportunity cost analysis. Repeat it on a regular basis and keep track of your results, so you can see how the business landscape and opportunity costs vary over time. With this information, you can seize the best moment in which to act.

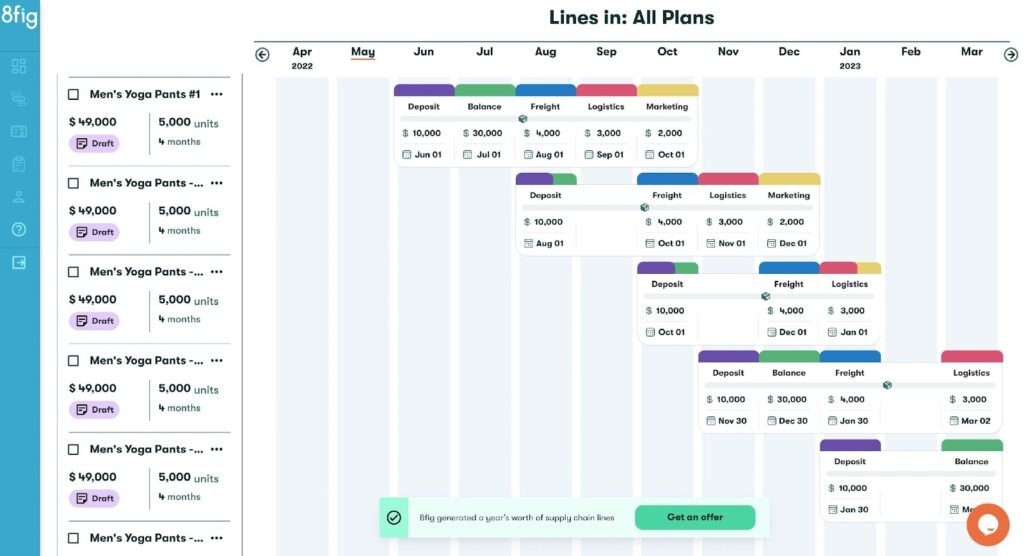

For example, ecommerce businesses can use 8fig’s supply chain planning tool to break their products down according to unit economics and understand what is happening with each one, also taking each product’s projected sales into consideration.

What product categories and specific product listings might incur hidden costs such as disproportionate return rates, inbound shipping costs or higher acquisition expenses? How are those figures likely to change over time? It’s only when you look holistically at everything which informs a given opportunity’s unit economics that you can make truly data-driven decisions about that opportunity.

By having a visual point of reference for each product line and its forecasted performance scenarios, analysis becomes simplified, leading business owners to make more profitable choices about which lines to pursue and which to drop – and to spot the optimum point at which to make each change.

Expand your data

Part of what makes opportunity cost analysis so challenging is, there’s no way to be 100% sure about how each option will play out. You have to project all potential outcomes, forecast financial impact as much as possible, and examine your assumptions.

Success entails bringing together masses of data, which could require improving your data pipelines and data gathering practices. The more data you draw on, the greater the chances that you’ll walk away with a clear decision about the best course of action.

Especially when we’re talking about evaluating opportunities that aren’t truly comparable to anything you’ve done before, pulling third-party data into the picture becomes all the more important. Anything from census and weather data to search volume, foot traffic or buyer intent data might be useful to your analyses, and there are many sources that offer this information as a service, either paid or for free.

As discussed above, it’s only once you’ve considered all the implications of a given decision that you can apply it to our handy opportunity cost analysis formula. To do this well, you might need to add a cloud data warehouse to unite all your data in a single repository, and/or upgrade business intelligence tools to include more automation, because there’s too much data for manual analytics.

For example, small businesses can use SolveXia’s no-code data automation and AI-powered data analytics to integrate most data sources and legacy data systems, making it easier to perform more complex projection-based analyses.

No matter what software connectors or data consolidation repository infrastructure you use, easy compiling and analysis is the name of the game. It’s only by blending your data sources that you can generate analyses that will serve you well, allowing you to break down silos and make informed decisions about opportunities quickly, as they arise.

Discover new possibilities

Opportunity cost analysis could open up new possibilities that you might not have thought of, so when you carry out this analysis, actively pursue every alternative, including what might seem like “crazy” ideas. You can only determine whether a given opportunity would be a mistake to ignore if you’ve entertained that opportunity as a real possibility.

This requires keeping tabs on what’s happening elsewhere in your niche market ecosystem, as well as how your customers are feeling about your brand and space. It also requires having mechanisms in place for brainstorming and discussing these ideas as they come up.

For example, you could invite your employees to brainstorm with you through an online collaborative space like Notion, using it as a sort of white board for fleshing out the concepts underlying an opportunity. Using a social listening tool like Mention is likewise helpful in this regard, as it allows you to stay in touch with what customers and potential customers are talking about.

The trend discovery and analysis platform Exploding Topics is also a game changer for spotting opportunities worth exploring. Have you been operating in the natural health supplements retail space for several years? Then you might not even be aware that sea moss gummies were introduced to the market in the past three years – let alone that people are searching for them, and talking about them on social media, at a noteworthy growth rate of 600%.

Exploding Topics allows you to search for insights on many industry terms, which you can search by keyword or browse by category tag. The platform also offers a highly valuable email newsletter, for curated discovery of emerging trends, including charts like the above, as well as short blurbs that put the trends into context.

Regardless of how you come to discover them, once you’re armed with these ideas, you can put all the possibilities through your opportunity cost analysis process. You might be surprised to see just how achievable – and maybe even profitable – your “crazy” idea can be.

Opportunity cost analysis isn’t an either/or affair

As you can see, opportunity cost analysis isn’t always easy, but it can be worth the effort for the sake of driving business growth. By ensuring you have all the data you need, opening up to more potential courses of action, repeating the analysis frequently, and starting off with clear business goals, you can propel your business towards ongoing growth, no matter what the economy is doing around you.