Competitive intelligence (CI) is the process of capturing, analyzing, and activating information related to your competitive landscape. Done right, CI empowers everyone at your organization to make decisions more confidently and execute responsibilities more effectively.

Before we go any further, a note for those of you who prefer to watch rather than read: Everything covered in this blog post is also covered in this video!

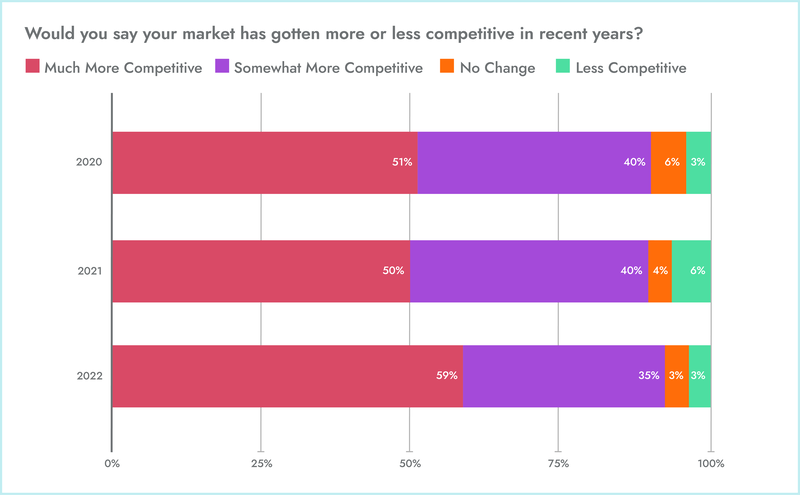

In recent years, technology has had a transformative impact on CI—in more ways than one. First of all, the advent of cloud deployment has made it easier than ever to launch a product, leading to the rapid intensification of competition:

