6 Top Competitor Analysis Tools for Funding Research

Competitive intelligence allows your company to analyze and track information related to your competition. The goal of competitive intelligence is to empower your business. Competitive intelligence enables your sales and marketing teams to differentiate your business from competitors.

Below are some of the tools we use in competitor research for our customers to analyze competitors and understand what they are doing and what they plan to do next. Let's take a closer look at six of the top competitive intelligence tools used for funding information.

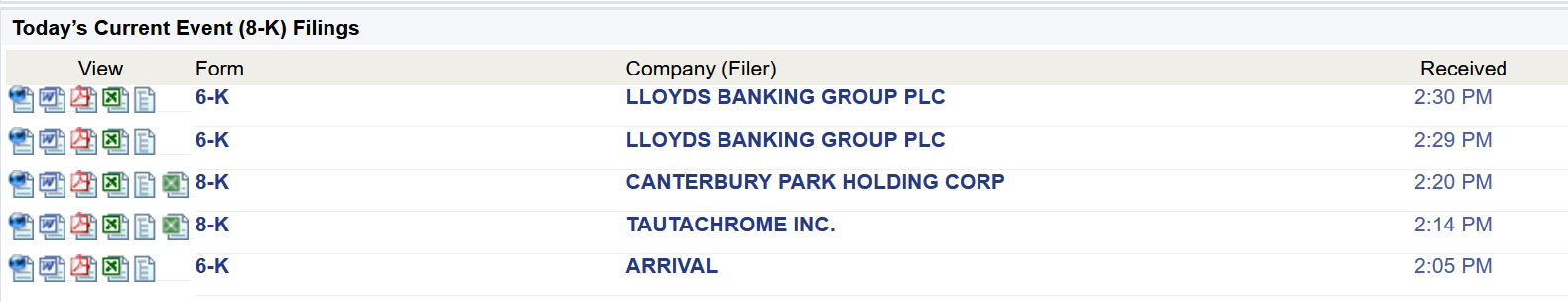

1. EDGAR IPOs

The EDGAR IPO database is a great source of IPO information This website is designed specifically for professionals in the financial industry who need to access real-time SEC filing information that is conveniently located in one place. SEC filings are published in easy-to-comprehend formats. The service includes:

