Since the onset of the COVID-19 pandemic, the world continues to face a global energy crisis that has forced international leaders to reexamine how they’re fueling their countries.

Price increases in oil, gas, and electricity (further propelled by the Russia-Ukraine War) have led to nations shelling out historic sums of capital and even dipping into their own energy reserves to meet demands—a reality that, if perpetuated, will lead to financial collapse for a handful of global economies.

To combat rising prices and develop domestic energy resources, the US and President Biden’s administration has taken proactive legislative measures with the Inflation Reduction Act, which includes tax incentives for fostering a robust solar industry (i.e., the White House aims to triple domestic solar manufacturing by 2024).

Many are seeing the Act as a direct response to claims that the US depends too heavily on Chinese exportations of solar power panels—China being the world’s leading exporter of solar cells. Last year, China exported 3.201 billion solar cells, up 17.56% year-on-year, with an export value of US$28.460 billion, up 43.79% year-on-year, according to research sourced in the AlphaSense platform.

And while the Act’s incentives have already drawn in new business from international companies (South Korean Conglomerate Hanwha Group and their $2.5 billion investment) to establish solar manufacturing power supply chains, a myriad of hindrances are slowing Biden’s plan for a more eco–conscious powered country.

Below, we dive into the key forces behind developing solar power supply chains within the US, the nation’s major roadblocks towards becoming an energy-independent country, and how nations worldwide are following suit.

Inflation Reduction Act

This past August, President Biden enacted the most significant legislation for the renewable energy movement in nearly two decades: the Inflation Reduction Act (IRA).

Through the Act, the federal government will provide tax incentives of up to $369 billion for new solar, wind, thermal, and energy storage devices over the next decade. The groundbreaking legislation comes after US solar manufacturers argued that the nation could depend on 40% of its electricity from solar energy by 2035 with the help of Congress.

If they passed clean energy funding and solar manufacturing tax credits, in the long run, these credits would create an entirely domestic solar supply chain producing 100 percent American-made panels. Domestic solar panel manufacturers would shield Americans from a similar fate they experienced this past summer: gas prices in the US rose an incredible 44.1% between July 2021 and July 2022.

Escalating prices of energy have put immense pressure on the Biden administration to actively invest in less costly, reliable forms of energy—solar power being the answer. In July, President Biden unveiled efforts to provide low-income residents with solar power—a move that could allow communities to shut out of an expensive, fast-growing market for renewable power to reduce their utility bills.

The Act will do more than just provide economic relief but also create new economic opportunities.

According to an analysis commissioned by the BlueGreen Alliance from the Political Economy Research Institute (PERI) at the University of Massachusetts Amherst finds that the ”more than 100 climate, energy, and environmental investments in the Inflation Reduction Act will create more than 9 million good jobs over the next decade—an average of nearly 1 million jobs each year.” The bill’s broad investments will also help sustain the millions of existing jobs in the clean economy.

Already, President Biden’s Act is generating interest. South Korea’s Hanwha Group has announced plans to build a $2.5 billion solar-manufacturing supply chain in Georgia, the largest solar investment to take advantage of the US’s massive tax incentives.

Under Qcells, the conglomerate would build new facilities in the Atlanta region that would manufacture 3.3 gigawatts of solar panels a year—enough to supply around 18% of the estimated US demand in 2022. Qcells would also manufacture almost every single component required of solar panels, including solar cells, ingots, and wafers, on-site—otherwise, items not currently manufactured in the US.

Experts are expecting an influx of national and international interest looking to take advantage of Biden’s energy incentives, setting the stage for a lucrative future for energy investors:

“Certainly, now I think with the passing of the Inflation Reduction Act, my anticipation would be that the strong incentives that are in that bill for building solar power plants will really supercharge the industry and that we’re going to see a very dramatic continuation and growth of the deployment of solar technology in the United States.”

– Former Data Scientist Expects Acceleration in US Installation | Expert Call

China’s Role in Solar Power Manufacturing

The global adoption of solar power is due largely to China’s low energy and labor costs. By leveraging a combination of cheap coal, heavy Chinese government subsidies that allow solar panels to be sold in foreign markets, and the use of forced “slavery”-like labor conditions, prices for solar panels have come down about 75% in the past decade.

While China claims that automation accounts for a large portion of the price, there is a lack of evidence that these Chinese factories have made such improvements. However, the Chinese government has admitted to operating “surplus labor” programs that relocate millions of residents in Xinjiang to work in these factories, supposedly without coercive tactics, Chinese officials claim.

This uncertainty around whether ethical working standards are being practiced in China’s Xinjiang region has led to the solar industry experiencing disruptions as US officials crack down on human rights abuses, which produce almost half the world’s supply of a crucial component in solar panels. Some of China’s largest solar-panel suppliers have had shipments to the US detained or sent back due to the Uyghur Forced Labor Prevention Act (UFLPA).

According to the US Customs and Border Protection, UFLPA establishes a “rebuttable presumption that the importation of any goods, wares, articles and merchandise mined, produced, or manufactured wholly or in part in the Xinjiang Uyghur Autonomous Region of the People’s Republic of China, or produced by certain entities, is prohibited” and “that such goods, wares, articles, and merchandise are not entitled to entry to the United States.”

UFLPA presumes that all items produced in China’s western region of Xinjiang are made with forced labor and block companies from importing such products.

But how exactly does the UFLPA affect establishing solar power supply chains in the US?