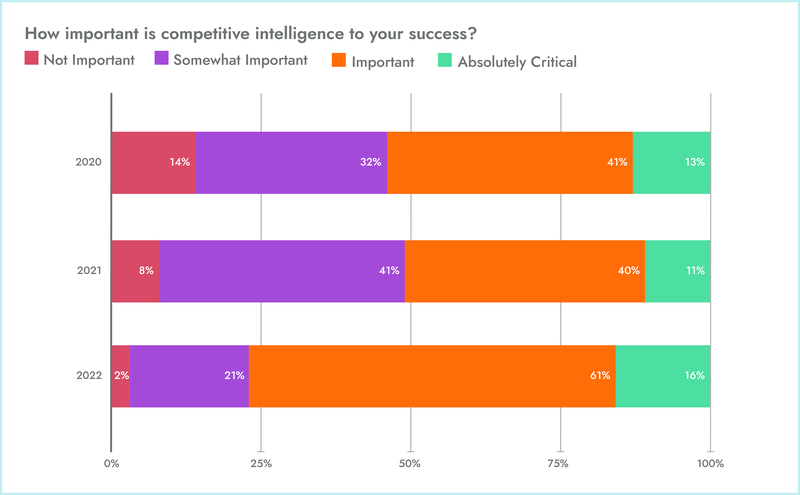

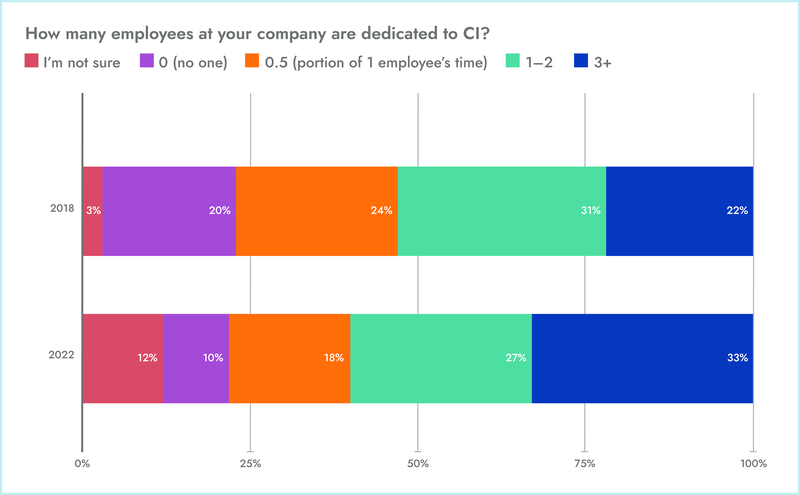

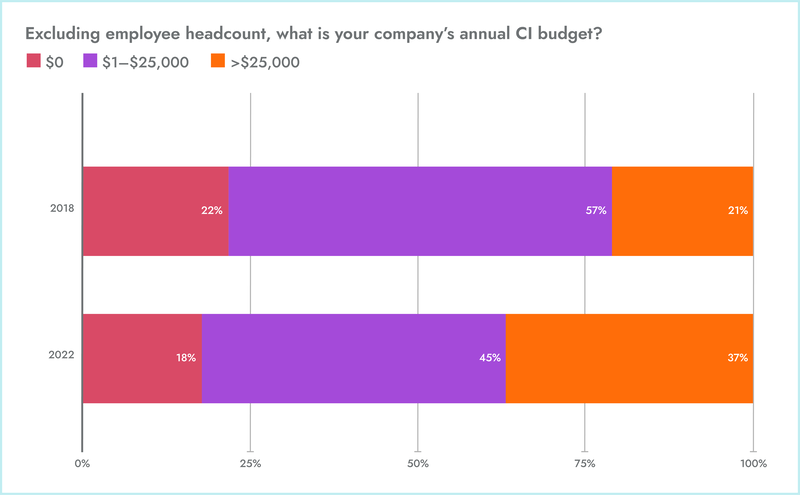

All data referenced in this blog post is via the 2022 State of CI Report.

And of course, as competition intensifies, so, too, does the need for CI:

So, how have companies responded to this change? By investing further in CI, of course! Since 2018, we’ve seen a 50% increase in the number of CI teams with 3 or more practitioners …

… and a 76% increase in the number of CI teams with budgets greater than $25,000:

Now, as we alluded to earlier, there is a second way in which technology has helped to transform CI in recent years—but before we get to that, we need to cover more of our bases.

By the end of this blog post, you’ll have an answer to each of the following five questions (you can use the hyperlinks to toggle between sections):

- What is my competitive landscape?

- What is the role of competitive intelligence?

- What are the components of the competitive intelligence process?

- How can I start building a competitive intelligence program?

- How do competitive intelligence teams measure their impact?

Here we go.

What is my competitive landscape?

You may have noticed that our definition of CI concluded not with “... information related to your competitors,” but rather “... information related to your competitive landscape.”

What does that mean?

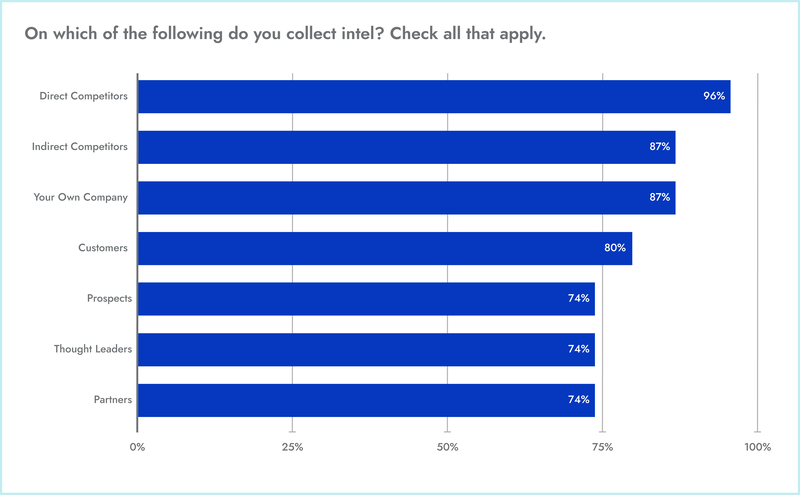

Your competitive landscape encompasses every entity that has the potential to impact your business. This includes not only direct and indirect competitors, but also partners, thought leaders, regulators, suppliers, prospects, customers, industry organizations, and so on.

