Hybrid Tables, Incremental Refresh and Table Partitioning in Power BI

Paul Turnley

DECEMBER 27, 2021

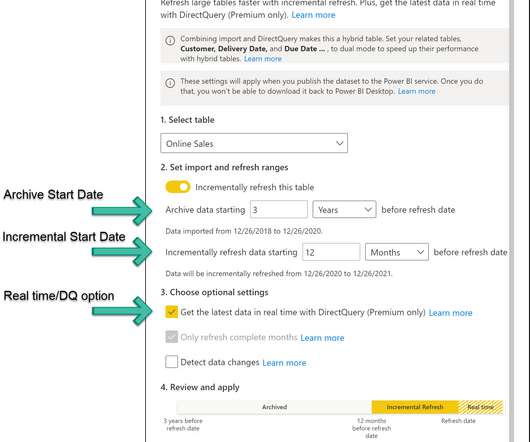

The December 2021 Power BI Desktop update introduced a long-awaited upgrade to the partitioning and Incremental Refresh feature set. The update introduces Hybrid Tables, a new Premium feature that combines the advantages of in-memory Import Mode storage with real-time DirectQuery data access; this is a big step forward for large model management and real-time analytic reporting.

Let's personalize your content