The Olympic podium. Bookish teens jockeying for valedictorian. The couples on the cusp of a $50K payday on British reality TV phenomenon Love Island. There is nothing more fundamentally human than competition (except perhaps the desire to win).

Understanding the competitive landscape in which you operate is a key driver of overall business strategy. And, of course, knowing who you’re actually competing against is the most imperative part of said strategy.

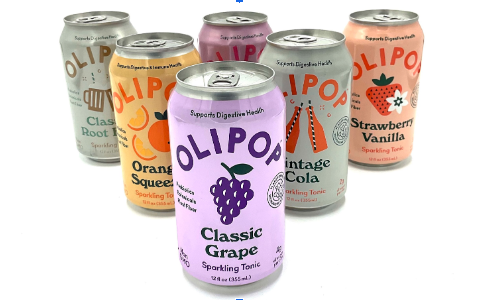

Consider Olipop, the effervescent darling of gut health enthusiasts nation-wide.

Yes, they sell “soda” (and it ain't half bad!). But to call Coke or Pepsi their direct competition would be a gross misreading of both ideal customer and market capitalization. Instead, narrowing scope to focus on, say, design-forward sparkling CBD drink Recess and is-it-juice-or-is-it-seltzer Spindrift would surface more actionable market insights that could be leveraged to win new customers and create a sustainable competitive advantage.

Focusing on how to take down entrenched industry powerhouses when you’re new on the scene may look noble, but nine times out of ten it’s the fast track to a resume refresh. There simply aren’t enough hours in the day to waste precious resources on aspirational competitors.

Enter the concept of direct and indirect competition, a mode of competitive analysis that can help you sort competitors into those businesses that sell similar products at a comparable price to the same ideal customer, from everybody else. Then, by determining which businesses represent your direct competition, you can establish a cohort of competitors on which to focus your CI efforts.

Pretty cool, right?

Let’s get into it.

What is competitor tracking?

It’s a noun and a verb mashed together to form a novel concept.

More specifically (that’s probably what you’re here for, right?), competitor tracking refers to the process of identifying, sorting, and monitoring the businesses that make up your competitive landscape.

- Identify: Who are your competitors?

- Sort: For each competitor you identify, ask yourself what kind of competitor they are. Direct? Indirect? Aspirational? We’ll go into more detail on how to categorize the competition later.

- Monitoring: Once you’ve effectively identified and categorized the competition, it’s time to gather competitive intelligence. What that actually looks like will be dictated by the category into which a given competitor has been sorted.

Performed in concert, the three distinct activities that make up competitor tracking should arm you with the intel you need to build a sustainable business advantage.

Competitor Monitoring Vs Competitor Tracking

Unlike competitive analysis and competitive intelligence , competitor monitoring and competitor tracking are synonymous.

Competitor Monitoring: Your Biggest Questions Answered

Before we can start breaking your competitive landscape into direct and indirect competitors, you need to understand why competitor monitoring matters and the best practices that will make it a valuable, ongoing exercise for your business.

Why is it important to track your competitors?

Because competitor monitoring can have a massive impact on the success of your business.

Basically, it allows you to:

Shine a light on competitors’ vulnerabilities: The press release that Competitor X published announcing changes in the c-suite. The feature that Competitor Y is about to sunset. The price increase Competitor Z just rolled out. Competitor tracking allows you to see (and leverage) the good, the bad, and the ugly.

So that you can:

Operate your business more strategically: Informing your product roadmap with data-backed decisions — focusing on features that address customer needs your competitors aren’t meeting — is a great way to turn market gaps into market share.

… which makes competitor monitoring the key to becoming a market leader.

How many competitors should you keep track of?

There isn’t a one-size-fits-all answer here: You might have one competitor. You might have 100. But the number you actively track totally depends on your market and your available resources.

