Read the 2022 State of Competitive Intelligence Report and you’ll find tons of encouraging insights:

- 33% of CI teams are making time for win/loss analysis on a monthly basis.

- 66% of growing CI teams plan to increase their investments in technology.

- 98% of stakeholders say CI is at least somewhat important to their success.

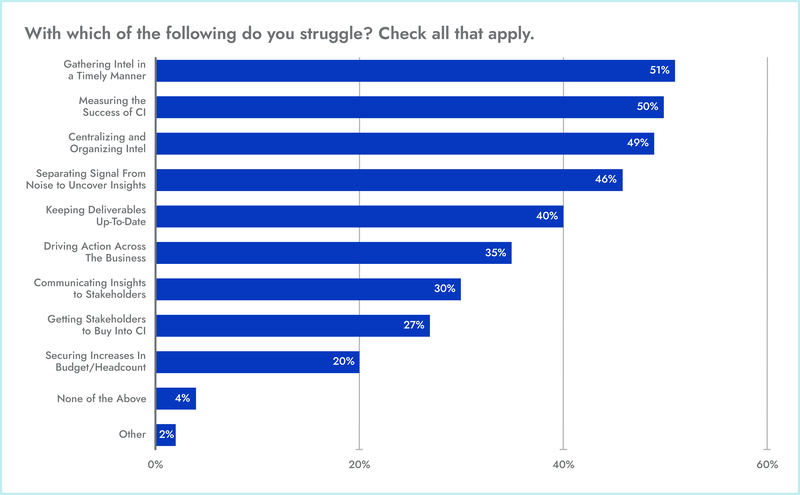

Alas, as evidenced by the report’s final chapter, the day-to-day life of a CI practitioner is not without its challenges:

To help you more effectively tackle the top three challenges—gathering intel in a timely manner, measuring the success of CI, and centralizing and organizing intel—I chatted with a few experts from around the B2B world. Keep reading to find out what they recommend.

1. Gathering intel in a timely manner

The upside of every company having a digital footprint is that every company can practice CI. (Before the internet came along, CI was neither feasible nor affordable for the vast majority of organizations). The downside is that the volume of information is completely overwhelming.

Here’s some advice from Andrew McCotter-Bicknell, Head of CI at ClickUp:

“Leverage your company. Create a culture of sharing and discussing intel with one another in your Slack channels, recurring meetings, etc.”

It’s true: Your colleagues are often the best source of intel. For those of you who are regularly sending a competitive newsletter (highly recommended), one way to implement Andrew’s advice is to spotlight your top intel contributors. Who wouldn’t want to get a company-wide shout-out?

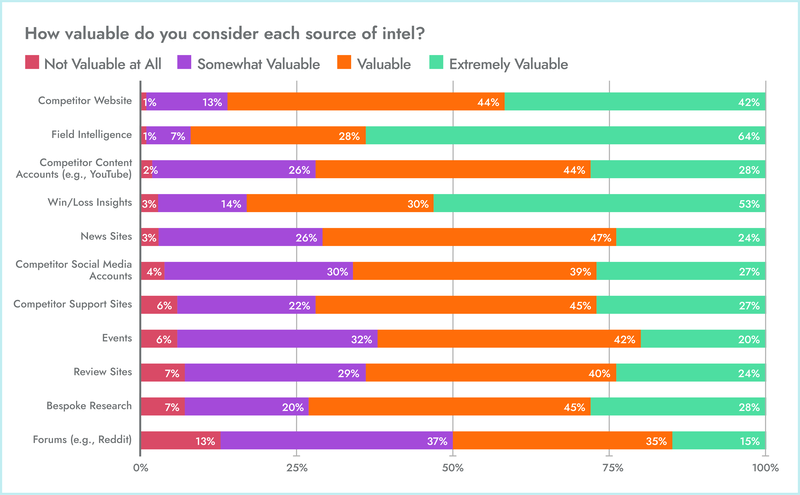

Two-thirds of CI practitioners say coworker-sourced intel (a.k.a., field intel) is extremely valuable.

When I spoke with Aaron Stillman, Director of Storytelling at AB Tasty, he also mentioned field intel—but that wasn’t all:

“With or without budget, you can establish an endless supply of data: Google alerts, Gong recordings, your colleagues, newsletters, Slack communities, etc. To avoid sensory overload, train your mind to recognize the keywords and topics that demand immediate attention.”

Is there a specific feature area that typically makes or breaks deals between you and a certain competitor? Or perhaps a specific industry in which you and this competitor are both striving to become ubiquitous? Asking yourself questions along these lines will make it easier to execute on Aaron’s recommendation—to quickly identify the pieces of intel that are actually worth your time.