The breadth of this definition speaks to the predictive power of CI. By capturing, analyzing, and activating information across the entirety of your competitive landscape, you can help your company both understand what’s happening today and prepare for what will happen tomorrow.

Learn more: How to Create a Competitive Matrix (Examples + Templates)

What is the role of competitive intelligence?

Like we said earlier: Done right, CI empowers everyone at your organization to make decisions more confidently and execute responsibilities more effectively.

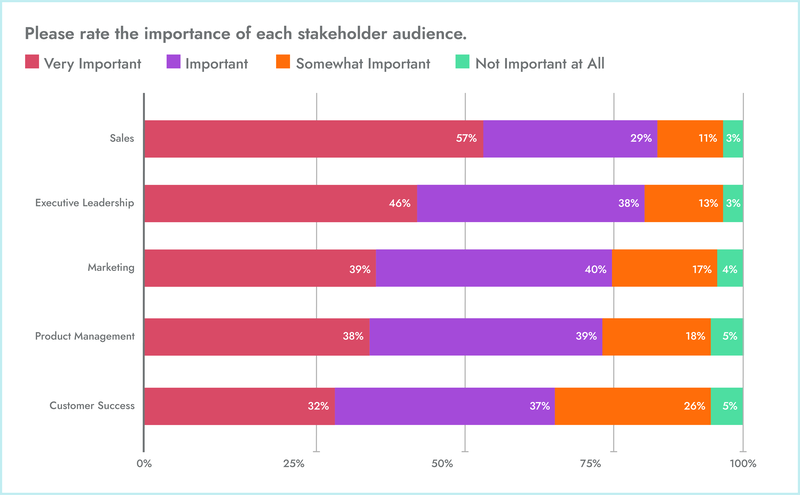

Let’s get a bit more specific. CI empowers:

- Product managers to more efficiently set and execute roadmap priorities

- Product marketers to develop differentiated positioning and messaging

- Brand marketers to develop differentiated narratives, campaigns, experiences, etc.

- Sellers to navigate the high-pressure moments that make/break net new opportunities

- Account managers to navigate the high-pressure moments that make/break renewals

- Corporate strategists to identify opportunities for partnerships, acquisitions, etc.

- HR managers to attract and retain top talent

- Executive leaders to more efficiently allocate resources

We could keep going, but you get the idea—when we say everyone, we mean everyone.

One key takeaway here is that the role of CI is both tactical and strategic. Whereas some folks need CI to do tasks (e.g., addressing a competitive objection), others need it to make plans (e.g., breaking into a new vertical).

Learn more: Who Uses Competitive Intelligence?

What are the components of the competitive intelligence process?

CI is a three-part process: research, analysis, activation. Many folks (including everyone at Crayon) consider measurement to be the fourth component, but for the sake of consistency and clarity, we can think of measurement as a subset of activation.

Research

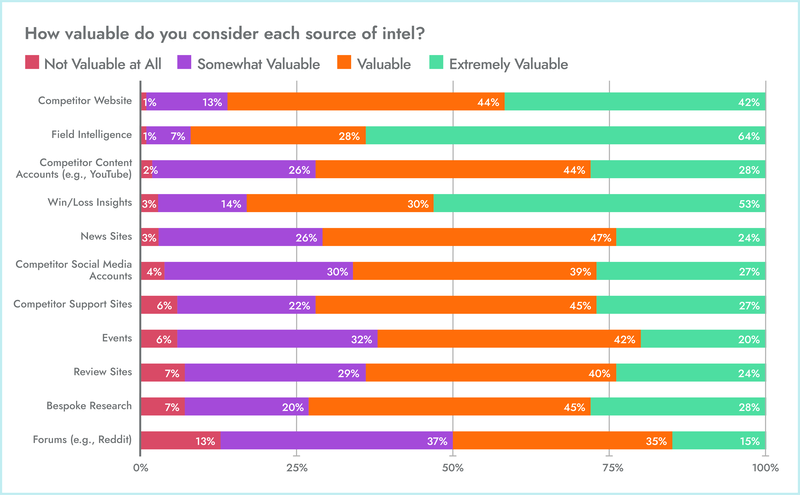

The research phase is where you collect intel. More specifically:

- Primary research refers to the collection of intel via interviews with employees, prospects, customers, etc.