Let’s say you’re the newest small-business focused all-in-one CRM solution on the scene (good luck 😅). The competitive landscape looks something like this:

Simply looking at the reality you find yourself in might be enough to make you consider niching down further, focusing your solution on a particular vertical in which the competition is less, well, everywhere. Regardless, it would be utterly impossible for you to track key CI across a dozen competitors. As such, you need to prioritize.

That’s why we recommend a tiered approach to competitor tracking.

A tiered approach, really?

100%.

Consider the following. You’ve identified five competitors (A, B, C, D, and E, respectively). Last quarter, your sales reps noticed an uptick in deals lost when Competitor B was mentioned by the prospect. Competitor D just decided to move up-market. Competitors A, C, and E haven’t really changed much in the last two quarters.

From a competitor monitoring standpoint, all are not created equal.

When it comes to B, you need deep intelligence: release notes, new website pages, trend anomaly detection. Literally any data that will help you understand their strengths, weaknesses, and priorities, and empower stakeholders across your organization to make decisions and execute accordingly.

When it comes to the rest of them, you need high-level intelligence: news mentions, press releases, tweets — just enough to ensure that you’re aware of potentially disruptive developments, but not so much that you’re distracted by companies that don’t impact your business and drowning in meaningless noise.

So while four of the five businesses are “direct” competitors (and our friends over at D could move back downstream at any moment), if we further divide them into the following categories:

- Primary: Competitor B

- Secondary: Competitor A, Competitor C, Competitor E

- Tertiary: Competitor D

We can better allocate resources to have a more profound impact on business outcomes.

A non-tiered approach — in our case, going at Competitors A, C, D and E with the same zealous gusto we brought to Competitor B — would result in a lot of work, even more noise, and little to no strategic value. A full-blown competitive analysis is probably overkill for those secondary and tertiary competitors. But a cadence of quarterly or annual reassessment will ensure you’re allocating CI resources appropriately.

How do you keep track of competitors?

Seriously though. Our award-winning CI platform will help you identify and prioritize your rivals, capturing and curating key intel — on their website, from all over the internet, and what your team gathers in the field — to help you crush the competition.

4 Types of Competitors to Watch Out For

While there are many ways to sort your competitive landscape, the most common starting point is to determine whether each competitor represents a “direct” or “indirect” competitive threat to your business.

#1: Direct Competitors

Direct competitors are the ones that keep you up at night. These are the businesses your reps are constantly losing deals to, the ones your product team perpetually finds themselves adjusting the definition of “table stakes” for when it comes to feature development.

As such, they should be the primary target of your competitor monitoring efforts.

How do you identify direct competitors?

Direct competitors offer:

- Similar products and/or services

- To the same customers

- At the same price point.

When evaluating a solution, these are the competitors your prospects will compare you to. The ones that show up in your G2 matrix. They might even represent solutions your prospects are currently using.

Direct Competitor Examples

Instagram and TikTok.

Hello Fresh and Blue Apron.

The Shell and Sunoco stations inexplicably located across the street from one another by Fenway.

Direct competition can be seen everywhere, from multinational corporations to small local businesses. Even startups on the bleeding edge of a newly minted industry face competition. Nobody is immune to its pressures.

#2: Indirect Competitors

Whereas direct competitors have a propensity to become thorns in your side, indirect competitors just kinda exist in your periphery (for now). As a result, they tend to require less active monitoring. Of course, that can change at any time.

How do you identify indirect competitors?

Indirect competitors:

- Sell different products and/or services

- To the same customer

(Note that price may or may not be a factor of comparison; if you offer a DIY SaaS solution and an indirect competitor has a pure service offering, there’s no apples-to-apples comparison here).

Put more succinctly, indirect competitors offer a different product that addresses a similar need for the same consumer. If you’re a niche accounting firm, they’re Turbotax. At the end of the day, an indirect competitor has the ability to meet the same needs (in this case, taxes filed mistake-free and in a timely fashion) as you, but they do so in a way that ensures they aren’t popping up head-to-head in sales conversations.