2. Measuring the success of CI

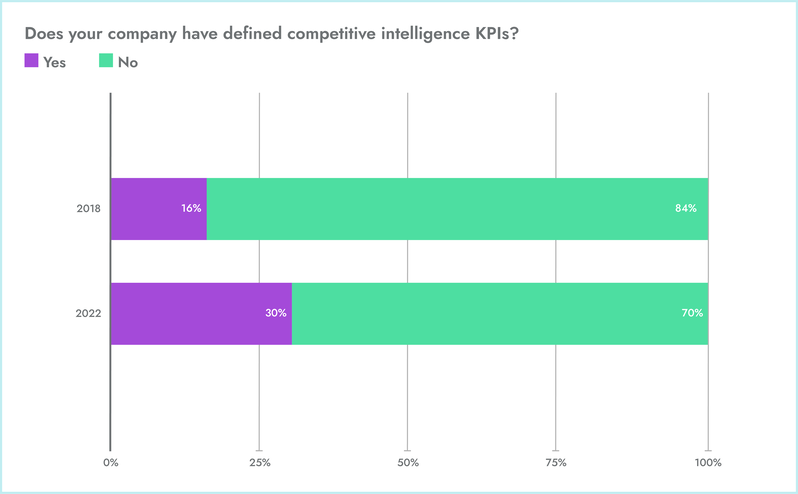

Given the progress we’re making, it’s clear that CI will one day be comparable to marketing: not quite a hard science, but nonetheless supported by a set of widely recognized metrics. Just look at the data: Since 2018, we’ve seen an 88% increase in the number of CI teams using KPIs.

If you’re ready to join the party, here are some words of wisdom from Andrew:

“In addition to tracking competitive win rate in Salesforce, you can easily poll sales team confidence on a recurring basis. Use a simple Google Form to ask questions like, ‘On a scale from 1 to 10, how confident are you when you’re up against Competitor X?’"

Jess Evans, Product Marketing Manager at Lokalise, endorses a similar approach:

“I recently surveyed my sales team on two questions: (1) ‘How much do you know about the competition?’ and (2) ‘How confident do you feel against the competition?’ I split this by roles when looking at the results—AEs are likely going to feel more confident about the competition than SDRs do.”

Connecting the dots is key here. By combining poll results with metrics like competitive frequency, competitive win rate, and influenced revenue, you can get a clear picture of where you’re driving the most impact and where additional support is most needed.

Aaron echoed this point and then took it a step further, saying:

“Asset utilization, in conjunction with reporting on win rate vs. competitive win rate, is a great way to understand if the materials being developed are making an impact. Another measure of success is the influence that market intelligence has on your company’s overall strategy and product roadmap.”

Although you don’t need to quantify everything—again, CI is not a hard science—time to market is a useful KPI when you’re trying to assess the impact you’ve had on the product roadmap. If, after incorporating CI into their ideation and decision-making processes, your PM team starts shipping features faster, it’s fair to say that your contribution is a positive one.

3. Centralizing & organizing intel

Obviously, there’s no point in trying to measure your impact until you’ve taken concrete steps to actually make an impact. And no matter which stakeholder audience you’re serving, perhaps the most important step is taking the intel you’ve collected and turning it into something—a positioning statement, a battlecard, etc.—that’s easy to access, understand, and use.

Here’s Andrew:

“Invest in a CMS like Seismic and build out a proper folder for CI. It’s not the most affordable route, but it keeps assets up-to-date and puts them next to other assets that teams need to stay educated and win deals. We can’t force people to go out of their way to find CI. We have to put it right in front of them or within their existing workflows.”

Proving that great competitive minds think alike, here’s Aaron:

“Put yourself in the shoes of the consumer, understand their workflow, and take steps to bring visibility throughout their workflow to make it as easy as possible for the intelligence to be leveraged. Tools such as Seva offer knowledge management solutions that can make it very easy for stakeholders to find information using a commonly shared vernacular.”

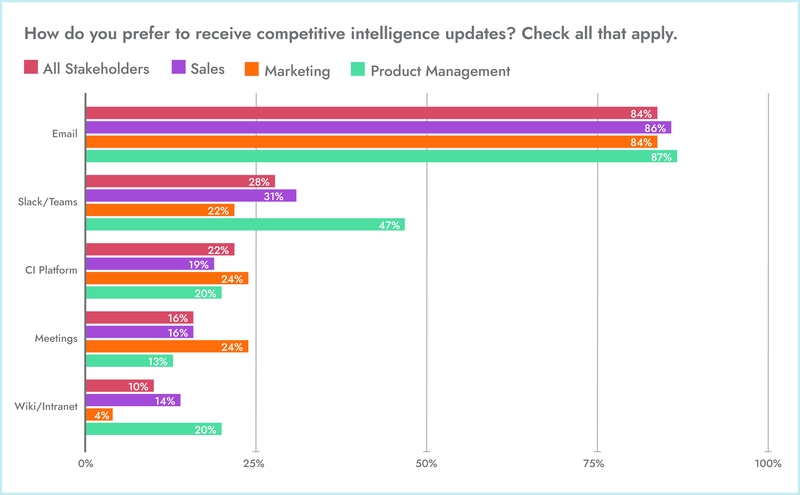

The main takeaway here is that you need to connect with your stakeholders and uncover their unique preferences. We also asked the stakeholders who participated in the State of CI survey to tell us about their preferences, and this is what we found:

Get all the insights from the CI industry’s largest and longest-running survey series

Believe it or not, this blog post has only scratched the surface of what you’ll find in the 2022 State of Competitive Intelligence Report. Click the banner below to get your free copy and learn all about the ways in which companies are supporting, practicing, and measuring CI!

Related Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World