- Secondary research refers to the collection of intel via sources such as competitors’ websites, third-party review platforms, SEC filings, etc.

An important note on which we’ll expand in the next section: Competitive research, both primary and secondary, is only productive when it’s done with a specific goal (or set of goals) in mind.

Analysis

The analysis phase is where you synthesize intel and extract meaning—where you “connect the dots,” so to speak.

As an example, let’s say your goal is to help your sellers win more deals—specifically by differentiating your email marketing tool from that of Competitor X. In the research phase, you collected reviews of Competitor X’s tool from G2 as well as win/loss notes from your CRM.

You notice a pattern: The most common cause of frustration across this competitor’s customer base is the inability to create multi-touch campaigns. And sure enough, your win/loss data reveals that, when your sellers do beat this competitor, it’s often because of this functionality.

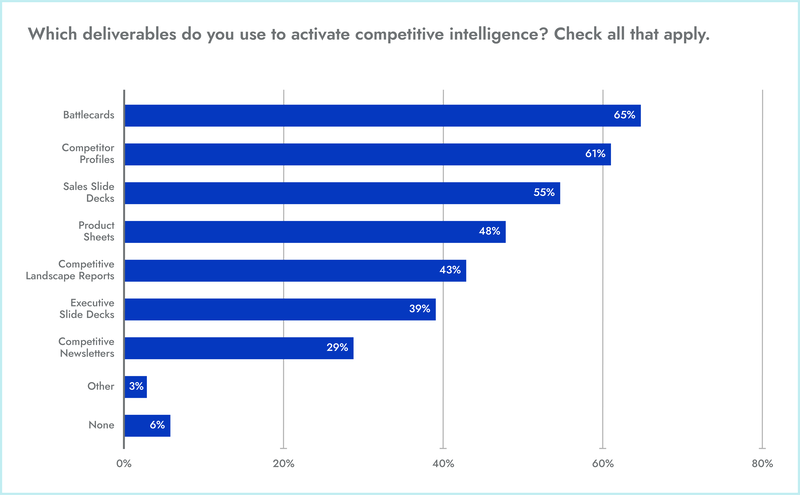

Activation

The activation phase is the most crucial of all—this is where you make your findings actionable for the stakeholders to whom they’re relevant.

There are several ways you could activate the findings from our example. You could:

- Update your Competitor X battlecard to include your newly discovered differentiator

- Train your sellers to lean on this differentiator in discovery calls and demos

- Partner with your content team to create new materials related to multi-touch campaigns

Another important note on which we’ll expand in the next section: A small group of trusted cross-functional partners can provide “gut checks” and help to ensure that the insights and deliverables you create are accurate and relevant.