SEC filing information

Quarterly and annual statements

Annual reports

Event-driven disclosures

Insider trading

Shareholder information

IPO/ISO data

Text and graphics

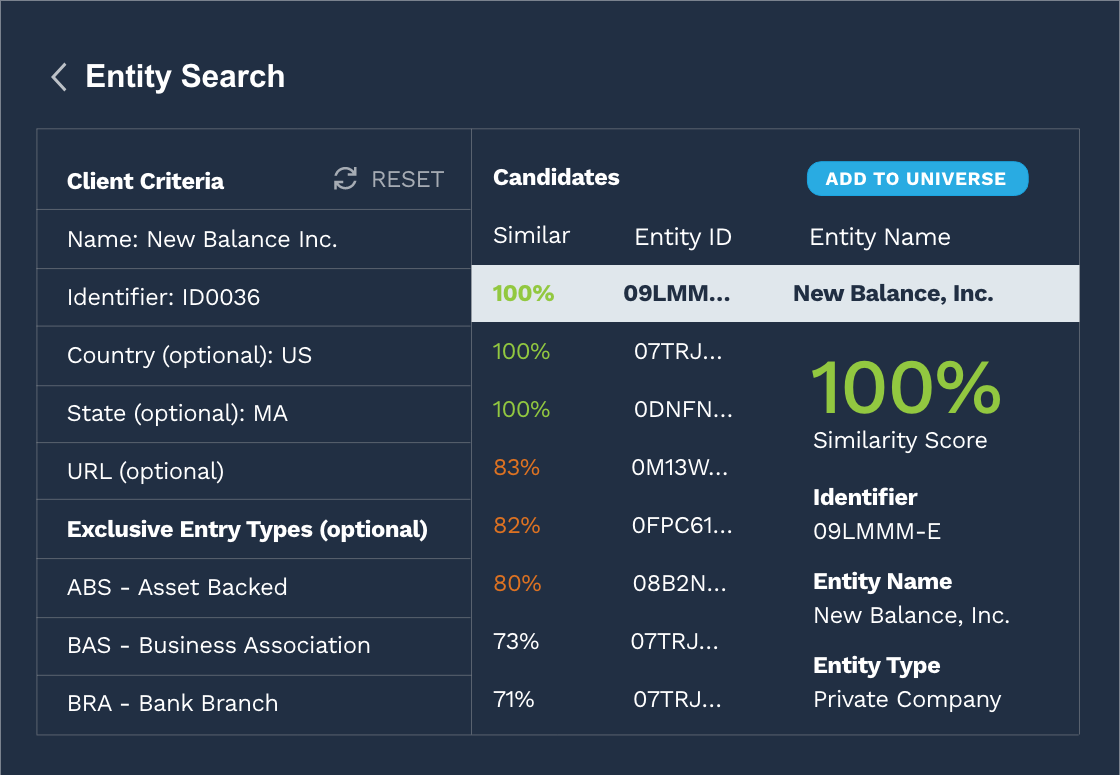

2. Factset

Factset has over one hundred third-party and forty proprietary datasets, accessible via a number of different options. Factset also has AI tools and machine learning helping you to discover signals and access the right information. Around 200K people use Factset to access financial data. As with many of the tools here, clients are mainly financial institutions, but there’s no reason why other companies cannot use these services. Some of Factset’s popular platform products include:

Factset workstation

Advisor dashboard

Portfolio analytics

Data exploration

Fixed-income portfolio analytics

3. IPO Monitor

IPO Monitor offers services to financial businesses that are grouped into seven categories.

Lifecycle Events

Filings: businesses will file a financial statement with the SEC, making this the first step to going public and introducing the company into the IPO Monitor’s database.

IPO Calendar: this lists the companies that have scheduled their IPO pricing and will begin trading in a public market.

Withdrawals: companies who have withdrawn their statement from the SEC

Pricing: companies who have priced their IPO

Aftermarket: pricing performance of a company’s stock

Email Alerts

Pricing alert: real-time alerts when pricing is announced

DailyReport: daily summary of pricings, recent filings, and news articles

IPO Calendar: a list of IPOs that have expected pricing

Aftermarket report: an aftermarket report that has one hundred of the most recent pricings

Weekly Wrap-up: a weekly summary of the “lifecycle events”

Proprietary Reports

Best & Worst: gives a list of the best and worst performing IPOs

Underwriter Reports

Industry Funding

Lock-up Periods

Quiet Periods

Hot IPOs

Search Tools

Basic: search by company name or a stock symbol

Full-text: search the text sections of a business profile

Custom Performance Reports

This allows subscribers to generate an aftermarket performance report around pricing, industry segment of SIC code, securities type, underwriting type and geographic region

IPO Company Profile

Each company has its own separate webpage in the database. When conducting competitor analysis, this is one of the best ways to gain basic information about a competing company.

4. MarketIQ

MarketIQ is another database of financial information, particularly focused on deals. Features include:

International deals database

Quick search option to search company information

Advanced search with customizable search criteria, data views, extraction, export to PDF files

5. The Deal

The Deal website gives deal makers and advisors a range of tools including league tables, special reports, alerts, people coverage, company databases, articles, and newsletters.

The Deal is one of the leading sources of competitive intelligence around corporate deals.

6. Zephyr

The Zephyr company databases have historical detail, comparables and multiple original documents. Zephyr publishes company financials, deal histories and corporate structures. Features include:

Searching via hundreds of criteria

Detailed competitor analysis on sets of deals

Easy-to-read graphs

Customizable alerts

Deal league tables

Zephyr provides data for 4M+ companies worldwide.

Wrapping it up

We hope after reading this article that you've gained a better understanding of how competitive intelligence tools can help with finding funding information. With plenty of competitive intelligence tools available, it’s essential to select the most appropriate ones. Our list of the top six competitive intelligence tools covers everything from shareholder information to international deals databases, to produce the strongest competitor analysis.