A survey produced this past April by the Solar Energy Industries Association, a non-profit trade association, revealed that 318 solar projects within the US have experienced delays or were entirely canceled—a number that’s only grown over the past few months. However, industry leaders believe that if no resolution is found, UFLPA could also have a devastating impact on the solar workforce.

“As we experienced during the second quarter, it remains challenging for our renewables customers to finalize contracts and schedule projects as the solar panel supply chain learns how to work through the new UFLPA importation requirements. UFLPA went into effect in June, and the industry expects to see more efficiency, reliability, and scale with the importation process in the first half of 2023.”

– FTC Solar Inc. | Q3 2022 Earnings Call

“While our suppliers were able to provide the CBP sufficient documentation to meet WRO compliance requirements, and we expect the same will be true for UFLPA purposes, we cannot currently predict what, if any, impact the UFLPA will have on the overall supply of solar panels into the United States and the related timing and cost of solar projects included in our capital plan.”

– WEC Energy Group Inc. | 10Q

Driving Global Competition

Broker research suggests that trade tensions and competition will continue to rise globally as polysilicon, a high-purity form of silicon that serves as an essential material component in the solar photovoltaic (PV) manufacturing industry, has been a focus amid rising trade tensions between China and the US/Europe.

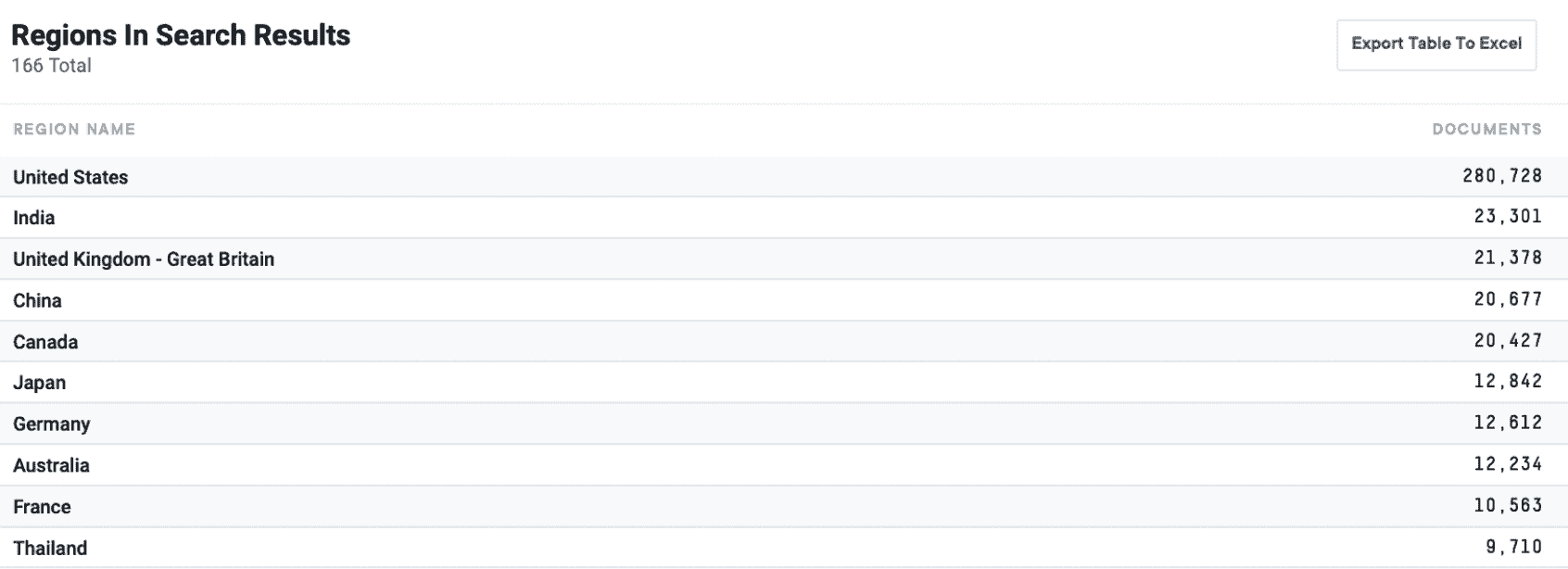

While brokers believe that the US is heavily enforcing legislation tied to UFLPA, they expect the pressure of this massive supply chain issue to eventually diminish. As global solar competition is rising, with the US, Europe, and India enacting their own policies to promote domestic solar production, they note that their production scale remains small.

Caption: While the US leads conversations on solar power within AlphaSense, a growing number of international corporations are exploring solar power as an energy alternative.

What does the future look like for the global market of solar power manufacturing?

As investments continue to pour into industry growth, experts are forecasting 6.9% CAGR growth during the forecast period of 2021 to 2028—projecting an evaluation of USD 293.18 billion by 2028. It’s a massive leap from the global solar energy market’s evaluation of $52.5 billion in 2018.

Staying Ahead of the Energy Market

Monitoring, reacting, and strategizing market movements within the energy industry is no easy feat.

It can be a full-time job that requires constantly digesting an inundation of published information and sorting through which insights to act on in a timely manner. That’s why more industry leaders are adopting market intelligence platforms like AlphaSense, which helps you cut through the noise and take action on lucrative business opportunities.

Sign up for your free trial today to learn how AlphaSense can keep you ahead of your competition.

Don’t miss our Global Supply Chain Outlook Report, in which we cover the current state and potential outlook for Oil & Gas, Automotive & Manufacturing, and Aerospace & Defense industries.