Indirect Competitor Examples

This is a fun one.

Peloton and Soulcycle are indirect competitors.

One sells an at-home spin bike, the other offers in-studio classes. Same customer, different solution. And yet despite that fact, upon recognizing two key shifts in the market (negative sentiment towards Peloton plus a desire to return to in-person human interaction after two years of relative isolation), Soulcycle launched this campaign that overtly attempts to take customers from an indirect competitor:

“Miss the studio? Give us your Peloton, we’ll give you classes.” It wouldn’t have made sense in late 2020, when Peloton was ubiquitous; today, however, because of competitor monitoring, Soulcycle was able to identify an opportunity. It’s a simple, powerful campaign that might resonate with customers but, more importantly, serves as an insanely powerful brand message.

This is why monitoring your indirect competitors matters!

#3: Perceived Competitors

Perceived competitors are a particular type of indirect competitor.

These are competitors that you don’t necessarily see as competitors—because your products are totally different—but this one isn’t about you. The perception we care about here is that of your prospects.

This perception may be the result of poor messaging, a wholesale lack of brand familiarity, or a simple mistake (when I was at WordStream, a martech platform, the number of early-stage prospects who told us “they were all set, they used Wordpress,” would shock you).

If perceived competitors come up at all, it’s typically on the very front end of the sales cycle (think “response to an early BDR touchpoint,” not “Q+A at the end of a pitch”) and they can be dealt with rather easily by simply stating why your solution and their solution are actually quite different, because you’re here to help the prospect with X, whereas the perceived competitor is focused on Y. Heck, it may even be a nice opportunity for your reps to flex their glowing personalities with a nice pun. You do you.

#4: Aspirational Competitors

Like perceived competitors, aspirational competitors are an offshoot of the indirect competitor designation. In fact, they might be extremely indirect.

Aspirational competitors are leading companies in the broader industry that can inspire marketing opportunities. These are companies that you admire in regards to their marketing or management practices. You might have similar philosophies, but you aren’t competing for the same prospects.

When HubSpot first came to market, they might have viewed Salesforce as an aspirational competitor. They both offered CRM solutions, albeit at vastly different price point and, therefore, different ideal customers

Of course, this is no longer the case. As HubSpot matured, and their product suite grew, they surged upstream; today, the two often compete for deals.

Keeping an eye towards aspirational competitors can help guide your business; while you aren’t going to sink the same level of resources into them as you would, say, the competitor your team lost a dozen deals to last quarter, they’re worthy of high-level monitoring.

Direct vs Indirect Competitors

Maybe it’s obvious to you, but in some cases, the line between direct and indirect competition is paved with nuance. The ability to articulate which is which will ensure you aren’t conducting top-tier competitor monitoring for businesses that don’t impact your bottom line.

How, then, do you determine whether a competitor is direct or indirect?

Well, “you” don’t.

Your stakeholders will make the decision for you. Who comes up frequently in your opportunities? Who doesn’t? Don’t waste your time on companies that aren’t threatening your market share.

If you’re looking to narrow your focus, a great way to uncover your most pernicious direct competitors is to examine competitors that prospects mention on sales calls with a tool like Gong.

By observing the sheer volume of a given competitor’s mentions present in your Gong transcripts (and, of course, competitive win rate in these deals), you can determine how much of a threat a given competitor actually represents, and adjust your monitoring efforts accordingly.

How Crayon's Tiered Approach to Competitor Monitoring Reveals Actionable Insights

It doesn’t matter how broad or narrow your competitive landscape ends up: Competitor tracking is an ongoing battle. Your intelligence gathering and the resultant collateral are dynamic, constantly evolving with the market.

As such, even if you manage to develop a rigorous, tiered approach, gathering intel around your most significant direct competitors and turning it into something stakeholders across your organization can leverage is a time-consuming process.

By continuously capturing and prioritizing data across your competitive landscape, Crayon will take your competitor monitoring to the next level.

.jpg)

Related Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World