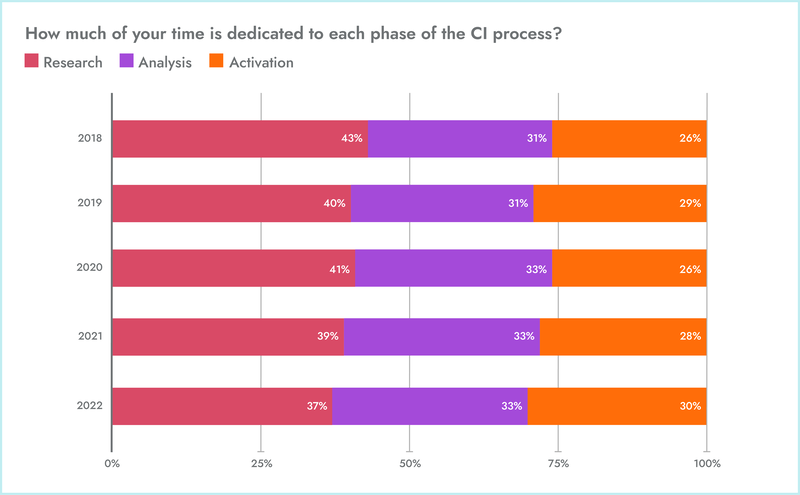

In recent years, we’ve observed that teams are gradually spending more time in this phase of the CI process. This is the second major change that we alluded to in the introduction: With the help of automation, CI teams are shifting time away from (secondary) research and towards activation:

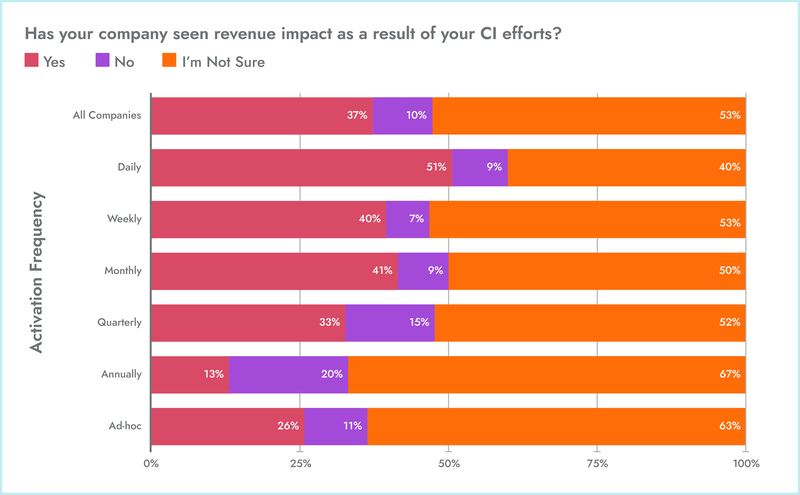

The importance of this shift cannot be overstated, as activation is closely correlated with revenue. Compared to teams that activate intel on an ad-hoc basis, those that activate on a daily basis are twice as likely to say their work has directly impacted their companies’ bottom lines:

That being said, revenue isn’t the only way you can measure the impact that CI has had on an organization (we’ll return to the subject of KPIs in the final section of this post). The point is that, by allowing CI teams to automate their secondary research and focus on the creation and delivery of true, actionable insight, technology has pushed the value of CI to new heights.

Learn more: 10 Essential Examples of Competitive Intelligence (With Tips for Inspiring Action!)

How can I start building a competitive intelligence program?

Although the process of building a CI program can vary dramatically depending on your company and industry, there are a few key steps that most folks need to take in order to succeed:

- Get an executive sponsor

- Identify your initial stakeholders and partners

- Capitalize on quick wins

Let’s briefly expand on each of these.

1. Get an executive sponsor

An executive sponsor ensures that, from the get-go, you are:

- Visible across the company, and

- Focused on a meaningful, measurable goal

If, for example, your sponsor is the CRO, maybe the initial purpose of your program is to accelerate revenue, as measured by competitive win rate and competitive sales cycle duration. Alternatively, if your sponsor is the CPO, maybe the initial purpose of your program is to accelerate feature delivery, as measured by time to market.

What matters is that you have a purpose and your purpose is tied to actual business goals. With this foundation, you’ll be able to quickly show value, and your sponsor’s counterparts in the C-suite will be falling over themselves to get in on the action.

2. Identify your initial stakeholders and partners

Armed with an initial sense of purpose, your next step is to determine:

- Who you’re going to be supporting with CI, and

- Who can help you deliver that support as effectively as possible

Trying to accelerate revenue? Great—your sellers are your initial stakeholders, and their managers are your initial partners. With the help of these partners, you’ll be able to answer questions like:

- Are our sellers already consuming CI? If so, where and in what format?

- Do we have any sellers who are already crushing the competition? If so, what’s their secret?

