The Digital Shopper & the Evolving Retail Landscape

How has retail changed in the past few years? While there are multiple right answers to this question, the most obvious one is the shoppers. Retail shoppers have changed dramatically. They have changed how they shop, where they shop, when they shop, or for how much (price) they shop. There are over 2.14 billion digital shoppers today. From being local shoppers loyal to 1-2 stores in their locality to being global shoppers with access to millions of online stores, these digital shoppers today have more power than they ever did before. Power to access data from multiple channels, power to compare products and prices, power to choose from a variety of similar options, and power to shop whenever and wherever.

Shopper demographics have changed too. Millennials and Gen Z shoppers form a large portion (85%) of online shoppers and also influence shopping decisions made by their parents/elders. They are tech-savvy, informed, and make use of the data they have at their disposal. They are increasingly disloyal to brands and make decisions heavily influenced by price.

These shoppers know the purchasing power they hold and have very high expectations. Traditional retail can no longer pacify their expectations. Retail businesses have to evolve to cater to these new-age shoppers. They need to curate assortments, prices, and experiences that resonate with shoppers by leveraging digital buying signals that shoppers leave behind at every stage of their buying journey.

Read More : 2024 Retail Trends & Shopper Expectations to Watch Out For

And what are these digital buying signals?

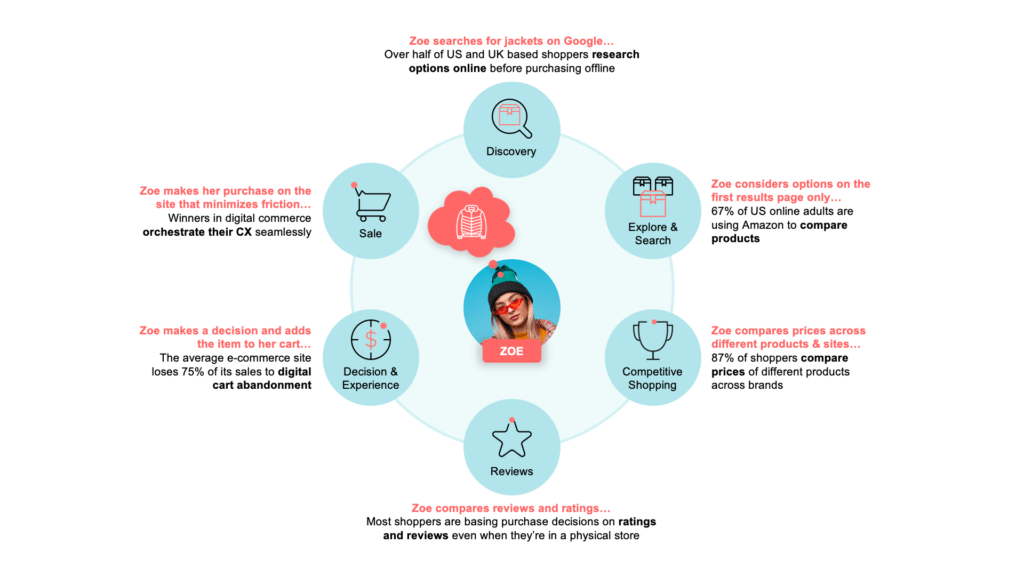

Across the eCommerce landscape, there are digital breadcrumbs that are critical signals of shopper preferences, trends, willingness to pay, and more. These breadcrumbs track the entire buying journey of a shopper – from the discovery stage (searching for a product on Google or marketplaces like Amazon) to the consideration stage (visiting different websites to compare products and prices) and finally the decision-making stage (reading online reviews and ratings to make a purchase decision) – and everything in between. Together these form the digital buying signals.

Consider an example of a modern-day, tech-savvy, channel-agnostic Millennial shopper wanting to purchase a jacket:

- Like most shoppers her age, she starts her buying journey by searching for ‘Jackets’ on Google or Amazon. This is the search and discovery phase.

- She considers options on the first results page only.

- She checks if the desired product is in-stock, variants of the in-stock products which probably look better to her, private-label alternatives that are cheaper but suit her needs, and so on before moving to the consideration stage.

- She then compares prices across different products and websites. This is the consideration stage. (87% of shoppers compare prices of different products across brands)

- As she moves closer to the decision stage, she compares reviews and ratings for the products she has shortlisted. (More than half (53%) of shoppers consider retail websites to be the most trustworthy source of reviews)

- She then makes a decision and adds the jacket to her shopping cart. (The average eCommerce site loses 75% of its sales to digital cart abandonment)

- She completes the purchase on the website that minimizes friction and doesn’t have hidden costs. (90% of shoppers will shop more and at a higher frequency online if given free shipping.)

During her buying journey, she leaves behind her preferences in the form of digital buying signals and is likely to spend more time on a website that has one or more of the following:

1. The desired item in stock

2. Alternatives, if the item is out of stock

3. Variants of the in-stock item that may suit the requirement better

4. Private label alternatives

5. Best paired-with items

6. The most competitive prices for the item and its alternatives

7. Genuine reviews and ratings of the products

While the merchandiser is comparing only the lead SKU, the shopper is comparing a wider consideration set, which is why similar matching becomes critical. Our approach gathers intelligence around the products that shoppers are comparing you against.

Additionally, according to Forrester, a shopper considers price, quality, availability, speed of delivery, and convenience while making the purchase decision. These broad influencers translate into a host of digital buying signals that a shopper leaves behind. E.g.

Digital Buying Signals

| Reviewing & Comparing Prices | Analyzing Product Quality | Ensuring Product / Assortment Availability | Delivery & Convenience |

| Product page price | Ratings & reviews | Share of shelf visibility | Delivery fee |

| Cart level price | Product descriptions | In-stock/out-of-stock products | Delivery time |

| Post-discount price | Product images | Hyperlocal availability | Cart level charges |

| Price of the variants | Units left in stock | Pick-up in-store (BOPIS) | |

| Price of similar alternatives | Availability of best-selling products | ||

| Price of private label alternatives |

Out of these 17 odd signals left behind by the shoppers in their buying journey, retailers and brands today track only about 20% of them by using the inside-out approach and miss out on all the remaining ones. Thereby losing out on consumers’ consideration basket which eventually results in lost sales.

Also read : How to Classify, Match Product With Machine Learning

In order to capture and act upon a larger % of these digital buying signals, at a bare minimum, retailers should look at exact as well as similar matches of their SKUs assortment + similar items to best selling/top of the page SKUs that are exclusive to the competition, i.e. exact + similar matching.

Best-in-class Product Matching is at the foundation of our data intelligence. We continuously and dynamically gather critical outside-in signals across the eCommerce landscape.

With Intelligence Node, brands and retailers can capture Outside-In data that helps influence digital GTM strategies

How will brands and retailers benefit from digital buying signals?

With access to multiple data points across the eCommerce ecosystem, retail businesses will be privy to all the data that shoppers are looking at. They will be able to compare their product prices, product descriptions and images, digital shelf visibility, stock availability, and MAP violations with the exact competitor products and with similar products that their shoppers are reviewing in the consideration stage. With this information in their arsenal, they will be able to identify gaps, align product descriptions and prices with shopper expectations, ensure stock availability of trending products, maximize their share of shelf, and offer the best experience to their shoppers. This in turn will lead to increased consumer retention, improved conversions and market share, and brand loyalty.