- What are our sellers’ CI pain points? Is intel hard to find? Out-dated? Unactionable?

Plus, your partners will serve as a sounding board of sorts, providing a safe environment to test ideas, pilot deliverables, and get feedback.

You may be thinking: Supporting sales isn’t the only way to accelerate revenue. What about supporting product so they can make our customers happier, or supporting marketing so they can make our messaging more unique?

Valid points! But that’s a lot to put on the plate of a brand new CI program. It’s cliche, but you really shouldn’t try to boil the ocean. Plus, in order to get buy-in from those additional stakeholder groups, you may need to show proof of concept—which brings us to our “last” step.

3. Capitalize on quick wins

There’s a reason you need to identify the pain points afflicting your initial stakeholders: so you can capitalize on quick wins and immediately build momentum for your program. Perfection is not the goal here—the goal is simply to do something, to make CI tangible.

Are your sellers tired of scrambling for intel at the last second? Find out where they like to spend their time and put resources there. Are they suspicious of the intel they’ve been given before? Pick a handful of crucial insights—e.g., “Competitor X can’t do [insert functionality].”—and see if you can validate them. Are they unsure what to say when a certain competitor is mentioned? Work with your partners to spin up a talk track.

All it takes is one quick win to start generating excitement and trust—and then you’re off to the races.

Learn more: 3 Ways to Get Employee Buy-In For Your Competitive Intelligence Program

How do competitive intelligence teams measure their impact?

In all kinds of ways! It depends entirely on the stakeholder groups they’re supporting. We’ll share some real-world examples of KPIs in a moment, but first, let’s get some perspective:

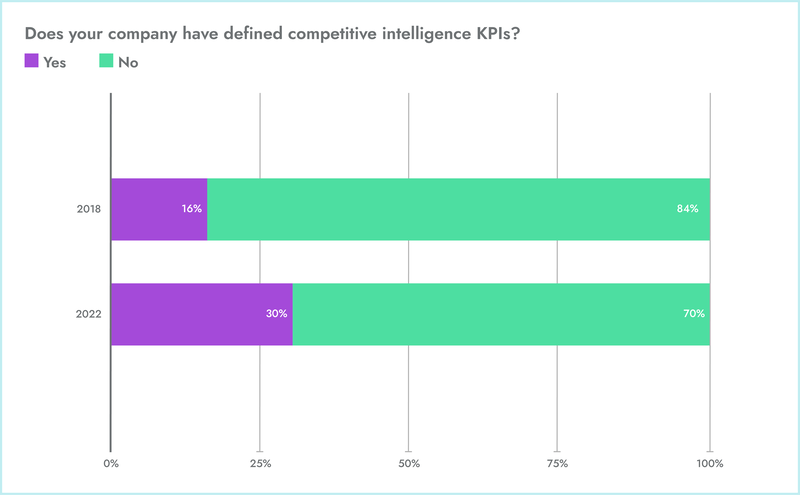

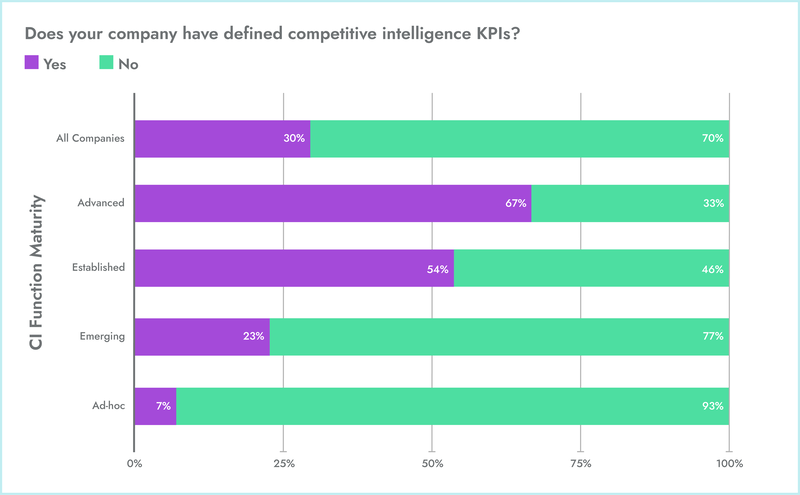

Despite the impressive strides made in recent years, less than one-third of CI teams are measuring their impact with defined sets of KPIs. This is largely a matter of maturity:

Why is an advanced CI program ten times more likely than an ad-hoc CI program to have KPIs? It all comes down to that magical buzzword: stakeholders.

An advanced CI program, by definition, is in lock-step with its stakeholders, vetting each and every request through the lens of their overarching goals. The requests that are actually fulfilled, therefore, can be very easily tied back to an agreed-upon set of metrics.

Meanwhile, an ad-hoc CI program, by definition, is without stakeholders. It’s divorced from any kind of long-term objective, which makes it very difficult to evaluate it in a reliable and meaningful way.

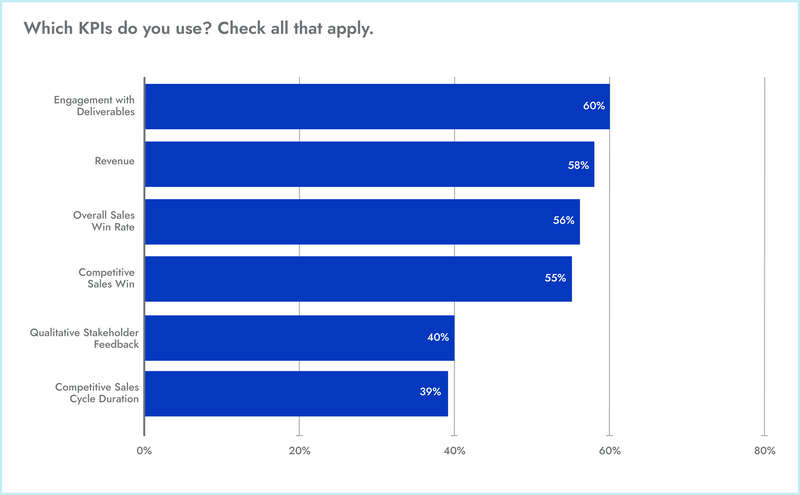

To wrap up, here are six examples of competitive intelligence KPIs (each accompanied by the percentage of teams that use it):

Some of these are self-explanatory, so I’ll just add a few notes:

- Engagement with deliverables is popular because it’s relevant no matter which stakeholder group(s) you’re supporting. You can track the open rate on your CI newsletter, the activity in your CI Slack channel, the usage of your battlecard, and so on.

- Qualitative stakeholder feedback should, quite frankly, be more popular. The sense of confidence and focus that you bring to your organization, though not easily quantified, is a testament to your skill.

- Competitive sales cycle duration refers to the average amount of time that it takes your sales team to close a competitive opportunity (either as a win or a loss). The idea here is that CI enables your sellers to more efficiently identify and deposition competitors, thus shortening the sales cycle.

Learn more: Influenced Revenue: How CI Practitioners Can Prove—and Amplify—Their Impact On Sales

Check out Competitive Advantage Academy to learn more

Hungry for more content on CI and the impact it can have across your organization? Enroll in Competitive Advantage Academy, the world’s only collection of free, on-demand CI certifications. The Activator course is perfect for anyone who wants to see what activation actually looks like in practice, as well as a deep dive into the kinds of intel that are available on the web.

Related Blog Posts

Popular Posts

-

The 8 Free Market Research Tools and Resources You Need to Know

The 8 Free Market Research Tools and Resources You Need to Know

-

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

How to Measure Product Launch Success: 12 KPIs You Should Be Tracking

-

24 Questions to Consider for Your Next SWOT Analysis

24 Questions to Consider for Your Next SWOT Analysis

-

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

How to Create a Competitive Matrix (Step-by-Step Guide With Examples + Free Templates)

-

6 Competitive Advantage Examples From the Real World

6 Competitive Advantage Examples From the Real World